Why International Investments Still Matter

One question we are often asked is, “why bother with international investments?” U.S. multinational companies have revenue generated all over the world, so what if diversification is just a matter of “de-worseifying” and bringing suboptimal outcomes?

I understand this concern, considering that for a long stretch of time, the U.S. has outperformed the rest of the world. Over the past 10 years ending April 30, the MSCI USA Index has outperformed the MSCI EAFE Index by more than 140%.1

However, we believe there are long-run benefits of investing globally.

There are strong parallels to “growth” dominating “value” within the U.S. markets when looking at foreign markets versus the U.S.

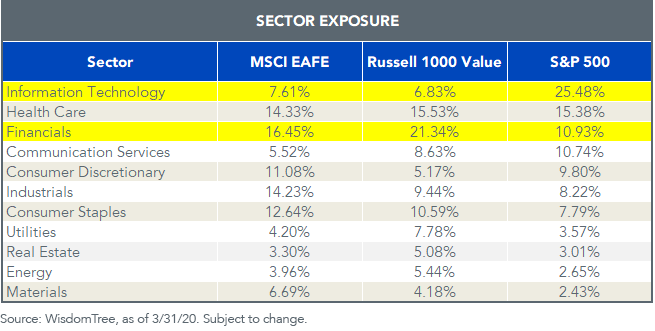

Standard market cap-weighted international indexes have sector exposures akin to U.S. value benchmarks, particularly the lack of technology sector exposure and over-weight position to financials and commodity-dependent sectors.

For definitions of terms in the chart, please visit our glossary.

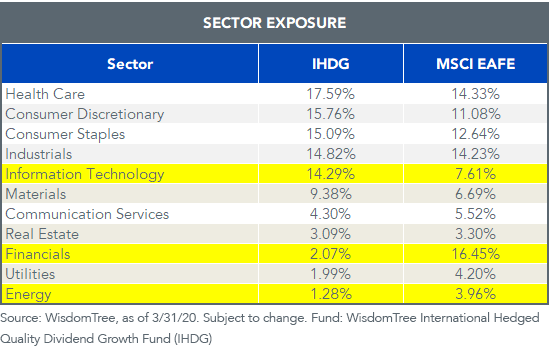

But not all international strategies have these sector tilts.

The WisdomTree international quality dividend growth strategy has a sector balance closer to the S&P 500, particularly being over-weight in technology versus the MSCI EAFE Index and providing meaningful weights to the health care and consumer sectors. In shifting the weight away from traditional value benchmarks, it also has little exposure to sectors that are typically value heavyweights, such as energy and financials.

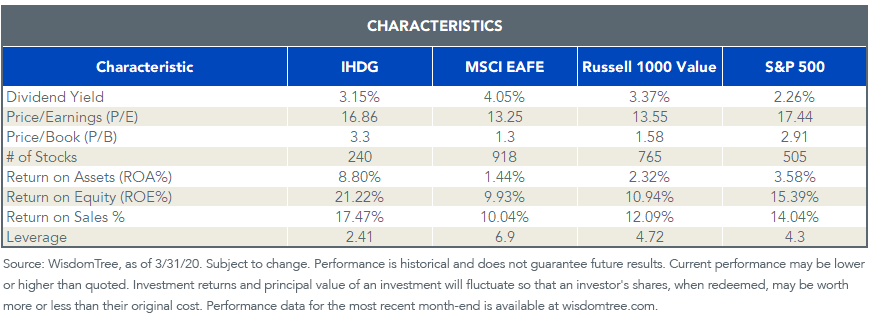

We believe screening for profitability, low leverage and earnings growth creates a valuation profile that is more attractive than broader international benchmarks.

Yes, the MSCI EAFE Index is less expensive than the S&P 500 on a price-to-earnings (P/E) ratio basis (by about four points), but the S&P 500 has a return on equity (ROE) that is 50% greater, profit margins that are 40% higher and less leverage. These higher margins and profitability ratios warrant the premium multiple of the S&P 500.

By contrast, when one focuses on these profitability and growth metrics in selecting higher quality companies, the situation is completely reversed.

The WisdomTree International Hedged Quality Dividend Growth Fund (IHDG), which seeks to track, before fees and expenses, the price and yield performance of the WisdomTree International Hedged Quality Dividend Growth Index, currently has a ROE that is 40% greater than the S&P 500, profit margins 3.5% higher than the S&P 500 and a leverage ratio that is one-third that of the MSCI EAFE Index and almost half that of the S&P 500. For these better profitability and growth metrics, you are also not paying a premium multiple to the S&P 500 but getting the market at around a one-point discount instead.

For definitions of terms in the chart, please visit our glossary.

While the characteristics of broad international benchmarks are understandably “less expensive for good reasons,” we believe this basket of international quality stocks looks attractively priced versus the S&P 500 for its improvement in quality and growth characteristics.

1Source is Bloomberg as of 4/30/2020.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.