Follow Buffett into Japan

Warren Buffett’s Berkshire Hathaway recently purchased 5% stakes in five Japanese general trading firms, known as “sogo shosha.”

Jesper Koll, WisdomTree’s Japan Strategist, believes a number of considerations beyond the traditional inexpensive valuations and great cash flow motivated Buffett’s purchases:

- Sogo shosha can be a great inflation hedge. They are an integral part of global markets for commodities, both soft and hard. Shares typically track inflation, which is important as many investors are now looking for good inflation hedges.

- Sogo shosha are dominant venture capital firms in Japan. They see every deal. Buffett is buying one of the best filters for Japan and innovative Asian start-ups.

- There’s geo-strategic upside. As the technology cold war between U.S. and China intensifies, Japan is poised to become a big winner. Sogo shosha will be key dealmakers as global companies are forced to switch from Chinese suppliers to Japanese ones.

- Sogo shosha are at the forefront of Japan’s shift away from seniority-based to performance-based pay.

All said, Buffett’s purchase serves as a reminder that there are good values to be had outside the U.S.

Below I review some broader portfolio applications of Buffett’s “Buy Japan” strategy, and why investors may want to follow his lead.

Japan ETF

WisdomTree has a dividend-weighted basket of Japanese companies called the WisdomTree Japan Hedged Equity Fund (DXJ). DXJ currently gives more weight to these soga shosha than market cap-weighted Japan indexes, thanks to their current high dividend levels.

DXJ owns four of the five companies Buffett bought at a weight of 6% of its portfolio, compared to just 3.5% for the five companies in the MSCI Japan Index.

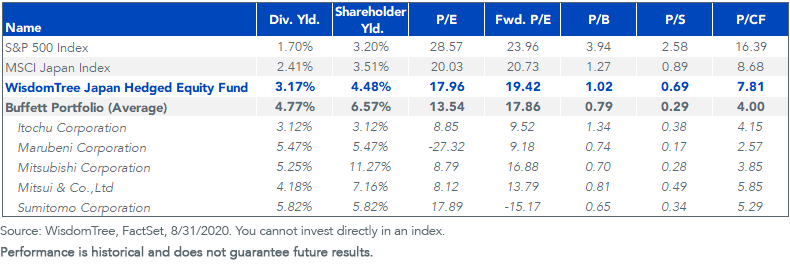

These sogo shosha have prices that average 79% of their book value, with four of the five below 85% of book value. If you believe in the quality of that book value, you’re buying an asset for less than liquidation value that is providing nice current cash flows via dividends and buybacks.

These five new Buffett holdings also currently trade at 4 times cash flow, for a 25% average cash-flow yield.

As of August 31, DXJ had a price-to-cash-flow multiple of 7.8 times, or an approximate 13% cash flow yield—not far from the Buffett basket.

The U.S. market and the S&P 500 Index by contrast, has a price-to-cash flow of over 16 times, with a cash flow yield of just 6%, which is 75% below the cash flow levels of Japanese corporates in Buffett’s Japan portfolio.

The current dividend yield of DXJ, while lower than Buffett’s Japan portfolio, is now approaching twice the level of the S&P 500, at over 3%. Japan was not known as a high dividend country for decades. But a renewed focus on returning cash to shareholders and improving returns on equity have made Japan a dividend growth leader. While S&P 500 dividends grew 10% a year for the last decade, and prices appreciated with that dividend growth, Japanese dividends grew 8.5% a year for the last decade and generally prices were up less (about 7%).

Valuations Comparison

For definitions of terms in the chart, please visit our glossary.

Japanese Valuations

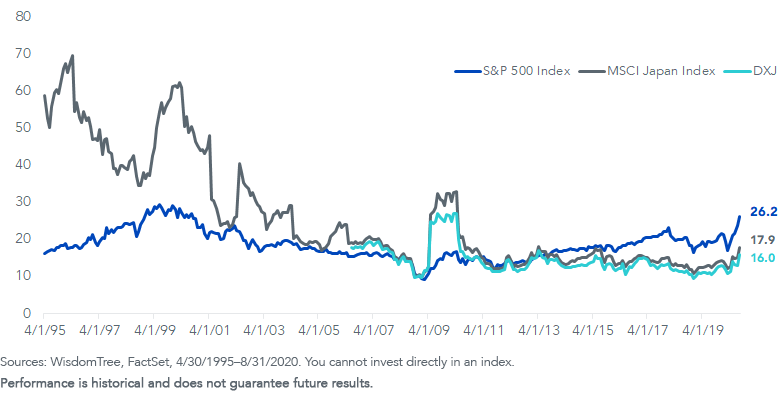

Stepping back, Japanese equity valuations have been contracting for the last three decades. Following the peak of the Nikkei at nearly 40,000 at the end of 1989, to just over 23,000 more than 30 years later, valuations have continually compressed.

In the early 1990s, Japan traded at over 60 times earnings1, when the S&P 500 was below 20 times earnings. Now the U.S. market is in vogue with expanding multiples, while Japanese valuations languish.

Japan was trading at similar multiples as the S&P 500 following the great recession in 2009 from 2011–15. But starting five years ago, the S&P 500 de-coupled, led by the large technology stocks that fueled a rise in the S&P 500’s earnings multiple.

As of August 31, the S&P 500 had a P/E ratio of 26 times, while the MSCI Japan’s was 18 times and DXJ’s was 16 times.

Price-to-Earnings Ratios

Japan clearly should trade at a lower multiple given different sector compositions and growth profiles. But its exposure is aligned for a re-opening of the global economy given the cyclical nature of corporate Japan. The nation is highly leveraged to global growth, with an emphasis on Industrials and Consumer Cyclical companies. Global fiscal stimulus should support it following the coronavirus pandemic.

While the U.S. markets are generally ‘priced for perfection,’ Japan is trading at its lowest multiples in decades with a potential for positive catalysts—renewed global growth, an under-owned market and now the ultimate value investor stepping in that could restore confidence in Japanese assets.

Buffett engaged in a very interesting yen-denominated bond issuance last year—raising ¥430 billion of yen-denominated bonds (over $4 billion). If the yen declines in value, his debt will decline in U.S. dollar terms, offsetting any losses that come from being inherently long the yen when buying these stocks. This allows Buffett to isolate the true ‘equity opportunity’ without having to navigate a separate currency bet.

We believe investors should consider following this type of approach, too. DXJ incorporates that currency hedge to neutralize movements of the yen and help investors focus on the potential gains of Japanese stocks.

Unless otherwise stated, data sources are WisdomTree and FactSet, as of August 31, 2020.

1Based on the MSCI Japan index

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.