Fed Watch: At the Ready

Unlike other Federal Reserve (Fed) related news since the beginning of March, the April FOMC meeting did not provide any groundbreaking headlines. The policymakers have been incredibly busy over the last six weeks, so this was not really much of a surprise. In fact, wasn’t it kind of refreshing to have a Fed announcement on the scheduled day when one was expected? That being said, the Fed continued to make it abundantly clear they stand “at the ready,” should the need arise.

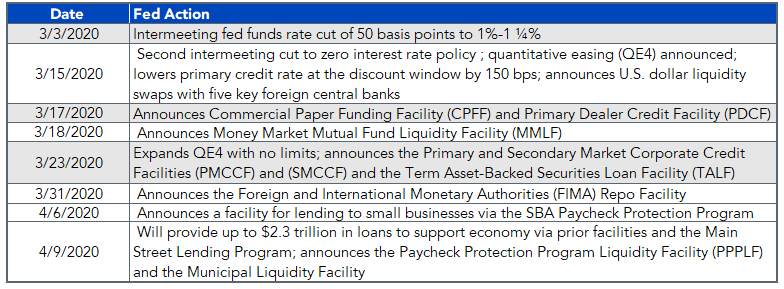

As I’ve mentioned on numerous occasions, thus far, the Fed deserves high grades for their proactive and, more importantly, preemptive policy responses to the COVID-19 situation. Let’s look at the timeline of actions since the beginning of March:

For definitions of terms in the table, please visit our glossary.

There is no doubt the Fed realizes the gravity of the situation from an economic, as well as money and bond market, perspective. However, at this point, sometimes you have to take stock of your actions before making your next move. It is widely expected the U.S. economy will “crater” in Q2—a viewpoint echoed by Chairman Powell earlier this month. Interestingly, while Powell acknowledged that unemployment is expected to rise very high, he also noted such a development would be temporary, and that when the virus runs its course, the rebound could be “fairly quick” and “robust.”

Conclusion

I wrote about the Fed’s balance sheet in last week’s blog, and the total increase is now up to nearly $2.3 trillion, as of this writing. The Fed remains in “whatever it takes…and then some” mode. In fact, we believe the policymakers will be in no hurry to scale back, let alone reverse, any of their policy responses up to this point, even when the situation shows signs of improvement. Powell & Co. seem to be very cognizant of the dangers of any “false starts.”

Unless otherwise stated, data source is Bloomberg, as of April 27, 2020.