Broad Commodities, the Hedge against Inflation and Supply Chain Driven Disruptions

2021 will remain known as the year when both inflation and broad commodity investment woke up from their decade-long slumber. While distracted observers may chalk this up to chance, specialists will recognize the effect of disrupted supply chains and renewed demand on inflation and broad commodity investment. Historically, broad commodity investments, physical or futures contract-based, have been a very strong inflation hedge. This is particularly the case when inflation is unexpected, resulting from exogenous pressure or geopolitical effects. As inflation has proven more resilient than transitory, investors are searching for a way to protect their investments against erosion. If history is any guide, broad commodities stand head and shoulders above many other assets.

Can monetary policy fix the global supply chain?

U.S. inflation has been printing above 5% since Q2 2021. The December 2021 reading of 7%1 was the highest since July 1982. While the Federal Reserve (Fed) pointed to transitory inflation earlier, this language has progressively left Federal Open Market Committee minutes. Over time, Fed officials have turned more and more hawkish to a point where four hikes are on the table this year. Furthermore, elevated inflation is a global phenomenon, with Europe and parts of Asia facing similarly elevated changes in prices. Euro area inflation is at a series high (i.e., since the formation of the eurozone in 1999), with the December 2021 print at 5.0%.2 The U.K.’s December 2021 inflation topped 5.8%,3 the highest since April 1992. While most Asian nations are maintaining an inflation rate within central bank targets, South Korea and Singapore have seen an acceleration in prices in 2021.

Inflation is not only high, but readings have taken analysts by surprise. The Citi Inflation Surprise Indices (which measure the deviation between consensus surveys of economists and actual inflation readings), are at a series high for global, the euro area and the U.K., and are just coming off the highs for the U.S. Looking for the source of this unexpected surge in prices across the globe, the disruption of the global supply chain is at the top of the list. The coronavirus and its multiple variant-driven waves have uncovered the weaknesses of an overly specialized and overly stretched supply chain, creating shortages and driving up prices. Fundamental changes to our society and way of work, illustrated by the “Great Resignation,” have further emphasized those disruptions. Suppose such changes are the cause of inflation. It may not be immediately treatable through a course of monetary tightening, as quick or as strong as it is.

Broad commodities, a natural inflation and supply chain hedge

In such an environment, investors need to look for ways to hedge their portfolios. Growth companies, which have been driving the exceptional performance of equities over the last few years, are extremely vulnerable to inflation and rate hikes. Rising interest rates outstrip future growth expectations, leading to a negative effect on the present value of the stock.

Looking back at 2021, it is no surprise that broad commodities have performed extraordinarily well, with a 27.11% gain.4 The last time commodities returned that much was in 2000. At the time, U.S. CPI inflation was close to 4%. This is no coincidence. While most assets are a poor hedge against inflation, broad commodities are known for their capacity to hedge against inflation.

Commodities are, in fact, intrinsic components of inflation indexes around the world. Up to 50% of inflation baskets are directly or indirectly linked to commodity prices through food, energy or materials used in cars, buildings and infrastructure.5 This is even more important today. The same mechanisms that transform supply chain disruption into inflation also create elevated commodity prices, such as increased agricultural products prices or increased metal prices.

Broad commodities, an effective hedge against expected and unexpected inflation

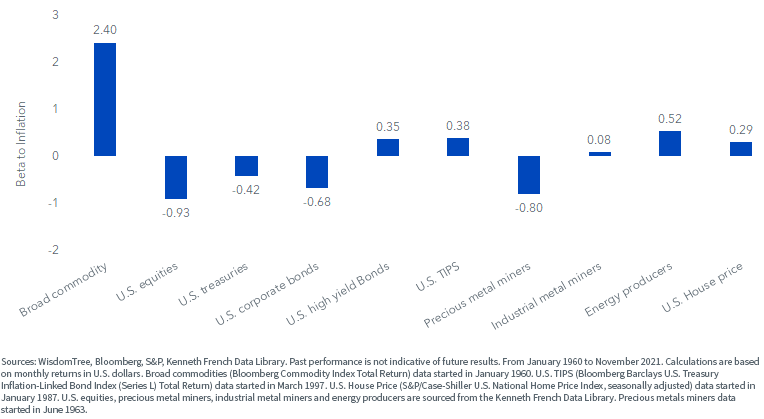

Looking at historical data, we observe that broad commodities has the highest beta to inflation among many asset classes. U.S. equities exhibit a very negative beta to inflation, indicating their tendency to perform poorly when inflation is trending up. Even equity sectors that have the reputation to hold up well against inflation, like miners or energy producers, do not come close to the beta exhibited by broad commodity futures. In fixed income, both Treasuries and corporate bonds tend to suffer in periods of increasing inflation. High-yield bonds and inflation-linked bonds (TIPS) fare better but, again, not nearly as strong as broad commodities.

Figure 1: Beta to expected of main asset classes

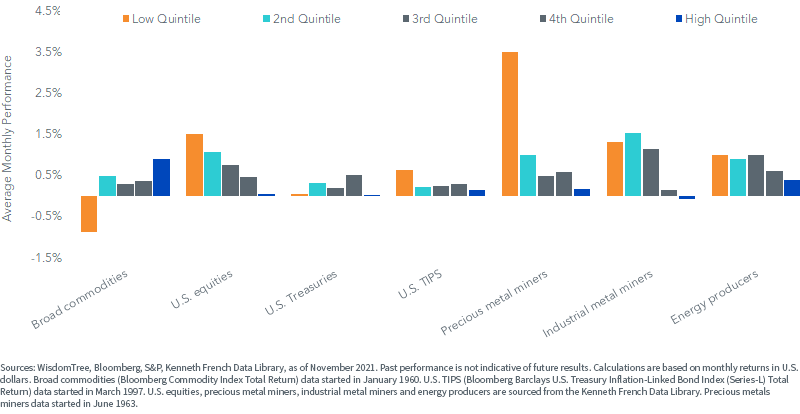

On top of being positively correlated to inflation, the behavior of commodities in different inflation regimes is also very interesting. In figure 2, we split every monthly return since January 1960 into five quintiles by the level of realized inflation (i.e., U.S. CPI) during those months. The low quintile, i.e., months when inflation was low, was the only type of period when the average broad commodities futures contract performed negatively. Then as inflation increased, the performance of commodities also increased.

Broad commodities are the only asset here that has historically performed the best in months when inflation is the highest. U.S. equities, miners and even U.S. TIPS have historically performed the best in low inflation environments. This is again quite a powerful testament to commodities as an inflation hedge.

Figure 2: Performance depending on the level of realized inflation

1 U.S. Bureau of Labor Statistics

2 Eurostat

3 Office for National Statistics

4 Source: Bloomberg, 12/31/20–12/31/21. Using the performance of the Bloomberg Commodity Total Return Index.

5 Sources: WisdomTree, U.S. Bureau of Labor Statistics, European Central Bank, U.K. Office for National Statistics, as of July 2021.

Important Risks Related to this Article

Pierre Debru is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.