WCLD: A Top Performing Tech ETF Positioned for a “New Normal”

Determining how much the coronavirus has permanently changed businesses is one of the biggest challenges facing corporations and investors today.

Disruptive events, like the COVID-19 pandemic, are often catalysts for long-term operating changes. These market dislocations can expose companies that are driving or quickly adapting to change, and create opportunities for significant gains in market share.

Last year WisdomTree launched the WisdomTree Cloud Computing Fund (WCLD) with high conviction that the widespread adoption of cloud-based computing could not only disrupt the software industry, but permanently alter standards of business and human interaction.

As a thematic fund, WCLD’s strategy is predicated on the long-term structural shift toward cloud-based computing, rather than short-term cyclical or technical signals.

The coronavirus has forced companies to adjust to this “new normal.” Digitizing operations and implementing tools that enable a distributed workforce are critically important to business continuity.

We believe the pandemic-induced business disruption has accelerated the shift to the cloud and will lead to rapid growth for the industry. In our view, WCLD’s year-to-date outperformance versus broad market indicies demonstrates that a significant transformation is already underway. For standardized performance of WCLD, please click here.

As of writing, the average large-cap blend fund, representing the overall U.S. stock market, is down 13.31% year-to-date, according to Morningstar.1 The top-performing U.S. equity category has been Technology, which is flat year-to-date with average fund performance of -0.01%.2

In the U.S. Technology category, which includes 236 funds, WCLD is among the top five performing funds year-to-date. WCLD has returned 24.81%3, outperforming the U.S. Technology category average by approximately 2,482 basis points (bps)!

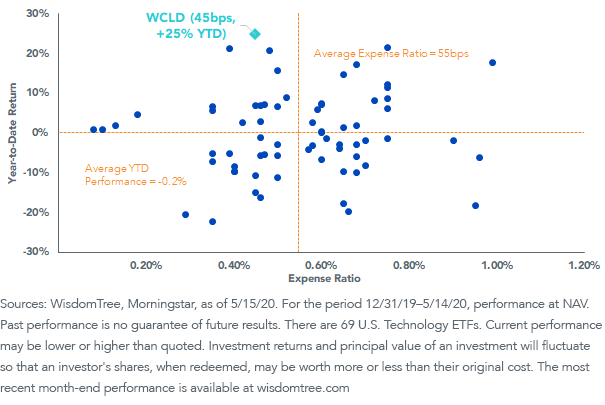

If we compare the ETFs in the U.S. Technology category, the results make a compelling case in support of WCLD.

WCLD has outperformed by approximately 2,464 bps year-to-date with an expense ratio that is 10 bps below the average U.S. Technology ETF.4

U.S. Technology ETFs - Expense Ratio vs. Year-to-Date Performance

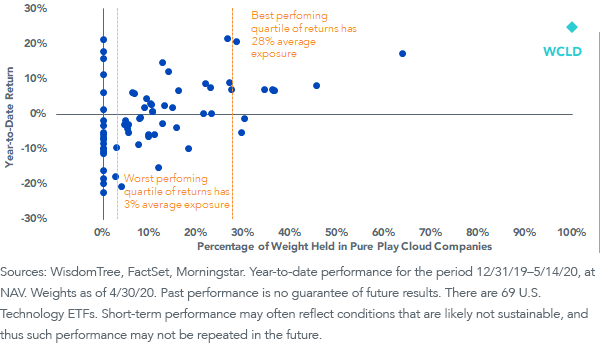

On average, ETFs in the Morningstar U.S. Tech category hold only 12% of their total weight in pure-play cloud computing companies.5 The funds ranking in the top quartile based on year-to-date performance have double the average cloud exposure, with 24% of their total weight held in cloud companies on average. Meanwhile, funds in the bottom quartile have 3% exposure to the cloud industry, on average.6

US Technology ETFs - Cloud Exposure vs. Year-to-Date Performance

WCLD Provides Unique, Targeted Cloud Exposure

WCLD, through a collaboration with Nasdaq, leverages the expertise of Bessemer Venture Partners (BVP), a leading venture capital investor in cloud-based businesses with more than a decade of investment success in the cloud computing industry.

WCLD seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index (EMCLOUD). BVP, in collaboration with Nasdaq, sets the investment parameters for selecting eligible cloud company constituents within EMCLOUD’s investment methodology.

