Alternative Universe: Come Sail Away

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these model portfolios.

A gathering of angels

Appeared above my head

They sang to me this song of hope

And this is what they said

(They said) come sail away, come sail away

Come sail away with me (lads)

Come sail away, come sail away

Come sail away with me…

I thought that they were angels

But much to my surprise

We climbed aboard their starship

We headed for the skies

(Singing) come sail away, come sail away

Come sail away with me (lads)

Come sail away, come sail away

Come sail away with me…

(From “Come Sail Away,” by Styx, 1977)

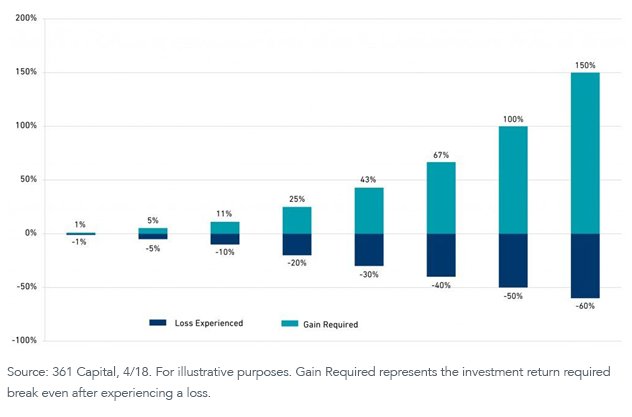

As we mentioned before, advisors are showing an increased interest in including lower-correlated (i.e., alternative) strategies in their client portfolios. The current virus-induced market disruptions and corresponding increased volatility have reminded advisors of the value of building more diversified portfolios in an attempt to improve consistency. It has been a very long time since the rule of compounding needed to be remembered—that is, if you don’t lose as much in down markets, you don’t need to gain as much in up markets to still come out ahead in the long run, because of the power of compounding:

The Power of Compounding

We have also written about the importance of focusing on the long term when investing in a portfolio. Are we contradicting ourselves?

We don’t think so, and the reason is investor psychology and investor behavior. It is not that the market has not always recovered from downturns over different periods of time—it has. But in disruptive markets many investors find it very difficult to maintain the discipline required to realize long-term recoveries.

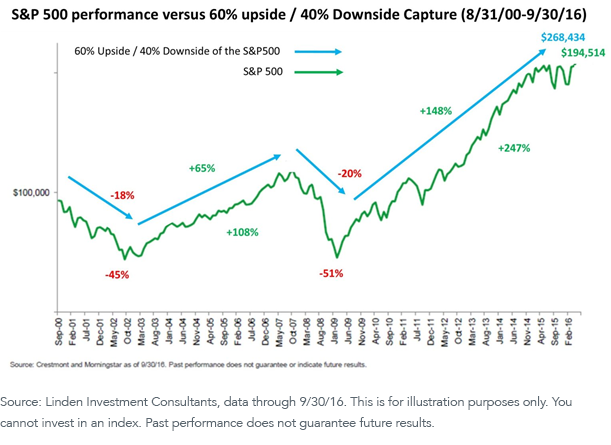

This is where lower-correlated strategies can make a difference. By improving the consistency of performance (go up less in up markets but, more importantly, lose less in down markets), many investors find it easier to maintain discipline with their long-term plans. This has potentially powerful cumulative effects:

Why Limiting Volatility (Downside Risk) is So Important

For definitions of terms in the chart, please visit our glossary.

Alternative investments cover a wide variety of strategies: equity long/short, event-driven, global macro, managed futures, short-biased, arbitrage, market neutral, and others. The commonality among them is that they do not simply rely on stock or bond beta to generate performance. This is precisely why they tend to have lower correlations to traditional markets.

Historically, these strategies were found primarily in hedge funds and were available only to qualified purchasers1. Following the “Great Financial Collapse,” the market saw an avalanche of mutual funds and, more recently, ETFs that seek to deliver these strategies to more retail investors.

It is important to note that some of these strategies depend on illiquidity and/or leverage to generate performance. As such, not all alternative investment strategies lend themselves to the mutual fund or ETF structure.

At WisdomTree, we offer an explicit Volatility Management model portfolio to help advisors do exactly this—create a more diversified overall portfolio for their clients and hopefully improve the consistency of performance. This model is part of our Outcome-Focused category of model “sleeves” designed to solve for very specific investment objectives.

