Introducing the New WisdomTree Enhanced Commodity Strategy Fund

Commodity strategies have significantly underperformed U.S. stocks and bonds over the last decade. But as markets look past the immediate effects of COVID-19, many commodity prices are rebounding. Calls for higher inflation on the re-opening of the market are coming from many strategists, including Wharton Professor Jeremy Siegel.

WisdomTree is excited to introduce an updated approach to broad-based commodity investing.

WisdomTree Enhanced Commodity Strategy Fund’s (GCC) New Dynamic Maturity Selection

We recently restructured the WisdomTree Continuous Commodity Index Fund into the WisdomTree Enhanced Commodity Strategy Fund (GCC), with a focus on providing broad exposure to a diversified basket of commodities.

Key new Fund details:

- A new, lower expense ratio of 55 basis points

First-generation commodity indexes such as the Bloomberg Commodity Index (BCOM) often ignore an important element in constructing commodity strategies: the cost of maintaining those positions.

High carry costs can arise when a strategy invests in a single point on the futures curve. When a futures curve is in contango (upward sloping prices over longer maturities), maintaining positions in the front-end futures contracts1, where the curve is usually steeper, can significantly erode returns.2

Our enhanced roll strategy3 seeks to boost returns by dynamically selecting maturities in an effort to maximize carry, enhance return and reduce volatility compared to more standard, front-month commodity strategies.

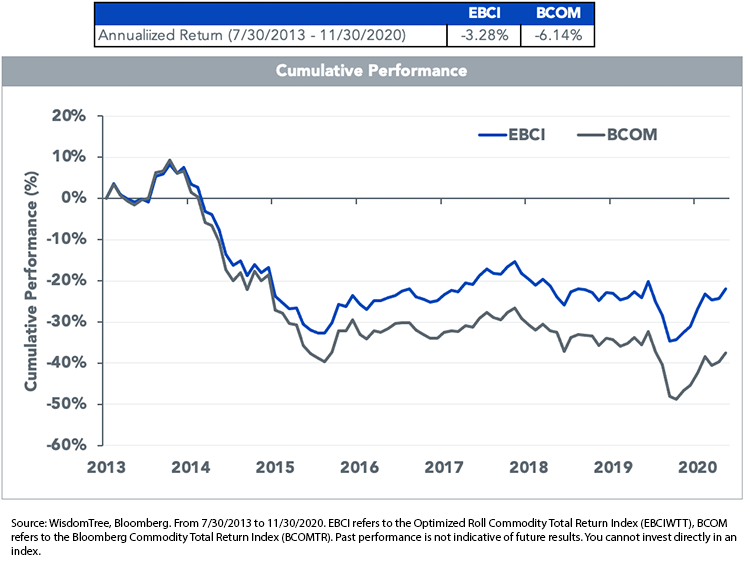

The chart below illustrates the impact carry-agnostic strategies can have on returns compared to strategies that use a more dynamic, carry-based rolling strategy.

Over the last 7 years, BCOM has delivered -6.14% total returns. An index of the same commodities, but utilizing a dynamic and optimized roll strategy, mitigated the drag from rolling these positions and generated a return of -3.28% per year.4

Broader and More Diversified Exposure

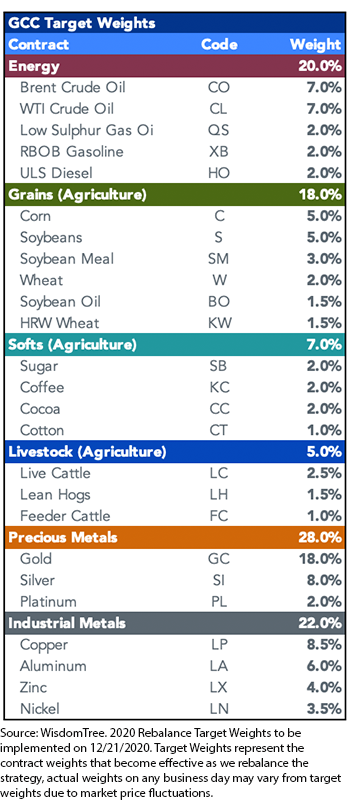

In addition to updating GCC’s roll methodology, we also updated and broadened its exposure to a more diversified basket of 25 commodities via futures contracts.

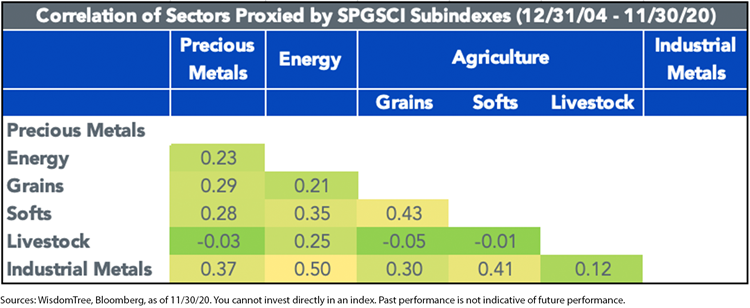

Of the 28 commodities reviewed for inclusion, we selected a comprehensive exposure across four major sectors: Energy, Agriculture (which includes Grains, Softs5 and Livestock), Precious Metals and Industrial Metals. The portfolio is not only broad but also diversified. Correlations among the four sectors are low (below 0.5), which reduces total portfolio risk.

