Global Dividend Update

Dividend payouts have been under pressure globally.

Dividend suspensions for large U.S. companies are typically rare events. Boeing’s dividend suspension announcement in March was the first for an S&P 500 constituent since PG&E in December 2017.1 Over forty S&P 500 companies have announced suspensions this year alone.

Despite the U.S. experiencing historic dividend cuts in just a few months’ time, it has fared better than most major international markets.

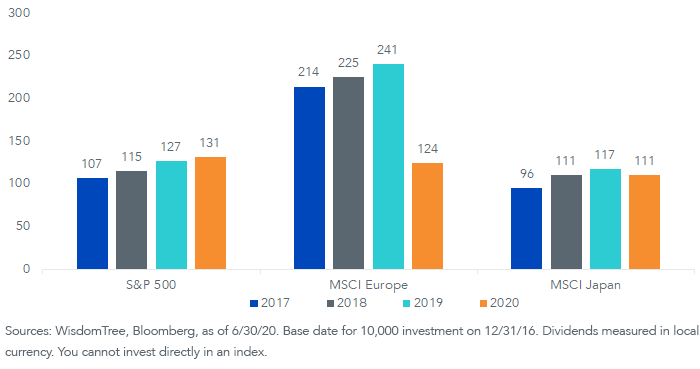

Suspensions and dividend cuts that were announced in the first half of this year will weigh on S&P 500 dividends during the second half of the year. But through June, dividends were modestly above last year’s payouts over the same period.

Japan’s payouts are down roughly 5%. By comparison, Europe dividends have been nearly cut in half.

Dividend Income on Investment of 10,000 for First Six Months – January through June

Let’s review some of the main drivers of differences across regions that have contributed to the relative resilience of markets like the U.S. and Japan as compared to Europe.

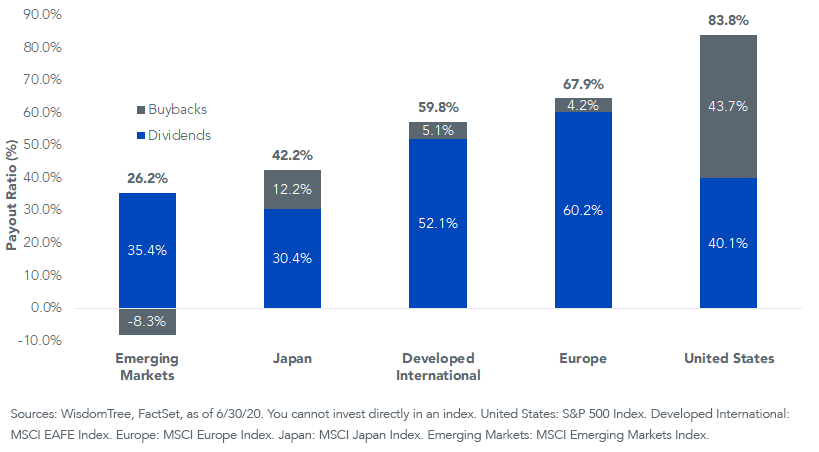

- Dividend payout ratios are highest in Europe (60%) and lowest in Japan (30%)—higher payouts provide less room to maintain dividends when earnings are reduced.

- U.S. companies pay a significant portion of earnings in buybacks, which are perceived as more discretionary and were the first payouts to be cut—dividend cuts are a more negative signal in the U.S. than in Europe.

Trailing 5-Year Median Payout Ratio: Dividends + Buybacks as a % of Earnings

2. Political and Regulatory Responses

- European governments have placed the most severe restrictions on dividend payouts. The European Central Bank (ECB) asked eurozone banks to refrain from dividends until at least October 2020, and the Prudential Regulatory Authority (PRA) requested the same of UK banks until the end of 2020.

- In the U.S., major airlines have suspended dividends until September 2021 in exchange for stimulus payments of more than $30 billion but there have been no widespread restrictions on dividends for companies that have not received government money.

- U.S. banks, which are highly regulated by the Federal Reserve, recently had their Q3 dividends capped at Q2 levels as part of the June 25th stress test results. Importantly, there was no industry-wide ban on dividends.

- Japan has made no announcements on dividend restrictions.

- China has championed dividend increases from state-owned enterprises (SOEs) as a sign of economic strength, but also because SOE dividends are relied on for funding government budgets.2

3. Timing and Frequency of Payouts

- U.S. companies tend to pay dividends quarterly, allowing for more flexibility in changes to payouts.

- European companies tend to pay annual dividends. Over 70% of MSCI Europe dividends are typically paid through June, which means many dividend announcements had to be made this spring amid heightened uncertainty and lockdowns.

- Many companies in Asia paid 2020 dividends in the first half of the year based on healthy 2019 profits, helping ensure the safety of dividends in many parts of Asia for this year.

