Was This Cloud Grown Organically?

The Software & Services industry can be divided into two factions: the cloud software providers and the traditional software providers.

There is widespread agreement among industry stakeholders that software deployment via cloud, otherwise referred to as providing Software as a Service (SaaS), is the preferred business model.

Software companies and their shareholders tend to particularly align in support of the SaaS subscription-based revenue model. While traditional software companies derive revenue from single, large and upfront transactions, cloud SaaS companies employ a recurring revenue model with smaller and more frequent transactions. The SaaS model is preferred, which can result in a more predictable, annuity-like revenue stream.

Traditional software company Citrix Systems (CTXS) recently announced a strategic transition to a subscription-based revenue model. Its CEO discussed a few commonly cited reasons for the shift to cloud1,2:

Transparency—“…the strength that we're seeing in subscription bookings serves to improve our predictability and certainly accelerate our growth in future periods.”

Faster Growth—“…the fastest-growing part of the business is pure SaaS.”

Client Demand—“There are secular changes going on in networking driven by the adoption of cloud more than anything else….We've seen…a more pronounced move to software versus hardware. And that’s simply because customers are looking for more flexibility, more choices in a way that they deploy their capabilities.”

Traditional software companies are pursuing the cloud model both organically, like CTXS, and inorganically through mergers and acquisitions (M&A).

Meanwhile, the intensifying competition within the Software & Services industry has driven consolidation among SaaS providers, as well as private takeouts.

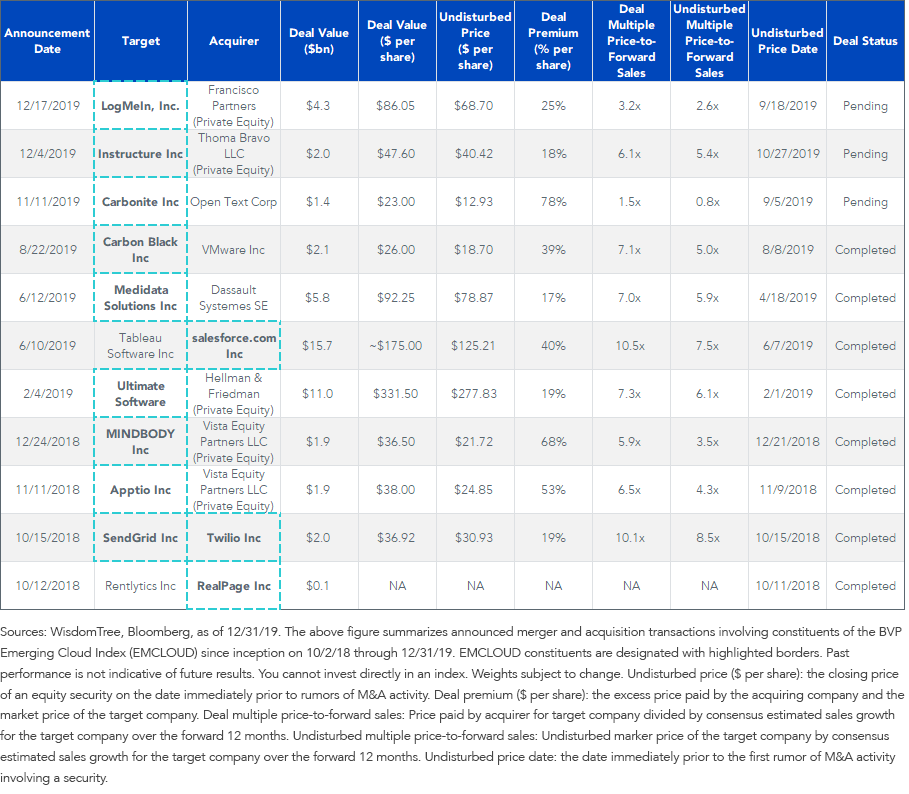

As evidenced by M&A activity within the BVP Nasdaq Emerging Cloud Index (EMCLOUD), SaaS companies have been acquired by traditional software companies, cloud peers and private equity firms at premium valuations.