Among key investment criteria are revenue thresholds and growth requirements that are suited to identifying emerging cloud companies with rapid growth potential. The end result of these constraints is a unique basket of 52 cloud stocks that has very limited overlap with benchmark indexes for U.S. equities, tech and growth strategies. The S&P 500, S&P 500 Growth, S&P 500 Information Technology and Nasdaq 100 Indexes only share four to five companies in common with WCLD—and they all hold less than 10% of their weight across these companies.7

The coronavirus pandemic could drive permanent changes in standards for remote work and data management. We see WCLD as a potential way for investors to position for long-term growth in the cloud computing industry and as a hedge against disruptive forces of change in technology and in our current operating environment.

1WisdomTree, Morningstar, as of 5/15/20. For the period 12/31/19–5/14/20, performance at NAV.

2WisdomTree, Morningstar, as of 5/15/20. For the period 12/31/19–5/14/20, performance at NAV.

3WisdomTree, Morningstar, as of 5/15/20. For the period 12/31/19–5/14/20, performance at NAV.

4WisdomTree, Morningstar, as of 5/15/20. For the period 12/31/19–5/14/20, performance at NAV.

5WisdomTree, FactSet, Morningstar. Year-to-date performance quartiles based on performance for the period 12/31/19–5/14/20, at NAV. Pure-play cloud computing companies are defined as the constituents of WCLD. Weights held in pure-play cloud companies are as of 4/30/20.

6WisdomTree, FactSet, Morningstar. Year-to-date performance quartiles based on performance for the period 12/31/19–5/14/20, at NAV. Pure-play cloud computing companies are defined as the constituents of WCLD. Weights held in pure-play cloud companies are as of 4/30/20.

7WisdomTree, FactSet, as of 4/30/20. Pure-play cloud computing companies are defined as the constituents of WCLD. Constituents are subject to change.

Important Risks Related to this Article

Past performance is no guarantee of future results.

There are risks associated with investing, including the possible loss of principal. The Fund invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties and the Index may not perform as intended. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Nasdaq® and BVP Nasdaq Emerging Cloud Index℠ are registered trademarks and service marks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree. The Fund has not been passed on by the Corporations as to its legality or suitability. The Fund is not issued, endorsed, sold or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

THE INFORMATION SET FORTH IN THE BVP NASDAQ EMERGING CLOUD INDEX IS NOT INTENDED TO BE, AND SHALL NOT BE REGARDED OR CONSTRUED AS, A RECOMMENDATION FOR A TRANSACTION OR INVESTMENT OR FINANCIAL, TAX, INVESTMENT OR OTHER ADVICE OF ANY KIND BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS DOES NOT PROVIDE INVESTMENT ADVICE TO WISDOMTREE OR THE FUND, IS NOT AN INVESTMENT ADVISER TO THE FUND AND IS NOT RESPONSIBLE FOR THE PERFORMANCE OF THE FUND. THE FUND IS NOT ISSUED, SPONSORED, ENDORSED OR PROMOTED BY BESSEMER VENTURE PARTNERS. BESSEMER VENTURE PARTNERS MAKES NO WARRANTY OR REPRESENTATION REGARDING THE QUALITY, ACCURACY OR COMPLETENESS OF THE BVP NASDAQ EMERGING CLOUD INDEX, INDEX VALUES OR ANY INDEX-RELATED DATA INCLUDED HEREIN, PROVIDED HEREWITH OR DERIVED THEREFROM AND ASSUMES NO LIABILITY IN CONNECTION WITH ITS USE. BESSEMER VENTURE PARTNERS AND/OR POOLED INVESTMENT VEHICLES WHICH IT MANAGES, AND INDIVIDUALS AND ENTITIES AFFILIATED WITH SUCH VEHICLES, MAY PURCHASE, SELL OR HOLD SECURITIES OF ISSUERS THAT ARE CONSTITUENTS OF THE BVP NASDAQ EMERGING CLOUD INDEX FROM TIME TO TIME AND AT ANY TIME, INCLUDING IN ADVANCE OF OR FOLLOWING AN ISSUER BEING ADDED TO OR REMOVED FROM THE BVP NASDAQ EMERGING CLOUD INDEX.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.