Is Buffett Doubling Down on Japanese Stocks?

Warren Buffett made a splash in Japanese markets in August 2020 with the announcement of a $6 billion investment in Japan’s five largest trading houses.

We highlighted the rationale for the prolific value investor to take stakes in these companies on our blog at the time.

In the year-and-a-half since, foreign investor interest in Japan has been tepid, and the S&P 500 has continued to outperform the TOPIX.

Buffett is known to have said, “be fearful when others are greedy, and greedy when others are fearful.” If the lack of foreign investor flows into Japan reflects investors’ collective market fear, Buffett is reflecting his greediness by reports indicating he may be doubling down on his Japanese equity purchases.

Berkshire Hathaway filed for a planned issuance of yen debt on January 5, with an amount unspecified. Some market participants view this filing as an indication Buffett may be boosting Berkshire’s stakes in the Japanese trading houses of Itochu, Marubeni, Mitsui, Mitsubishi and Sumitomo.

Hedging Currency Risk

In our post following Buffett’s initial investment in the five Japanese trading houses, our Global CIO, Jeremy Schwartz, wrote:

Buffett engaged in a very interesting yen-denominated bond issuance [in 2019]—raising ¥430 billion of yen-denominated bonds (over $4 billion). If the yen declines in value, his debt will decline in U.S. dollar terms, offsetting any losses that come from being inherently long the yen when buying these stocks. This allows Buffett to isolate the true ‘equity opportunity’ without having to navigate a separate currency bet.

Jeremy highlighted how the WisdomTree Japan Hedged Equity Fund (DXJ) could be a vehicle for investors to allocate to the Japanese market while aiming to neutralize the fluctuation between the dollar and the yen—which was Buffett’s goal in issuing yen-denominated debt.

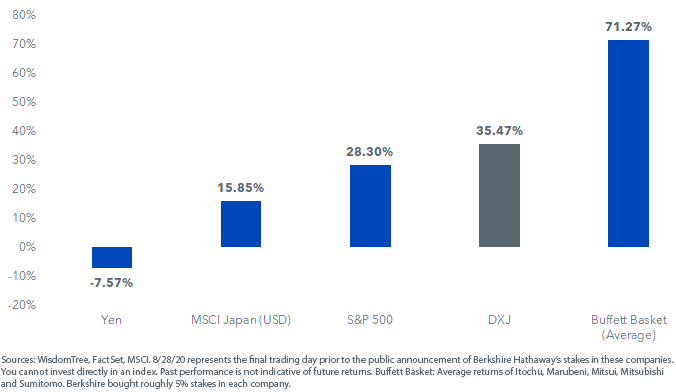

The decision to hedge FX risk was a prescient one for Buffett as the yen has depreciated over 7% versus the dollar since the announcement of the investment at the end of August 2020. This yen depreciation has been offset for investors in DXJ, which has outperformed the unhedged MSCI Japan Index by 19.62% and outpaced the S&P 500 by 717 basis points since August 28, 2020.

Berkshire’s latest yen debt offering is an indication of a potentially similar currency-neutral investment in Japan that Berkshire will be (or has already started) making—possibly increasing stakes on Buffett’s earlier investments, which are up 71% on average (over twice the 28% gain of the S&P 500).

Returns (8/28/20—1/24/22)

A Value Investor’s Paradise

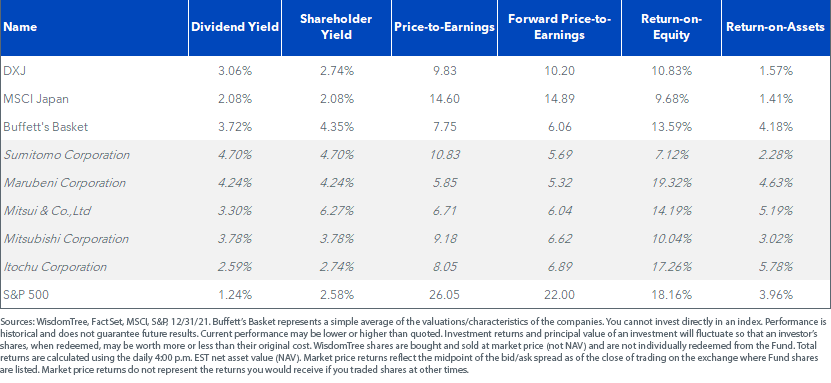

It should come as no surprise that Buffett would be finding Japan’s equities an attractive buy. The MSCI Japan Index trades at 15 times forward earnings compared to 22 times for the S&P 500.

A more value-tilted Japan basket like DXJ—which screens for exporters and weights by dividends—has even more attractive valuations at 10 times forward earnings and a dividend yield of 3.06%, a healthy premium to the 1.2% dividend yield on the S&P 500.

For the most recent standardized performance, 30-day SEC yield, and month-end performance click here.

For definitions of terms in the chart above, please visit the glossary.

Conclusion

For investors looking to follow Buffett’s lead with a value-sensitive basket that neutralizes currency risk, we would suggest an allocation to DXJ.

To learn more about our Japan 2022 outlook, please find a link to our recently posted outlook presentation and market insight.

Important Risks Related to this Article

Please read the prospectus carefully before investing.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations and derivative investments, which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.