Since EMCLOUD’s inception in October 2018, there have been 11 transactions announced at an average deal premium3 of ~40%. Notably, all but two of the transactions involved an EMCLOUD constituent as the M&A target.

For definitions of terms in the chart, please visit our glossary.

Acquirers of SaaS businesses are paying a premium for both expected and realized growth.

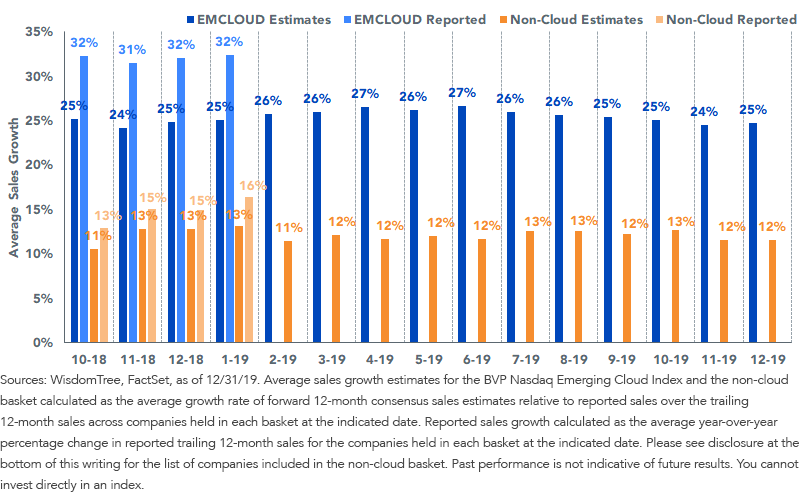

Consensus sales growth estimates for cloud SaaS companies are consistently double those of traditional non-cloud software companies; the average sales growth expectation for cloud has been ~25% as compared to ~12% for traditional software. More importantly, reported sales growth for cloud companies has exceeded consensus forecasts4 at a wider margin than non-cloud companies.

Consensus 12-Month Forward Sales Estimates vs. Reported

Gaining Exposure to Cloud M&A

This year, WisdomTree launched the WisdomTree Cloud Computing Fund (WCLD), which seeks to track the yield and performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index (EMCLOUD).

EMCLOUD leverages the expertise of Bessemer Venture Partners (BVP), a leading early-stage investor in cloud-based businesses. BVP sets the investment parameters for selecting eligible cloud company constituents within EMCLOUD’s investment methodology. The constraints determined by BVP provide a differentiated overlay to company selection with a focus on identifying emerging companies with rapid growth characteristics. BVP’s investment criteria also target companies that are predominantly deriving revenue through the cloud subscription model. These constraints provide “pure” exposure to the cloud software industry while avoiding exposure to traditional software businesses that have been slow to adapt to the SaaS industry standard.

We believe the disruptive, organic growth and the compelling economics of the SaaS revenue model are key reasons why many cloud businesses have become acquisition targets.

To gain exposure to a basket of cloud SaaS businesses with the potential for heightened M&A activity, investors should consider adding WCLD to their portfolio.

1Sources: WisdomTree, FactSet, Citrix Systems, Inc. Q2 2019 Earnings Call.

2Citrix System (CTXS) is not held in WCLD as of 12/31/19.

3Deal premium/discount is the difference between the price paid by the acquiring company and the market price of the target company. A large deal premium is typically viewed positively by shareholders of the target company.

