Adding Risk in a Zero-Sum Game: A Bad Idea

Many investors do not hedge currency in their foreign equity mandates. Their main rationales include a desire to conform to the status quo, a discomfort with hedging or belief in currencies’ diversifying effect.

Investors should think twice if they are strongly embracing any of those three approaches.

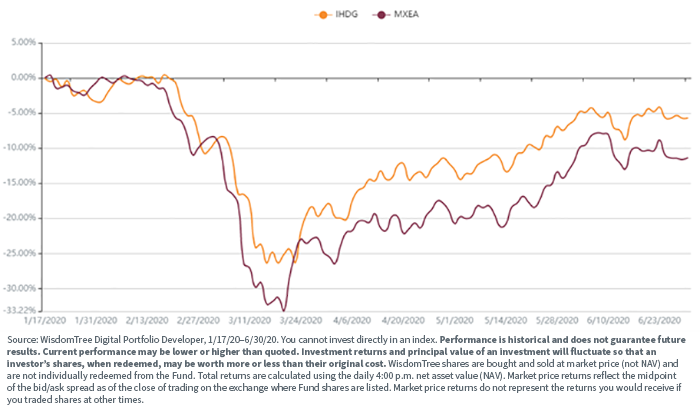

Let’s start with foreign exchange “diversification” during the COVID-19 crash, when the dollar surged during March 2020’s fear (figure 1). It’s like the old joke about “de-worsification”—owning foreign currencies backfired during that episode.

Figure 1: U.S. Dollar Index during COVID-19 Panic

.png)

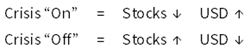

That action explains how hedged-currency equity mandates tended to have more muted downside than the MSCI EAFE Index (MXEA), which rode the currencies as they oscillated. The WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) provides an example (figure 2).

Figure 2: COVID-19 Crash Performance from MSCI EAFE’s 1/17/20 Peak to Mid-Year 2020

Standardized performance for IHDG is available here.

During the COVID-19 crash, it was simple:

Challenging Preconceived Notions

There are three common theories:

- Having foreign currency exposure helps mitigate portfolio risk

- Hedging currency is expensive, regardless of reality

- The U.S. dollar (USD) will weaken

The first theory we disagree with, the second is wrong and the third is a weak argument unless the investor is table-bangingly bearish USD.

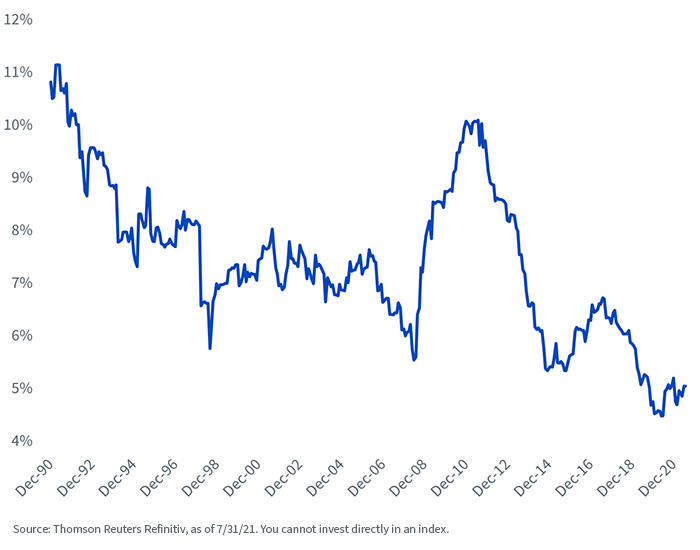

Before we get into it, look at figure 3 to fully appreciate this market’s sleepy persona—for now (figure 3).

Figure 3: 3-Year Currency Volatility, MSCI EAFE Countries

Addressing Theory #1: Is Having Foreign Currency Exposure Useful?

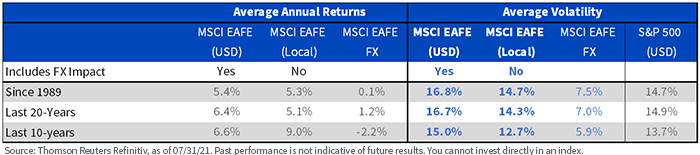

Since the MSCI EAFE Index launch in 1989, the cumulative annual gain from its component currencies has been just 0.1%. But that stability over 30+ years masks several bouts of intense action. MSCI EAFE component currencies witnessed annualized standard deviation of 7.5% in that time.

For what? For basically no reward. Sure, there were sometimes diversification benefits, but the 14.7% annualized standard deviation of stocks in their local markets ends up rising to 16.8% when tracked with currency layered on top (figure 4).

Figure 4: Currency Effect on MSCI EAFE Risk/Return

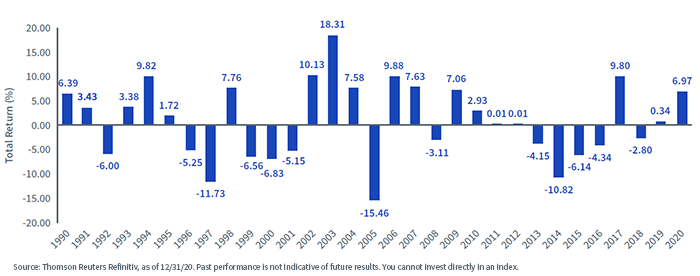

In the other “pain year”—2020—foreign currencies rallied 6.97%, but all of that came in the recovery months, not the panic period.

Looking at the rest of the time frames, the prospect of gains or losses in any given year is a coin toss. If foreign exchange is hedged, all the chart’s bars collapse to zero. We think that means fewer sleepless nights.

Figure 5: MSCI EAFE Index Calendar Year Returns from Currency

Addressing Theory #2: Hedging is Expensive

According to our Capital Markets team, bid/ask spread “slippage” from trade execution may cost investors in currency-hedged developed market equity funds just a basis point (bp) or two annually.

Also, currency hedging costs are directly tied to relative interest rates. Because so many other central banks pin overnight rates in negative territory while the federal funds rate is slightly above 0%, U.S. investors get paid to hedge.

Addressing Theory #3: Precipice of a Secular USD Bear Market

How about the investor that is steadfastly dollar bearish? Consider this: U.S. portfolios’ heavy bias to domestic large caps may already reflect that view.

We estimate that U.S. multinationals earn nearly half their profits abroad. When the dollar rallies, earnings have historically taken a hit from the currency translation. When it weakens, earnings have risen.

That means hedging forex to dollars has often ended up giving much-needed help in investment returns during the tough times—when Wall Street is reporting disappointing financial results.

It’s something to think about.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.