The “Vol Man” model is very straightforward. It currently consists of equally weighted positions in four ETFs. Despite the small number of holdings, we believe it delivers a nicely diversified lower-correlated allocation to broader portfolios:

- One of the ETFs runs a long-short equity portfolio that can be considered a low beta or even “short-biased” strategy.

- A second ETF strategy engages in merger arbitrage—that is, going long on companies being acquired and going short on companies that are acquiring in an attempt to capture the (typical) price movements of both companies as the deal moves toward closing.

- The WisdomTree CBOE S&P 500 PutWrite Strategy Fund (PUTW): As the name suggests, PUTW goes long on the S&P 500 Index and then sells put options against that Index. The premium earned helps to partially offset a downturn in the Index. As such, it is a form of “hedged equity.”

- The final ETF strategy runs a different form of hedged equity. It holds primarily long-dated U.S. Treasuries (the most traditional “hedge” to the equity markets), and then complements that position with long-dated call options (LEAPS) on the S&P 500 Index.

The positions in this model have reasonably low correlation to each other and, when combined, fairly low correlation to traditional stocks and bonds. So, the addition of this portfolio sleeve to a more traditional stock and bond portfolio has the potential to improve the diversification of the overall portfolio.

When markets go straight up, as they did for most of the past 10 years, people can lose sight of the value of diversification. But with a potentially new, more volatile market regime upon us, we believe better diversification can be a powerful tool in helping investors to maintain their investment discipline and advisors to deliver a more differentiated investment experience.

1Qualified purchasers can be either family-owned companies or individuals who own at least $5 million in investments. Qualified purchasers may also be entities or individuals who invest a minimum of $25 million in private capital on other people’s behalf or for their personal financial accounts.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Diversification does not eliminate the risk of experiencing investment losses. Using an asset allocation strategy does not ensure a profit or protect against loss.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice. This material is not intended to be a recommendation or advice by WisdomTree. WisdomTree does not undertake to provide impartial investment advice or give advice in a fiduciary capacity. Further, WisdomTree receives revenue in the form of advisory fees for our exchange-traded funds, and WisdomTree is also entitled to receive a fee from certain model platform providers for licensing model portfolios.

WisdomTree Asset Management, Inc., is an investment advisor registered with the Securities Exchange Commission and a wholly owned subsidiary of WisdomTree Investments, Inc.

For financial professionals: In the event that you subscribe to receive a WisdomTree Model Portfolio, you will receive investment ideas from WisdomTree in the form of a model portfolio. The information is designed to be utilized by you solely as a resource, along with other potential sources you consider, in providing advisory services to your clients. WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for your clients’ accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a model portfolio or any securities included therein for any of your clients. WisdomTree does not have investment discretion and does not place trade orders for any of your clients’ accounts. Information and other marketing materials provided to you by WisdomTree concerning a model portfolio—including holdings, performance and other characteristics—may not be indicative of your client’s actual experience from investing in one or more of the funds included in the model portfolio. The model portfolios, allocations and data are subject to change.

For end users: WisdomTree’s Model Portfolios are not intended to constitute investment advice or investment recommendations from WisdomTree. Your investment advisor may or may not implement WisdomTree’s Model Portfolios in your account. WisdomTree is not responsible for determining the suitability or appropriateness of a strategy based on WisdomTree’s Model Portfolios. WisdomTree does not have investment discretion and does not place trade orders for your account. This material has been created by WisdomTree, and the information included herein has not been verified by your investment advisor and may differ from information provided by your investment advisor. The model portfolios, allocations and data are subject to change.

There are risks associated with investing, including possible loss of principal. The Fund will invest in derivatives, including S&P 500 Index put options (“SPX Puts”). Derivative investments can be volatile, and these investments may be less liquid than securities, and more sensitive to the effects of varied economic conditions. The value of the SPX Puts in which the Fund invests is partly based on the volatility used by market participants to price such options (i.e., implied volatility). The options’ values are partly based on the volatility used by dealers to price such options, so increases in the implied volatility of such options will cause the value of such options to increase, which will result in a corresponding increase in the liabilities of the Fund and a decrease in the Fund’s NAV. Options may be subject to volatile swings in price influenced by changes in the value of the underlying instrument. The potential return to the Fund is limited to the amount of the option premiums it receives; however, the Fund can potentially lose up to the entire strike price of each option it sells. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.