The Credit Cycle: Opportunity Exists, but Be Selective

Our base case is that the credit cycle will not turn in 2020. Investors will likely continue to seek income in higher-yielding fixed income assets.

An important topic in credit strategy research in 2019 was the high return dispersion across corporate bond markets. Investors appear more discerning between good and bad bonds.

Given this situation, we are advocating for an up-in-quality trade for high yield (HY) investors who rely on fundamentals as opposed to credit ratings agencies.1

Animal Spirits, But Tread Cautiously…

Following a decreased probability of risks boiling over (e.g., hard Brexit, escalations in the U.S./China trade war) and a reversal in Federal Reserve (Fed) rate hikes, animal spirits were revived in 2019.

The result?

In 2019, the S&P 500 Index returned 31.5% and U.S. HY option-adjusted spreads narrowed 190 basis points (bps), with the highest quality rung of the market outperforming: BBs.2

But what’s driving this?

We believe investing in quality was a prudent approach for 2019 and will continue into 2020. While an outright recession is not our base case, U.S. growth is still expected to remain moderate, at best. In terms of corporate bond fundamentals, debt levels are elevated with the nonfinancial corporate debt/GDP ratio at 47%, near historic highs3.

Going Up in Quality for 2020

The Bloomberg Barclays U.S. Corporate High Yield Index has a yield to worst of 5.19%4. If the credit cycle runs on, as we believe it will, investing in U.S. High Yield could be advantageous for investors seeking income.

It’s our belief that discerning between strong and weak credits will be a significant factor for total returns in 2020. One way to do this is by allocating to bonds with a higher credit rating.

This was a rewarding trade in 2019, with high-yield BBs outperforming high-yield CCCs by roughly 600 bps.5 But it looks like the easy money in this trade may be behind us. We therefore recommend an up-in-quality trade but doing so using security selection and investing in bonds with stronger fundamentals.

WisdomTree’s approach to high-yield credit investing is to isolate high-quality, high-yield bonds while still seeking a comparable income profile to the high-yield bond market.6

When designing our rules-based approach, our goal was to screen the high-yield bond market to potentially avoid defaults/problematic credits.7

Strategy Effectiveness

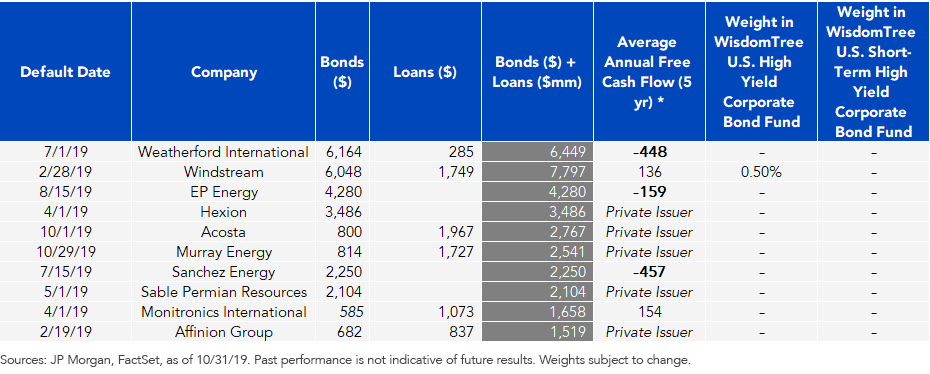

We track corporate fundamentals and defaults closely. In the table below, we break out the 10 largest defaults within the credit universe of corporate bonds and bank loans through 2019.

Largest Defaults of 2019 as of Oct. 31

While many factors are important, cash flow is a good place to start when evaluating the strength of an issuer, as cash balances are easier to track than other accounting variables. We see in the table above that over the past five years, most of the issuers either have been private issuers (providing less disclosure than publicly traded companies) or have generated negative free cash flow, two of our quality screens.

Portfolio Impact8

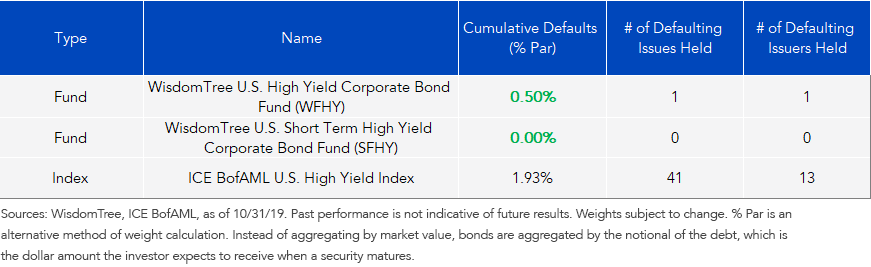

Avoiding some of the biggest defaults of the year serves as strong validation for our process. In the table below, we summarize the overall default statistics for the WisdomTree High Yield Funds in 2019 through October, as well as that of the broad high yield universe as proxied by the ICE BAML U.S. High Yield Index.

Defaults in High Yield in 2019 through Oct. 31

Please click the Funds’ respective tickers for standardized performance: WFHY, SFHY.

The WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) managed to significantly improve the total par value as well as the total number of defaults in 2019 through October 31 versus the ICE BofAML U.S. High Yield Index.

The same story is true for the WisdomTree U.S. Short-Term High Yield Corporate Bond Fund (SFHY), which had no defaults in 2019.

It’s our belief that the WisdomTree approach to high-yield investing captured quality investments through our fundamental screens, and the number of defaults could be a good proxy for the strategy’s ability to filter out bad bonds.

1An up-in-quality trade for HY is investing in the securities with higher credit quality per a rating agency or with stronger fundamentals relative to comparable securities.

2Source: Bloomberg, as of 12/31/19. U.S. HY is a proxy for the Bloomberg Barclays U.S. Corporate High Yield Index. High-yield BBs are proxied by the Bloomberg Barclays Ba U.S. High Yield Index. BB is a credit rating assigned by a credit rating agency. Credit ratings represent the highest of each portfolio constituent as currently rated by Standard and Poor’s, Moody’s or Fitch. Ratings are generally measured on a scale that ranges from AAA (highest) to D (lowest). Ratings from AAA to BBB are considered investment-grade.

3WisdomTree, Federal Reserve, as of 9/30/19.

4Bloomberg, as of 12/31/19.

5Source: Bloomberg, as of 12/31/19. High-yield BBs are proxied by the Bloomberg Barclays Ba U.S. High Yield Index. High-yield CCCs are proxied by the Bloomberg Barclays Caa U.S. High Yield Index.

6The U.S. high-yield bond market is proxied by the Bloomberg Barclays U.S. High Yield Bond Index.

7We consider problematic credits within the U.S. high yield universe to be those which trade at very low prices.

8Any views or analysis relating to the WisdomTree U.S. High Yield Corporate Bond Fund (WFHY) or the WisdomTree U.S. Short-Term High Yield Corporate Bond Fund (SFHY) are provided by Kevin Flanagan.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Credit ratings apply to the underlying holdings of the Fund, not to the Fund itself. Standard & Poor’s, Moody’s and Fitch study the financial condition of an entity to ascertain its creditworthiness. The credit ratings reflect the rating agency’s opinion of the holding’s financial condition and histories. The ratings displayed are based on the highest of each portfolio constituent as currently rated by Standard & Poor’s, Moody’s or Fitch. Long-term ratings are generally measured on a scale ranging from AAA (highest) to D (lowest), while short-term ratings are generally measured on a scale ranging from A-1 to C.