Break on Through to the Other Side

You know the day destroys the night

Night divides the day

Tried to run

Tried to hide

Break on through to the other side

Break on through to the other side

Break on through to the other side, yeah…

(From “Break on Through (to the Other Side)” by The Doors, 1967)

I was on yet another conference call the other day, and the “icebreaker” question was, “What have you learned about yourself this year?” I am not the most introspective of people, so the question knocked me back for a second.

But after giving it some thought, my response was, “It was a year of confirmation. After seeing myself every day on videoconference calls, I confirmed that I have the perfect face for radio. But, more importantly, I confirmed that I am an optimist. If the spectrum is measured from Grinch to Pangloss, I definitely am on the Panglossian side of the scale.” It is hard to imagine making it through 2020 with a pessimistic attitude.

What does being optimistic mean from an investment perspective? It means we are cautiously optimistic about the general economic and market environments—we think 2021 will be a “risk-on” year, especially in the second half, as the full impacts of both COVID-19 vaccinations and fiscal stimulus in the U.S. start working their ways through the system.

From an asset allocation perspective, here is how we see things:

1. The COVID-19 pandemic will hopefully soon be in the rearview mirror—a nightmare none of us will ever forget, but no longer the only thing we think about—let’s call that for the second half of the year, maybe (being optimists) even Q2.

2. We believe our grandchildren will curse our names regarding the national debt and deficit—we are borrowing from them to maintain our current lifestyles, and neither political party seems inclined to slow it down much. When trying to explain this to nonfinancial folks, I ask them, “What if I gave you a new credit card with no spending limit and no requirement to pay anything back other than interest. How large would you live?” The answer, of course, is LARGE. The piper eventually must be paid, but not today, and the grasshoppers1 who run Congress will eventually pass an additional fiscal stimulus package, which should provide a catalyst for positive economic growth.

3.We still prefer stocks to bonds. Rates will most likely grind higher from their current low levels, and the yield curve may continue to steepen. Credit spreads essentially have retraced back to their pre-pandemic levels, and we just don’t see huge upside return potential. Furthermore, credit quality will be critical as we move through the year. Bonds (as measured by the Bloomberg Barclays Aggregate Bond Index) did their job in mitigating downside risk when the pandemic first hit, but have lagged equity markets (as measured by the S&P 500 Index and the MSCI ACWI (all world) Index) in the second half of the year:

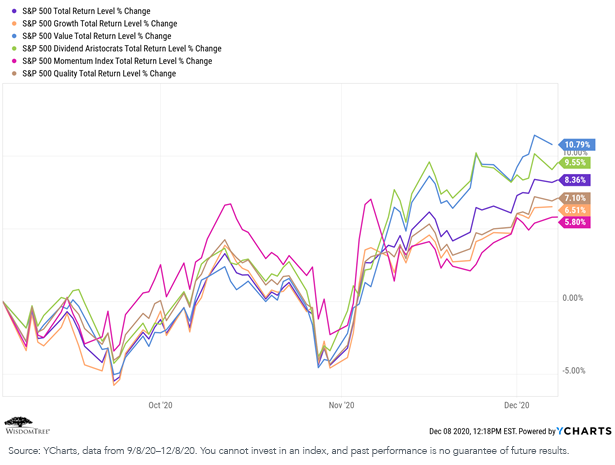

4. It’s too early to tell if “the great factor rotations” back toward value and size will continue, but there are signs suggesting they will2. This second chart shows the three-month results for different risk factors (growth, value, dividends, momentum and quality, all versus the broad market S&P 500 Index):

For definitions of terms in the chart, please visit our glossary.

