Cloud Industry Update: Rebalancing an Equal Weighted Strategy Amidst Momentum

The past six months have been eventful for the cloud computing industry.

The coronavirus pandemic has fortified the case for investing in cloud technology, at both the business and investment portfolio levels.

At the business level, remote work and digitized operations are now viewed as essential to business continuity for many enterprises.

At the investment portfolio level, the rapid growth of cloud companies and their potential for further acceleration has attracted attention. Investors recognize cloud computing as a mainstay technology that is integral and ingrained in the global economy.

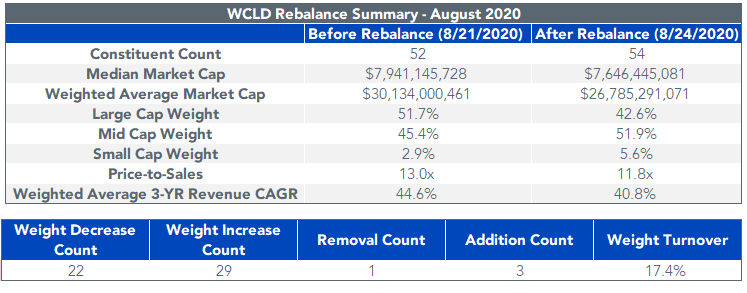

We recently rebalanced the WisdomTree Cloud Computing Fund (WCLD), which seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index. The Index follows a rules-based methodology that resets constituents back to equal weights semi-annually, in February and August.

WCLD has returned 42% since its February rebalance, which nearly coincided with the peak of the S&P 500 Index.1 Its performance has significantly outpaced benchmarks for tech, growth and overall U.S. equities by at least 19 percentage points over the same period.2 Past performance is not indicative of future results. You cannot invest directly in an index. For standardized WCLD performance, please click here.

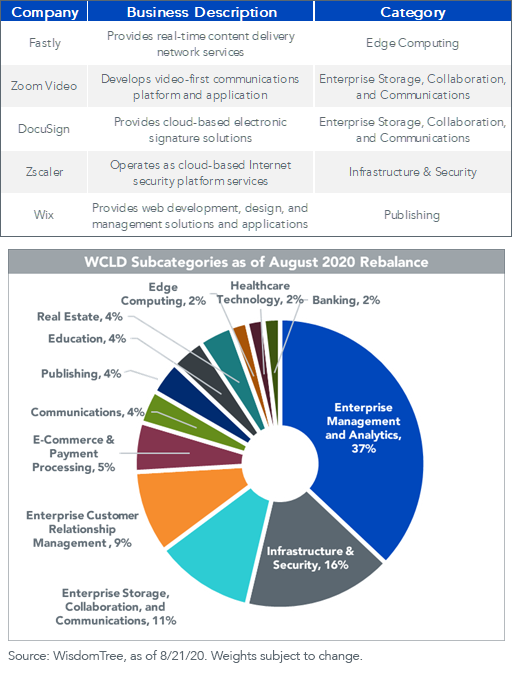

WCLD’s top performers since February include Fastly (+268%), Zoom Video (+185%), Zscaler (+148%), DocuSign (+137%) and Wix (+107%).3

Importantly, these companies do not directly compete within the same sub-category of the cloud industry, demonstrating the wide range in focus of the companies captured in WCLD.

Despite some of the largest intra-rebalance gains since the BVP Nasdaq Emerging Cloud Index launched, the Fund’s turnover remained mostly in line with historical levels this August (17% vs. 16% historical average).4

Heightened interest in the cloud industry along with strong earnings reports in the first and second quarters of 2020 drove valuations significantly higher from 9.7 times price-to-trailing sales in February to 13.0 times prior to the August 2020 rebalance. Notably, the latest rebalance lowered the aggregate price-to-trailing sales ratio of WCLD by roughly one point to 11.8 times.5

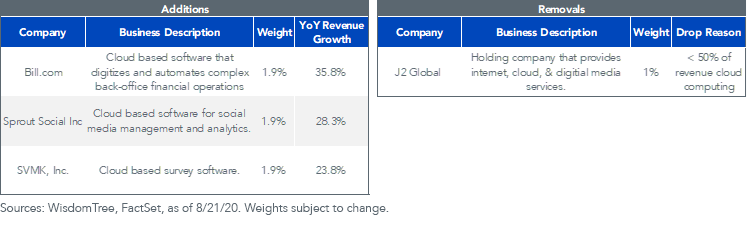

Three additional companies were added to WCLD, all within the Enterprise Management & Analytics category, although none are direct competitors. Bill.com and Sprout Social, which focus on financial and media management software, respectively, are recent public offerings from the end of 2019.6

Meanwhile, SVMK (widely known as SurveyMonkey) recently became eligible for inclusion after meeting the 15% revenue growth requirement for new additions.

Consistent with historical turnover trends, only one company was removed from the Fund. J2 Global, a holding company for a variety of services including cloud software, was removed after the revenue contribution from its cloud business fell below 50% of its total. For reference, several of the past removals from the BVP Nasdaq Emerging Cloud Index have been a result of M&A activity.

For definitions of terms in the tables, please visit our glossary.

With market capitalizations ranging in size from $231 billion (PayPal) to $1 billion (Domo, enterprise management software), WCLD’s equally weighted composition provides significant exposure to fast-growing, emerging businesses that are often overlooked or diluted in market cap-weighted benchmarks.7 In some cases, like with Zoom Video, WCLD has held companies before they grew in size and popularity, and were added to benchmark indexes.

In our view, WCLD’s exposure to rapidly growing, pure-play cloud companies is best positioned to capture the development of the cloud industry over time. For more information on WCLD, visit our Fund page: The WisdomTree Cloud Computing Fund.

1Source: WisdomTree, for the period 2/21/20–8/21/20. WCLD performance at NAV.

2Sources: WisdomTree, Bloomberg. For the period 2/21/20–8/21/20, the Nasdaq 100, S&P 500 and S&P 500 Information Technology indexes returned 22.9%, 2.8% and 19.6%, respectively.

3Sources: WisdomTree, Bloomberg, for the period 2/21/20–8/21/20. As of 8/21/20 (WCLD rebalance after market close), WCLD held 1.85% of its weight in Fastly, Zoom, Zscaler, DocuSign and Wix.

4As of 8/21/2020. Historical turnover since the BVP Nasdaq Emerging Cloud Index inception 10/2/18–8/21/20.

5Sources: WisdomTree, FactSet, as of 8/21/20.

6As of 8/21/20 (WCLD rebalance after market close), WCLD held 1.85% of its weight in Bills.com, Sprout Social and SVMK.

7Sources: WisdomTree, Bloomberg as of 8/21/20.

Important Risks Related to this Article

Short term performance may reflect condition that are unsustainable and may not be achieved in the future.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available above.

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and using a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund's prospectus for specific details regarding the Fund's risk profile.