Sector Allocations Focus on Hedging Inflation and Investing in Emerging Technologies

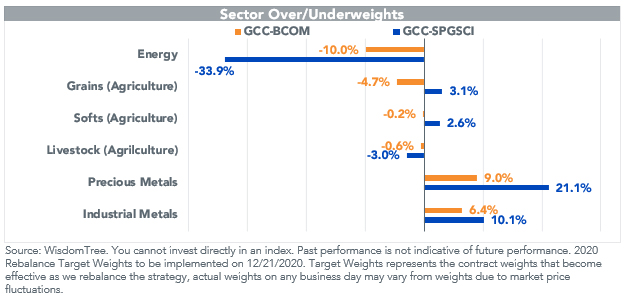

Comparing GCC with the well-established commodity indexes—S&P GSCI Index (SPGSCI) and BCOM—it is evident that our approach provides more weight to the Precious Metals and Industrial Metals sectors while underweighting the Energy sector.

Overweight in the Precious Metals Sector

There are three reasons behind our decision to overweight the Precious Metals sector: to help combat inflation, to hedge against U.S. dollar weakness and to help limit adverse drawdowns in a portfolio.

Precious metals historically have an inverse relationship to the U.S. dollar. Since 1996, the correlation of gold and silver with USD has been negative. Currently, it is around -0.5.6 With continuing low interest rates, loose monetary policy and rising deficits, we believe the U.S. dollar could weaken further.

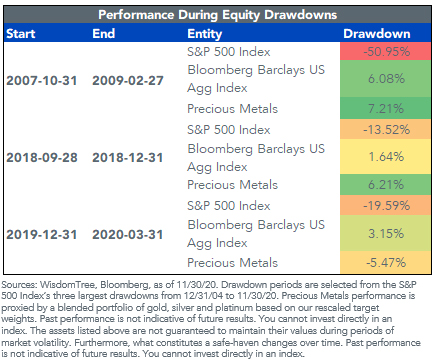

Frequently referred to as “safe-haven assets,” precious metals can reduce adverse portfolio drawdowns during periods of market uncertainty. Over the last 15 years, when the S&P 500 Index suffered extreme drawdowns, precious metals outperformed equities and even generated positive returns in some instances as investors sought safe havens.

Overweight in the Industrial Metals Sector

Industrial metals such as copper and aluminum are key components in the global shift toward electric vehicles and decarbonization because of their light weight, conductivity and ductility. These industrial metals are becoming more widely used in electronic devices, electricity delivery and storage, transportation (including electric vehicles), communication and manufacturing. Investing in these industrial metals is a thematic approach to capturing the rapid growth potential of emerging technologies and progress towards a more environmentally friendly world.

Underweight in the Energy Sector

In contrast to our emphasis on clean and sustainable energy, traditional energy sources such as crude oil and natural gas may continue to languish as consumers seek out cleaner alternatives. The vulnerability of the Energy complex was particularly pronounced in 2020 as sharply decreased demand, combined with a lack of storage capacity, led to negative crude oil prices for the first time in history.

Most importantly, the Energy sector has suffered from carry cost in the past. In particular, natural gas has historically suffered so much from carry cost that a position in this commodity would have lost basically all its value over the past 20 years.

Conclusion

As we emerge from lockdowns later in 2021, the macroeconomic backdrop could bring higher inflation. We believe it may be a good time for investors to investigate commodities as hedges to traditional portfolios given very low interest rates and elevated equity valuations.

GCC provides broad exposure across all commodity sectors with a focus on inflation hedges and future-oriented technologies. It moves away from the fixed rolling mechanism, seeking to maximize carry and enhance returns while lowering volatility.

1The futures curve is the graphical representation of the relationship between the price of futures contracts and the time to maturity of the contracts. The front-end futures contracts refer to futures contracts that have shorter maturities.

2Futures prices converge toward spot prices as they get closer to maturity. For contangoed commodities, this translates in a negative carry return. Contango tends to be more pronounced at the front of the curve, which implies that carry erodes return faster at the front.

3Rolling futures contracts refers to extending the expiration or maturity of a position forward by closing the initial contract and opening a new longer-term contract for the same underlying asset at the then-current market price.

4Returns are annualized from 7/30/2013 to 11/30/2020.

5“Softs” refers to commodities that are grown rather than extracted or mined.

6“Correlation” here refers to the five-year trailing correlation vs. USD. Data as of 11/30/20.

Important Risks Related to this Article

“Correlation” here refers to There are risks associated with investing, including the possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance. These factors include use of commodity futures contracts. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The value of the shares of the Fund relate directly to the value of the futures contracts and other assets held by the Fund and any fluctuation in the value of these assets could adversely affect an investment in the Fund’s shares.

Commodities and futures are generally volatile and are not suitable for all investors. Investments in commodities may be affected by overall market movements, changes in interest rates and other factors such as weather, disease, embargoes and international economic and political developments.

the five-year trailing correlation vs. USD. Data as of 11/30/20.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Jianing Wu joined WisdomTree as a Research Analyst in October 2018. She is responsible for analyzing market trends and helping support WisdomTree’s research efforts. Previously, Jianing completed internships and projects at Geode Capital, Starwint Capital, and Invesco Great Wall Fund Management with a focus in quantitative research. Jianing received her M.S in Finance from the Massachusetts Institute of Technology. She graduated with honors from Boston College with degrees in Mathematics and Philosophy.