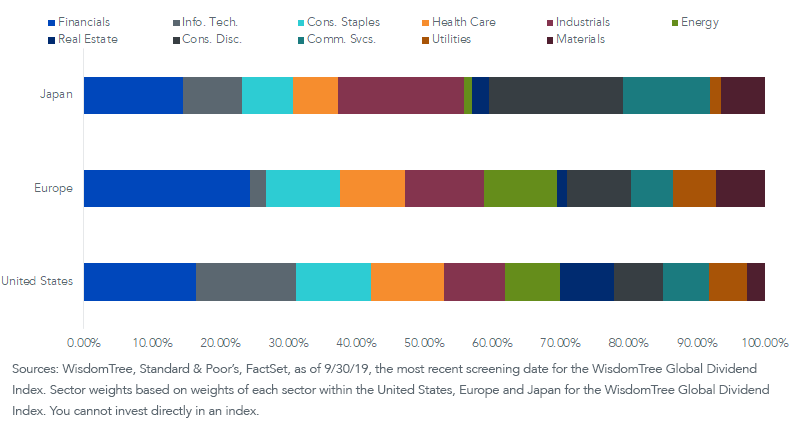

4. Sectors

- Dividends from more defensive sectors (Health Care, Cons. Staples and Tech.) have been more resilient to cuts relative to cyclical sectors (Financials, Industrials, Energy, Consumer Discretionary).

- Financials account for roughly a quarter of all European dividends. The sector is very cyclical and has faced severe regulatory and political pressure to suspend dividends.

- Within the U.S., three of the highest dividend-paying sectors (Info. Tech, Cons. Staples and Health Care) have been resilient to dividend cuts.

WisdomTree Global Dividend Index

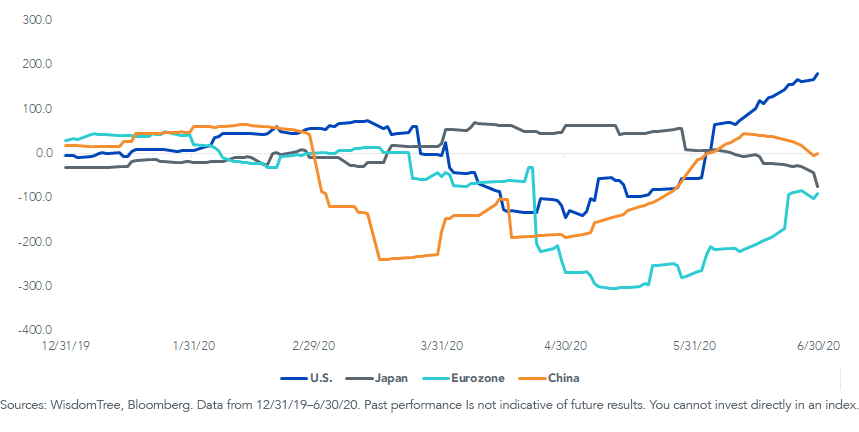

5. Severity of Shutdowns

- Despite China being the origin of the COVID-19 outbreak, China’s data has been improving in recent weeks, and Japan’s economic impact has been rather muted.

- The U.S. and eurozone are just beginning to emerge from months of severe lockdowns that will likely have economic ramifications for years to come.

Citi Economic Surprise Indexes

Dividend Diversification

While some of these factors are structural—payout ratios, dividend seasonality, sector differences—others were harder to anticipate, such as political and regulatory responses and the path of economic re-opening.

In the near term, dividends look to be safest in the U.S. This safety in part explains why dividend yields are also lower in the U.S. than in other markets.

Europe has the riskiest dividends, which brings with it the highest yields.

The bear case for Europe would be a second wave of COVID-19 that requires new shutdowns. The bull case would be no second wave, a healthy improvement in economic conditions and the payment of annual dividends in the fall that were suspended or cancelled this past spring.

The extreme uncertainty for the path of recovery for the global economy from the COVID-19 pandemic favors a well-diversified global portfolio for harvesting income.

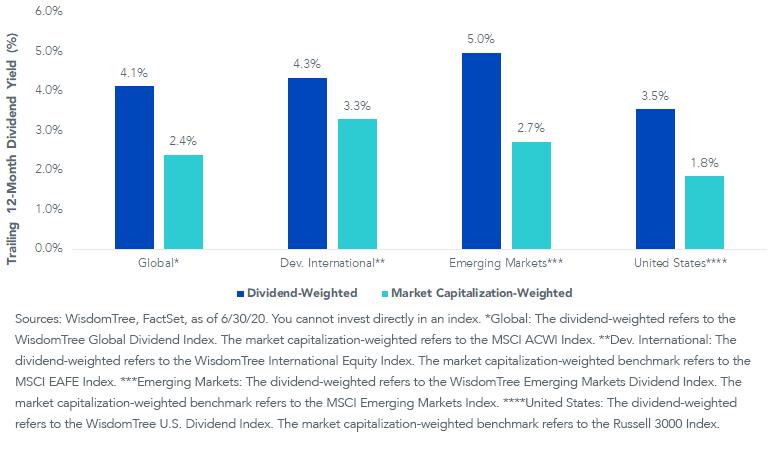

Dividend Yield on Dividend- and Market Cap-Weighted Strategies

1Andrew Edgecliffe Johnson and Daniel Thomas, “Companies axe dividends in global push for cash,” Financial Times, 3/23/20.

2Source: IHS Markit Webinar, “2020 Dividends: What’s next?” 4/3/20.