Can the Pandemic Be a Catalyst for Japan?

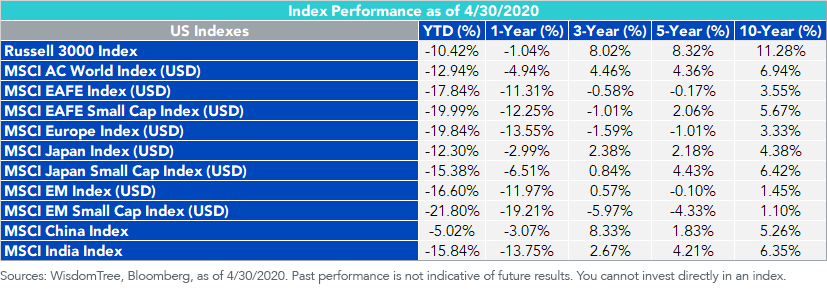

This week, on a special “Behind the Markets” podcast, Jeff Weniger and I spoke with Jesper Koll, Senior Advisor to WisdomTree. Japan is often described as a market that is cyclically geared to the world’s growth cycle, due to its export-oriented economy. It strikes me as a major surprise that Japan is outperforming other international markets by a fairly wide margin during the global economic shutdown.

Tokyo to Open by June: On the virus front, Japan has one of the oldest populations on the planet, with one in three people over the age of 70. Despite the virus impacting the elderly more, Japan has managed its way through the pandemic with very low death rates. This is a testament to the country’s emergency preparedness and procedures and the strength of its health care system. Koll sees Tokyo opening completely by the beginning of June.

Corona-nomics as a Catalyst: Koll sees cultural shifts in attitudes from Corona-nomics that even the aspirations of Abenomics was unable to accomplish. He believes the move to digitize practices required by the virus will have lasting, positive impacts on productivity growth trends. While Japan has long been one of the world’s best value bets, perhaps the virus is a catalyst to accessing the underlying value.

Cash War Chests: Japan’s listed companies went into the crisis with the biggest cash reserves ever recorded, with over $6.5 trillion in cash and short-term securities. This war chest was over 130% of the country’s gross domestic product (GDP) and more than three times the equivalent ratio in the U.S. Moreover, America’s cash is concentrated in big tech companies, but in Japan cash is evident in almost every sector. During a time when investors are worried about debt levels and refinancing, Japan’s cash levels stand out. Koll further believes Japan will put this cash to work in outward-facing merger & acquisition (M&A) deals to support future growth.

V-Shaped Recovery: Early data from Japan’s cyclical companies suggests a V-shaped economic recovery both at home and for key trading partners. Some of the capital goods companies are seeing growth rates of 20% year-over-year coming from China, and Koll believes Japan will be one of the first countries with positive earnings momentum coming as early as the current second quarter from this strength in China.

Accelerator Programs: Abe had announced a relief package of 20% of GDP, along with a longer-term incentive program to accelerate future growth in areas such as data center investments and health care. Japan is working on an industrial policy not just to counter the pandemic but to plant seeds for the future.

Japan Wants to Be the Dividend Champion of the World: In recent years Japan has started focusing on increasing cash payouts and companies are striving to maintain their dividend levels during the pandemic. We are seeing fewer dividend cuts in Japan than in Europe or even the U.S.

Yen Losing Risk-Off Nature? Despite the media headlines about America attacking the crisis alone, Koll sees the stability in the Japanese yen against the U.S. dollar and the Chinese renminbi as evidence that there’s tremendous global policy coordination right now. In prior bouts of economic uncertainty, the yen might have rallied to ¥75 or ¥80 to the dollar. Instead, it has been stuck around ¥107 or ¥108. One trend that may support continued yen weakness includes further portfolio reallocations from Japanese pension funds increasing their overseas bond holdings and outward-facing M&A deals that Koll sees coming.

Structural vs. Cyclical Employment Trends: Koll emphasizes the structural demographic support for consumer spending. With the number of Japanese aged between 25 and 35 falling by approximately 250,000 every year, you would rather be a 25-year old in Japan than in almost any other country in the world. The lack of supply of workers will support wage growth and consumption growth on a longer-term basis.

Japan is one of most interesting countries for value investors and also one that is performing well during this pandemic.

This was a great conversation with Jeff Weniger and Jesper Koll. You can listen to the entire discussion below.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.