The Disruption Song

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

Change is on its way now.

Nothing’s staying where it used to be

Can’t you feel things moving?

Never where we’d thought we’d ever be…

Disruption Song. No point in holding

Onto old plans. You know they’ve got to go…

Countdown is on

The ground is shifting

Countdown is on

Momentum’s taking us

Countdown is on

The world is tipping

Four, three, two, one.

Who knows which way this will play?

(From “The Disruption Song” by Jim Dandy Audio, 2017)

Investment Themes for 2021

As described in a previous blog post, WisdomTree has identified five primary investment themes that we believe have a high probability of playing out over the course of 2021 and beyond:

- Cyclical rotation back toward small-cap, value and emerging market stocks;

- Emerging markets, both in equity and debt;

- Reflation (higher than expected inflation in the second half of the year);

- A focus on quality and income, both in equity and debt; and

- Disruptive growth.

In this blog piece, we want to take a deeper look into this last theme—disruptive growth. As we’ve written about before, we believe that the COVID-19 pandemic fundamentally and perhaps permanently altered the way we work, socialize, take care of and entertain ourselves.

We believe this has led to certain “thematic” sectors and industries that are showing huge growth trends, and we think these trends will be with us for years to come. These industries include (but are not limited to) financial technology, cloud-based computing, platform-oriented businesses, human genomics, cybersecurity and online gaming and e-sports.

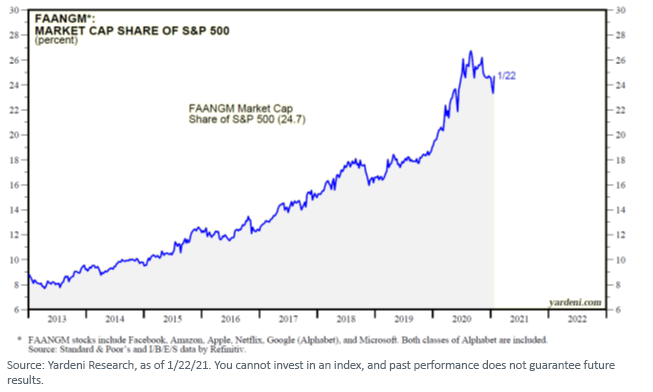

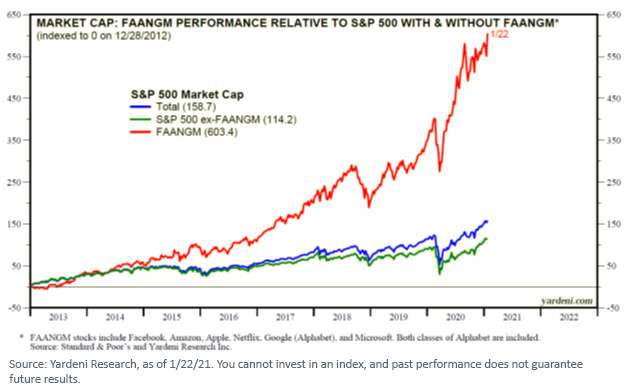

A favorite chart of mine compares the performance of the S&P 500 Index with and without the “FAANGM” stocks—Facebook, Apple, Amazon, Netflix, Google (Alphabet) and Microsoft. Performance for this group fell off recently as the “work from home” trade faded over the course of Q4 2020 and these companies faced increased regulatory and political scrutiny.

But they still represent a significant percentage of the market cap of the S&P 500 Index, and their collective performances have driven most the Index’s overall performance over the past several years:

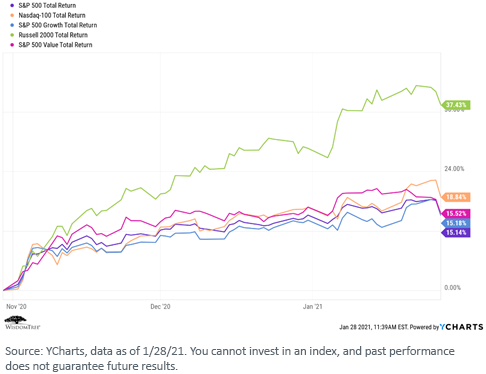

It is true that since the announcement of potential COVID-19 vaccines back in early November, we have seen a cyclical rotation back toward value and (especially) small-cap stocks, but that does not mean that growth stocks have fallen out of favor—they just have not gone up as much as value and small-cap stocks. We interpret that to mean that the disruptive growth story still has room to run.