4Source: FactSet, as of 12/31/19.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilize a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

The non-cloud baskets includes Autodesk, Inc., Automatic Data Processing, Inc., Avaya Holdings Corp., Benefitfocus, Inc., Black Knight, Inc., Blackbaud, Inc., BlackBerry Limited, Booz Allen Hamilton Holding Corporation Class A, Bottomline Technologies (de), Inc., Broadridge Financial Solutions, Inc., CACI International Inc Class A, Cadence Design Systems, Inc., Cardtronics plc Class A, Cass Information Systems, Inc., Ceridian HCM Holding, Inc., CGI Inc. Class A, Check Point Software Technologies Ltd., Cheetah Mobile, Inc. ADR Class A, Cision Ltd., Citrix Systems, Inc., Cloudera, Inc., Cognizant Technology Solutions Corporation Class A, CommVault Systems, Inc., Conduent, Inc., CooTek (Cayman) Inc. Sponsored ADR Class A, CoreLogic, Inc., CSG Systems International, Inc., CyberArk Software Ltd., Diamond S Shipping Group, Inc., DXC Technology Co., Ebix, Inc., Endava Plc Sponsored ADR Class A, Endurance International Group Holdings, Inc., Envestnet, Inc., EPAM Systems, Inc., Euronet Worldwide, Inc., Everi Holdings, Inc., EVERTEC, Inc., EVO Payments, Inc. Class A, ExlService Holdings, Inc., Fair Isaac Corporation, Fidelity National Information Services, Inc., FireEye, Inc., Fiserv, Inc., FleetCor Technologies, Inc., ForeScout Technologies, Inc., Formula Systems (1985) Ltd. Sponsored ADR, Fortinet, Inc., Gartner, Inc., GDS Holdings Ltd. Sponsored ADR Class A, Genpact Limited, Global Payments Inc., Globant SA, GoDaddy, Inc. Class A, GreenSky, Inc. Class A, GTT Communications, Inc., Guidewire Software, Inc., HubSpot, Inc., Instructure, Inc., International Business Machines Corporation, Interxion Holding N.V., Intuit Inc., Ituran Location and Control Ltd., Jack Henry & Associates, Inc., Leidos Holdings, Inc., LivePerson, Inc., LiveRamp Holdings, Inc., LogMeIn, Inc., Manhattan Associates, Inc., ManTech International Corporation Class A, Mastercard Incorporated Class A, Materialise NV Sponsored ADR, MAXIMUS, Inc., Microsoft Corporation, MicroStrategy Incorporated Class A, MobileIron, Inc., Model N, Inc., MongoDB, Inc. Class A, Monotype Imaging Holdings Inc., NIC Inc., NICE Ltd Sponsored ADR, NortonLifeLock Inc., Nuance Communications, Inc., Nutanix, Inc. Class A, OneSpan Inc., Open Text Corporation, Opera Ltd. Sponsored ADR, Oracle Corporation, PagSeguro Digital Ltd. Class A, Palo Alto Networks, Inc., Paychex, Inc., Pegasystems Inc., Perficient, Inc., Perspecta, Inc., Phunware, Inc., Pivotal Software, Inc. Class A, Pluralsight, Inc. Class A, Presidio, Inc., Progress Software Corporation, PROS Holdings, Inc., PTC Inc., Q2 Holdings, Inc., QAD Inc. Class A, Qiwi Plc Sponsored ADR Class B, Rapid7 Inc., RealPage, Inc., RingCentral, Inc. Class A, Sabre Corp., SailPoint Technologies Holdings, Inc., SAP SE Sponsored ADR, Sapiens International Corporation NV, Science Applications International Corp., SecureWorks Corp. Class A, SolarWinds Corp., Splunk Inc., SPS Commerce, Inc., SS&C Technologies Holdings, Inc., StoneCo Ltd. Class A, SVMK, Inc., Switch, Inc. Class A, Sykes Enterprises, Incorporated, Synopsys, Inc., Talend SA Sponsored ADR, Teradata Corporation, TiVo Corp., Total System Services, Inc., Trade Desk, Inc. Class A, TTEC Holdings, Inc., Tucows Inc., Tyler Technologies, Inc., Unisys Corporation, Upland Software, Inc., Varonis Systems, Inc., Verint Systems Inc., VeriSign, Inc., Verra Mobility Corp. Class A, Virtusa Corporation, Visa Inc. Class A, VMware, Inc. Class A, Western Union Company, WEX Inc., WNS (Holdings) Limited Sponsored ADR. As of January 7, 2019. Weights subject to change.