Eight Themes for China’s Near-Term Growth

We recently spoke with portfolio manager Jeff Jiangfeng Li from EFG Asset Management on our China of Tomorrow podcast.

Jeff currently manages a China equity fund and a global equity fund. Trained as an engineer, his team manages funds as active fundamental managers, with quantitative guardrails for risk management.

Jeff goes into the details of his investment process, which is consistently applied across his portfolios. The theme is to look for companies where valuation is still reasonable given expected profitability growth.

As we’ve also been advocating this past year, Jeff thinks China investors could be rewarded for broadening their investments away from media-focused leaders like Tencent and Alibaba toward less well known growth companies.

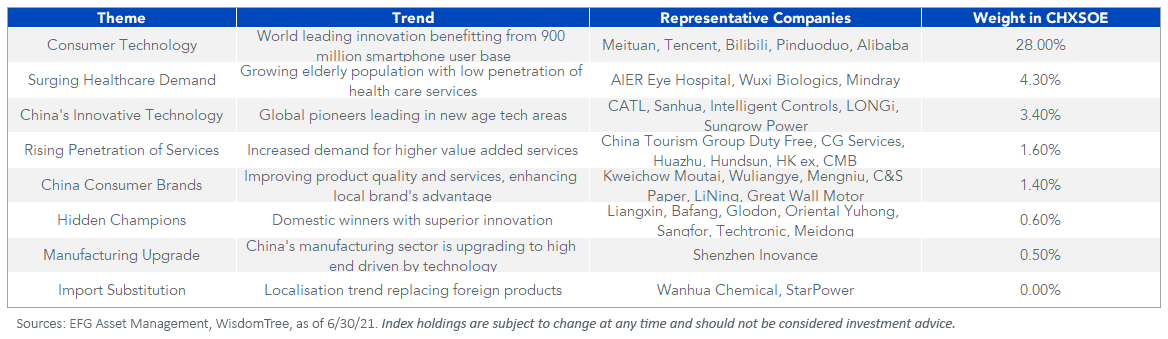

Below are EFG’s eight Chinese growth theme company ideas. The WisdomTree China ex-State-Owned Enterprises Index (CHXSOE) has broad exposure to each of these themes.

We maintain our focus on non-state-owned companies as a fundamental theme of investing in China. China’s growth rates have been adjusted down. The trend of China’s growth rate is much closer to the 4.5%–5.5% range for the near future, and we believe the best indicator of whether the country’s growth is on a good trajectory is whether its non-state-owned economy is able to grow amid the complex and state-dominated social environment. Recent news about companies like Didi and Alibaba show the idiosyncratic risk of one company and the benefit of investing in a broad basket of ex-SOE companies.

You can listen to our full conversation below.

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.