This Time It's for Real

One of our main themes for fixed income investors has been to consider a rate hedging strategy for bond portfolios. Rising rates were on full display from August of last year through the end of March 2021. Then there was a reprieve as the U.S. Treasury (UST) 10-Year yield reversed course and began falling. Until recently, that is.

So now you need to ask yourself the question: is your bond portfolio prepared for the possibility that this time the increase in rates is for real?

Where We Are

Let’s first give some perspective on the recent increase in Treasury yields. Since August 4, the UST 10-Year yield has risen nearly 50 basis points (bps) on an intra-day trading basis, with two-thirds of this increase occurring since September 22, 2021. However, it must be noted this was not the only gain in the Treasury market. The UST 5-Year yield has now risen to its highest level since February of last year, or pre-pandemic.

Why Now?

I mention those Treasury stats because this time around the rise in yields has different connotations. Indeed, the current episode of rate increases has two very important distinctions: first, legitimate inflation fears are becoming more apparent, and second, Federal Reserve (Fed) policy has now moved into a more visible “exit strategy” phase. Notwithstanding the recent disappointing nonfarm payroll number, the jobless rate dropped below the 5% threshold while wages continued on their upward trajectory. As a result, tapering at the November FOMC meeting is still on track, while the Fed is now evenly split on a rate hike in 2022, if not two. Unlike the rise in rates earlier this year, we now have Fed policy as a leading factor. Combined with heightened inflation fears, these factors are what can lead to a sustained increase in rates.

For standardized performance for HYZD please click here.

For definitions of terms in the table, please visit the glossary.

Utilizing a High-Yield Zero Duration Strategy

One vehicle investors utilize for rate hedging purposes are bank, or leveraged, loans. Let’s take a look under the hood at this option. Various reports have emerged stating that the underlying covenants behind these loans have been weakened considerably. According to a July 12, 2021, article from Bloomberg, “80% of new leveraged loans last month gave borrowers the ability to make unlimited investments. That’s up from zero in January and 25% in February.” In other words, lenders have now been making these loans ‘covenant-lite’ by not requiring a reduction in leverage before using the proceeds for other purposes.

The WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD) offers investors an alternative approach. This Fund employs our fundamental screening and income tilting process to isolate attractive bonds with strong income characteristics in the high-yield arena and then offsets these exposures with targeted short positions in Treasury securities and futures. Thus, investors are offered a quality-screened income-oriented solution that seeks to mitigate potential rate risk.

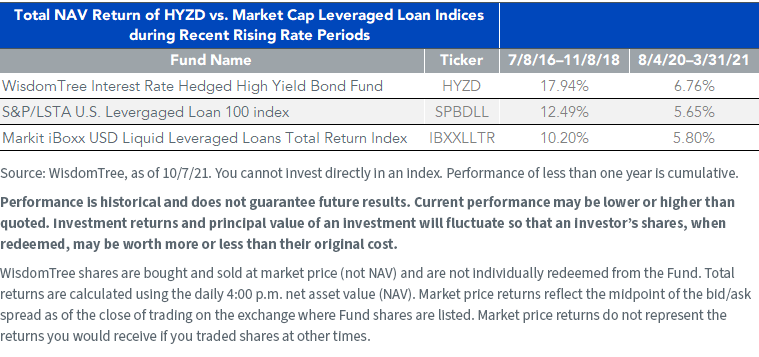

In addition, HYZD has exhibited stand-out performances versus the widely followed leverage loan alternatives. As I detailed in the accompanying table, during the July 2016–November 2018 rising rate period, HYZD outperformed those two closely followed leveraged loan indexes by a hefty 545 bps and 774 bps, respectively. More recently, the outperformance during the August 2020–March 2021 time frame was roughly 100 bps in both index comparisons.

Conclusion

The bottom line message is that investors have been given a second opportunity to deploy rate hedging strategies for their bond portfolios. HYZD is a core-plus type of solution that offers a ‘quality tilt’ and a track record that investors should consider going forward.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The Fund seeks to mitigate interest rate risk by taking short positions in U.S. Treasuries (or futures providing exposure to U.S. Treasuries), but there is no guarantee this will be achieved. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. The Fund may engage in “short sale” transactions where losses may be exaggerated, potentially losing more money than the actual cost of the investment and the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.