Model Portfolio Implications

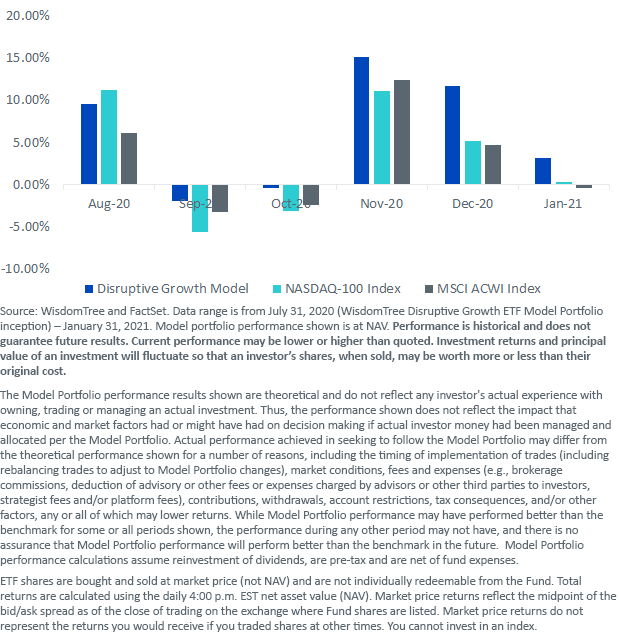

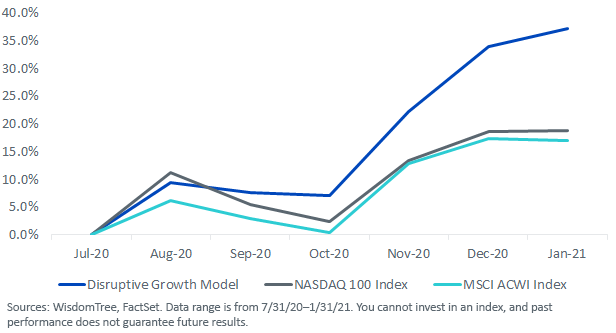

With this growth theme in mind, in mid-2020 we launched the WisdomTree Disruptive Growth Model Portfolio. We identified six specific sectors and ETFs that focused on “disruptive” industries and built a diversified portfolio accordingly.

The model includes the following ETFs: the WisdomTree Cloud Computing ETF (WCLD) and the WisdomTree Growth Leaders ETF (PLAT).1 The performances of both these strategies over the course of 2020 was strong, capitalizing on the various societal changes brought on by the pandemic. Over a common investment period from September 6, 2019 (WCLD’s inception date)–February 1, 2021, WCLD posted a total return of 74.6% (NAV) and PLAT a total return of 47.4% (NAV).2

Since inception, the performance of the disruptive growth model has been exactly what we hoped for, outperforming broad market indexes (e.g., the MSCI ACWI) and even tech-oriented indexes (e.g., the NASDAQ 100):

Click here for standardized performance.

In addition, over their common investment period dating back to October 2019, each of the individual six strategies in the portfolio has shown high double-digit (and in some cases triple-digit) returns at NAV.3

Equally appealing to us is the lack of security overlap between the different allocations. As of December 31, 2020, no two of the current six ETF positions had more than 17% securities overlap to each other, and most had less than 10%.

This portfolio carries high valuations corresponding to its high growth rates, and performance may be volatile, but we believe this level of diversification will help to generate a more consistent performance while still taking advantage of each individual strategy’s explosive growth.

Conclusion

With COVID-19 vaccinations slowly being rolled out and the global economy in what we believe is the early stages of a steady recovery (not even including what will almost certainly be another round of massive fiscal stimulus here in the U.S.), we anticipate that 2021 generally will be a constructive “risk-on” market environment.

'We believe our disruptive growth investment theme will play out well in this environment, as will our corresponding Model Portfolio. It can be allocated to as a stand-alone equity model or as a complementary “sleeve allocation” in broader portfolios where advisors are looking to add a little more “juice” to performance.

Either way, we like how we are positioned to take advantage of what we believe will be an enduring megatrend in the market. We think we may be singing “The Disruption Song” for a long time to come.

1As of December 31, 2020, the WisdomTree ETF PLAT held positions in Facebook (6.28%), Amazon (7.44%), Alphabet (Google) (8.17%) and Microsoft (7.6%), but not in Netflix or Apple. The WisdomTree ETF WCLD did not hold positions in any of the “FAANGM” stocks.

2Data sources: WisdomTree and Factset, using the Fund Comparison Tool on the Digital Portfolio Developer on the WisdomTree website: https://www.wisdomtree.com/tools. Access is limited to registered financial professionals. Past performance does not guarantee future results. For standardized performances, please go to the quarterly fact sheets prepared for both of these products and posted to the WisdomTree website.

3Past performance does not guarantee future results.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients. Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

PLAT: There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses, and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition, and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users, or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny, but there is significant risk that costs associated with regulatory oversight could increase in the future. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

WCLD: There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.