Introduction to Ethereum’s dApps—Deep Dive into OpenSea

This is the second blog post in a series about Ethereum’s blockchain applications.

Non-fungible tokens (NFTs) are taking over the Internet.

From athletes to corporations, we are seeing increasing interest in NFTs. In the past week, Visa bought a digital avatar—CryptoPunk #7610—for $150,000, making it the first major payment platform to tap into the NFT space.

So, what are NFTs? They are records of ownership of digital files on blockchains.

NFTs are called non-fungible tokens because each digital asset is unique. One NFT is not interchangeable with another, even if they are of the same value. The difference between an NFT and a bitcoin is that all bitcoins are the same—bitcoin is fungible.

In this blog post, we will explore one of the most popular NFT marketplaces, OpenSea, and its relation to Ethereum.

What’s OpenSea?

Founded in 2017 as a private company, OpenSea became the largest NFT marketplace facilitating peer-to-peer transactions of NFTs and crypto collectibles. It is essentially an eBay or Amazon for NFTs.

The platform allows anyone to buy, sell and mint1 NFTs with more than 200 payment options. Items include art, website domains, videos, games and music. Currently, OpenSea has more than 30 million NFTs, spanning 901,000 collections.2

OpenSea also allows developers to directly power their marketplaces on the platform. They can gain access to OpenSea’s full suite of functionalities, ranging from setting up auctioning methods to creating bundle sales.

OpenSea is currently pioneering a royalty model, where creators can choose to earn a royalty each time their NFT is re-sold. This concept enables creators to collect profit every time the item changes hand on the secondary market, and could potentially revolutionize the payout model for creators and provide more protection for intellectual property.

How does OpenSea work?

OpenSea is a non-custodial marketplace, meaning that it doesn’t store any digital assets. Instead, users store the assets in their own crypto-wallets, the same place where they store private keys for cryptocurrencies. Every time ownership of an item is changed, the record of ownership switches from the seller to the buyer. In this process, OpenSea takes a 2.5% fee.

Besides the 2.5% operations fee and purchasing/selling price, users incur gas fees during the transaction process. These gas fees are paid to Ethereum, the underlying protocol, for maintenance of the network. These include setting up an account, accepting an offer and cancelling a bid.3

Other NFT Marketplaces

Besides the 2.5% operations fee and purchasing/selling price, users incur gas fees during the transaction process. These gas fees are paid to Ethereum, the underlying protocol, for maintenance of the network. These include setting upOther major decentralized marketplaces include Rarible.

The main difference between OpenSea and Rarible is how they charge fees. On OpenSea, a user can list any file, but OpenSea waits for the file to be sold to mint the NFT. That way, if it doesn’t sell, the user doesn’t need to pay the minting fee. Rarible, however, mints immediately, so even if the NFT doesn’t sell, the user must pay fees. This difference has led to most new and veteran users moving to OpenSea.

While not in direct competition, there are other platforms that just sell NFTs. Autograph.io and NBA TopShot are the two largest examples. They don’t allow users to list their own NFTs but each sells NFTs for sports fans who want to collect.

OpenSea's Future

In April 2021, OpenSea partnered with Polygon and IoTeX to enable OpenSea’s cross-chain support. Now NFTs can be made on Polygon protocol in addition to Ethereum, and they can be transferred from one blockchain to another. Users also won’t have to pay gas fees for NFTs made on Polygon. OpenSea is working to make the platform more accessible to a larger audience, especially for people who haven’t worked in the digital space.

In late July, OpenSea raised $100 million from venture capital company A16z.4 Following the funding, OpenSea stated its hope to become a value transfer machine, instead of an information transfer machine, to realize true ownership and total freedom of trade.

OpenSea hasn’t been without controversy. Recently, it was revealed that a top executive at OpenSea profited by using insider information to buy NFTs in advance of OpenSea publicly promoting them. OpenSea did not have rules in place preventing such behavior and such rules were not required by regulation. However, such events may accelerate action by lawmakers or regulators, which may impact the value of NFTs or the marketplace, as well as Ethereum. The executive resigned and OpenSea has indicated that new rules have been implemented in response.

Conclusion

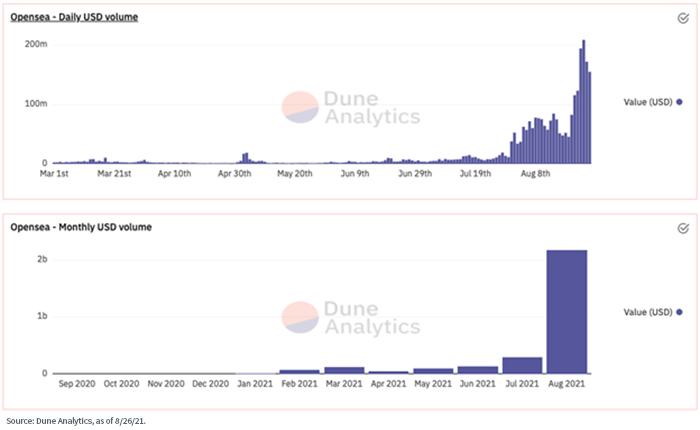

If last summer was the summer of DeFi, this summer is the summer of NFTs.

OpenSea became the top dApp on Ethereum with most gas burned.5 Since the end of July, it has kept breaking its daily volume record. It now generates a 30-day trading volume of $1.54 billion, a fivefold increase from the previous month.6

With Visa’s purchase of CryptoPunk, a new wave of participation has arrived. Traditional auction houses such as Christies have also begun to host sales of NFTs.

Despite many people questioning the objective worth of NFTs, the trend of digitalization and tokenization of rare collectibles is here to stay. For many reasons—among them that we humans desire what others desire—NFTs’ value is driven by this demand.

1 The process of adding a blockchain to an NFT is called minting. Some marketplaces, like OpenSea, allow users to mint NFTs on the site. The minted NFTs are stored in the user's crypto-wallet until OpenSea can facilitate a transaction.

2 https://opensea.io/about

3 OpenSea is built on the Wyvern Protocol, which is a set of smart contracts on Ethereum designed to power decentralized digital asset exchange.

4 https://twitter.com/opensea/status/1417468800845455360

5 https://dune.xyz/k06a/Ethereum-after-1559, as of 9/6/21.

6 https://news.bitcoin.com/openseas-record-breaking-monthly-nft-volume-captures-more-than-1-5-billion/

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing.

Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/anti-money laundering) procedures, noncompliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset.

Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value, and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology, and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to Internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different than when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility.

In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice or as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy. WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor, end client or investor, and has no responsibility in connection therewith, with respect to any digital assets, crypto assets or blockchain networks.

Jianing Wu joined WisdomTree as a Research Analyst in October 2018. She is responsible for analyzing market trends and helping support WisdomTree’s research efforts. Previously, Jianing completed internships and projects at Geode Capital, Starwint Capital, and Invesco Great Wall Fund Management with a focus in quantitative research. Jianing received her M.S in Finance from the Massachusetts Institute of Technology. She graduated with honors from Boston College with degrees in Mathematics and Philosophy.