Wages Pose a Threat to 2022 Profit Margins

For something we were told would be “transitory,” inflation sure is hanging around a long time.

Not since the commodities supercycle that preceded the global financial crisis has the issue of rising prices at the supermarket and gas station been on so many radars. With the S&P 500 now around 4,700 and Refinitiv’s consensus estimate for 2021 operating earnings of $208, it is fair to question whether broad market earnings growth can persist in an unwavering inflation environment.

The Street’s S&P 500 earnings projection for next year is $222, a 7.8% increase from 2021. To achieve it, S&P component companies will need to pass wage and input cost inflation to end customers.

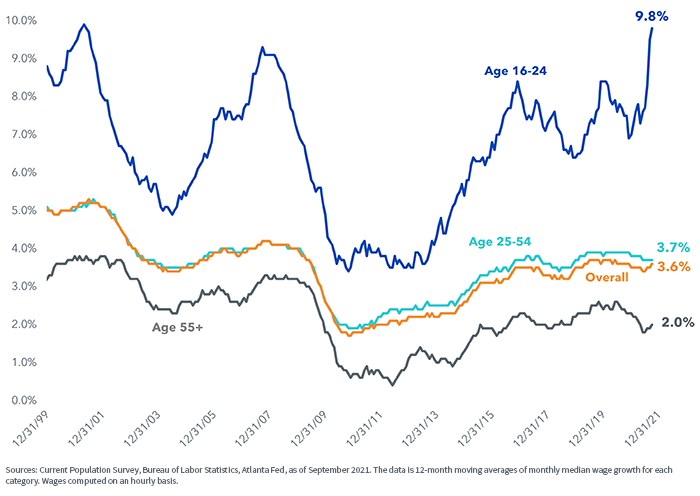

Thus far, much of the discourse has focused on compensation bumps for younger workers, as they tend to work in the low-skilled roles that have experienced wage pressure of late (figure 1).

Figure 1: Atlanta Fed Wage Growth

The big question is whether the age 25–54 cohort—workers in their prime earning years—will follow along the pay bump route, an outcome that has not yet appeared.

Still, not a day goes by that we do not hear about big compensation surges at law firms, for example.

In financial services, news of junior bankers getting salaries bumped up from $85,000 to $110,000 has been making the rounds for months. In the meantime, many analysts are pointing to wage pressures in both the tech and health care sectors.

Nevertheless, the Wall Street consensus is for S&P 500 profit margins to expand into next summer, with non-financial net margins in the mid-12% range. For context, margins only broke above 10% in 2017, according to BofA strategists.

How do companies keep firing on all profitability cylinders if inflation continues to roar? Something may have to give.

For investors crossing their fingers that the supply chain issues will end, alleviating price pressures, there are a few considerations.

First, about one in every 92 people in this country—including children, retirees and people not in the labor force—was a truck driver in 2019. But in 2020, the industry kicked 40,000–60,000 drivers out after launching a database that culled those with drug or alcohol violations.

Young drivers are hard to come by, especially when they see a potential future of autonomous trucks putting them in the unemployment line. No wonder there is a trucker shortage—and no wonder Wal-Mart is willing to pay $87,500 plus an $8,000 sign-on bonus for newly hired drivers.

Second, I’ve posited that the next chapter in “50 Shades of Inflation” is labor action. With workers at agricultural equipment maker John Deere and Hollywood film production lots going on strike, it is not a leap of faith to expect more labor action in 2022 than in 2021.

That raises the risk of inflation as a self-fulfilling prophecy: prices go up, so you demand higher wages, so prices go up, so you demand higher wages.

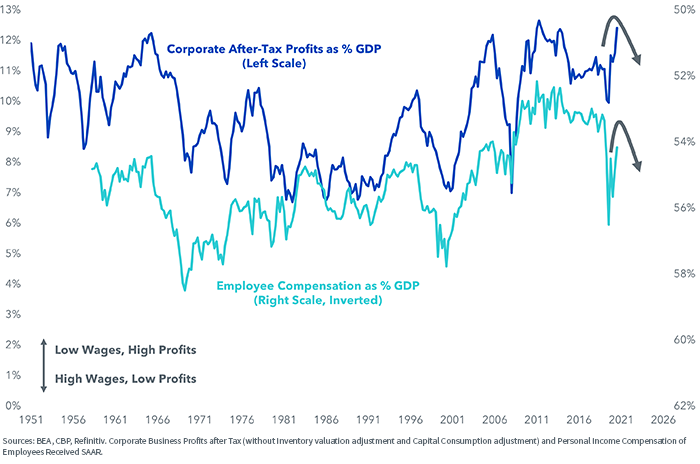

If so, figure 2 comes into focus as a particular issue for corporate earnings prospects.

Figure 2: U.S. Labor Costs & Corporate Profits (% GDP)

We have several ETFs that explicitly screen for profitability, identifying companies that may be better able to absorb an inflationary push. Take a look at our quality dividend growth concepts, which typically register highly on return on equity (ROE). The flagship is our WisdomTree U.S. Quality Dividend Growth Fund (DGRW).

Important Risks Related to this Article

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance. Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. For more information on indexes please see

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.