What Goes Up Has Definitely Been Coming Down

While the headlines surrounding the August Employment Situation report seemed to focus on the moderating pace of new hiring activity, in my humble opinion, the bigger story was the sizable drop in the unemployment rate.

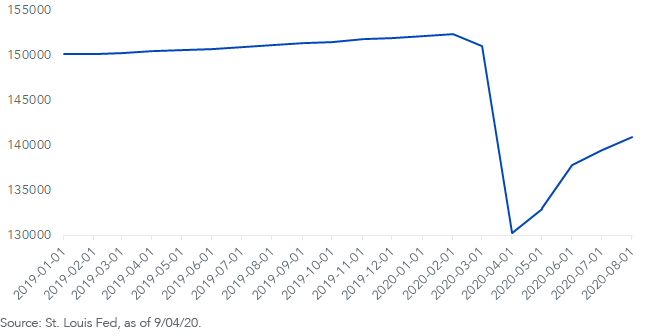

The markets and headlines tend to focus more on nonfarm payrolls (new hiring), and I have no quarrel with that, so let’s first get some perspective on that front. Total nonfarm payrolls rose by about 1.4 million workers, right around consensus forecasts. However, the overall gain was elevated by the hiring of 238,000 temporary census employees. Nevertheless, job gains were broadly based, which is an encouraging sign. New hiring has now recouped nearly 50% of the total job losses that occurred during March and April.

Total Nonfarm Payrolls

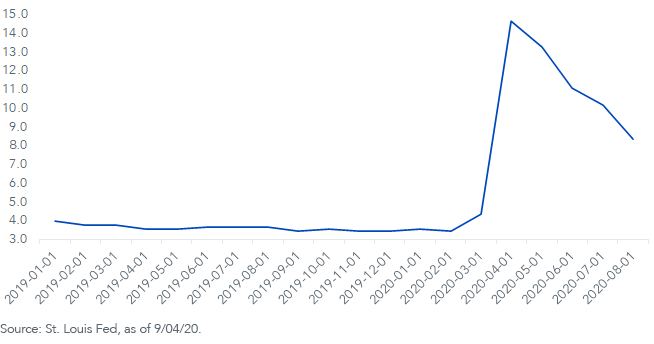

Back to my main focus, the unemployment rate. It shrank 1.8 percentage points in August, falling to 8.4%. The most important part of this update is that the decline came in the wake of a huge gain of 968,000 in the civilian labor force (another encouraging sign). However, civilian employment surged by nearly 3.8 million workers, or nearly four times the increase in the labor force—it’s just simple math.

Unemployment Rate

Bond Market Implications

As of this writing, the U.S. 10-Year Treasury yield had reversed some of last week’s decline, heading back up to the 0.70% mark. For the near term, I envision more of the same—a range-bound pattern. But, as I noted in last week’s blog post on the Federal Reserve (Fed), a move back toward the 1% threshold remains the base case.

With the Fed’s new ‘average inflation targeting’ policy framework, the monthly jobs report will be losing some of its cachet. We all know the Fed won’t be raising rates for quite a while even if we get some blowout jobs reports in the months to come. Remember, there will be no more pre-emptive rate hikes to ward off potential inflation. The Fed will have to wait to see the ‘whites of inflation’s eyes’ before pulling the trigger.

How Should Fixed Income Investors Consider Positioning Their Portfolios?

Fixed income investors should consider duration shortening strategies with the goal of complementing core bond holdings. The WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD) can be paired with the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) to potentially achieve this outcome.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. HYZD seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries (or futures providing exposure to U.S. Treasuries), but there is no guarantee this will be achieved. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Due to the investment strategy of AGGY, it may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.