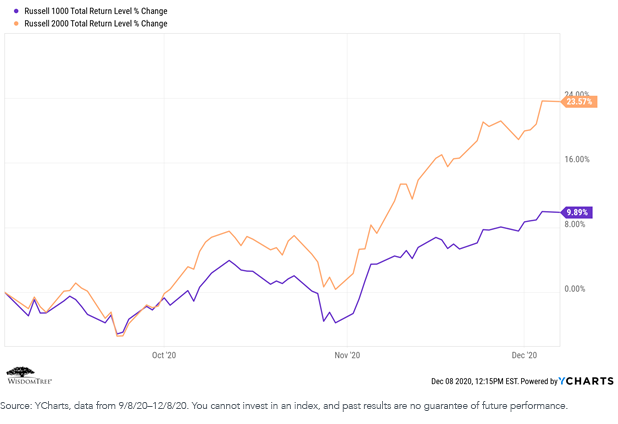

5. This third chart compares three-month returns for large-cap versus small-cap stocks (the Russell 1000 Index versus the Russell 2000 Index):

6. While size and value may be enjoying their day in the sun, this is not to suggest that growth no longer has a place in a well-diversified portfolio, as illustrated by comparing the three-month performance of the broad market S&P 500 Index to (a) the Nasdaq 100 Index (as a proxy for mega-cap tech stocks) and (b) the S&P 500 Growth Index:

7. Global diversification still makes sense, especially if you believe that (a) non-U.S. growth and earnings will outpace the U.S. and (b) the U.S. dollar will continue to slide. First, here is a three-month comparison of the S&P 500 Index to (a) the MSCI EAFE (developed international) Index and (b) the MSCI Emerging Markets (EM) Index:

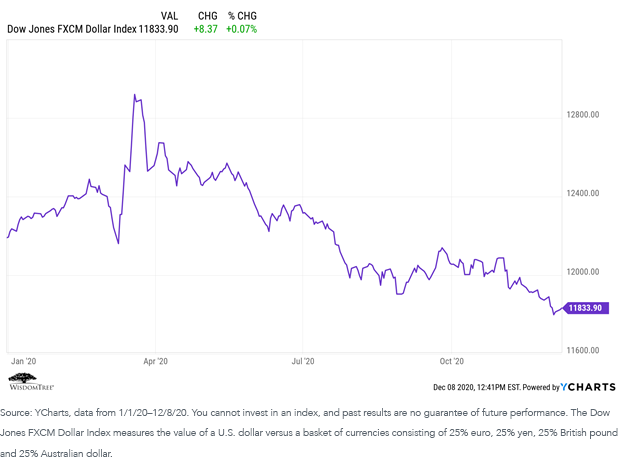

8. Next is a YTD chart illustrating the movement of the U.S. dollar versus a diversified basket of currencies:

Conclusion

While we generally are optimistic about the prospects for 2021, we remain aware that unforeseen events can (and probably will) occur. As we headed into early 2020, who foresaw a global pandemic?

U.S.-China and U.S.-Iran relations remain rocky. Here at home we have upcoming Senate races in Georgia, the outcomes of which may have significant effects on the tax, regulatory, judicial and legislative environments as we head through 2021.

In summary, there are many issues that could alter our outlook and portfolio positioning. But based on what we know now, our asset allocation guidelines are as follows:

- Stocks over bonds

- We remain globally diversified. Relative to the MSCI ACWI Index, we remain slightly over-weight in the U.S. and EM and under-weight in EAFE (developed international)

- Also relative to the MSCI ACWI Index, our equity portfolios maintain strategic tilts to small cap, value, yield and quality

- Relative to the Bloomberg Barclays Aggregate Bond Index, our bond portfolios remain under-weight in duration and over-weight in credit. We also maintain a heavy focus on credit quality

- We continue to believe that current income/yield is best delivered from our equity allocations instead of from taking excessive risk in our bond portfolios

- Our portfolios remain highly diversified at both the asset class and risk factor levels

2021 may be the year we “break on through to the other side,” but we believe in building all-weather portfolios that can handle whatever comes our way.

We wish you all a very happy holiday season and a safe, prosperous and healthy 2021!

1This is a reference to the Aesop fable about the ant and the grasshopper, where the grasshopper pays no attention to the future and simply lives for today, then ends up on the outside of the anthill looking in when winter finally arrives.

2Including, for example, signs that we are entering a cyclical economic recovery when, historically, size and value factors have performed well. Also in the mix are simply the dramatic valuation differences between large-cap growth and the size and value factors. At some point it was reasonable to expect at least somewhat of a “mean reversion” of these valuations.