Unlocking Volatility Hedges for Equity Markets

In an update to a piece that we originally published February 27, we believe strongly that investors should continue to seek out strategies that can capitalize on the negative correlation between equities and fixed income.

As the economic cycle ages, fears of equity market drawdowns and the need for hedges are discussed more often.

Some investors see challenges to hedging, often pointing to bond yields that are negative after inflation and concerns over “expensive” equities.

But we increasingly believe interest rates are going to stay low for longer.

Our Senior Investment Strategy Advisor, Professor Jeremy Siegel, believes bonds have increasingly become the “negative beta” defensive hedge asset of choice.

We see this on days when stocks are volatile: interest rates tend to go down (which means bond prices climb higher).

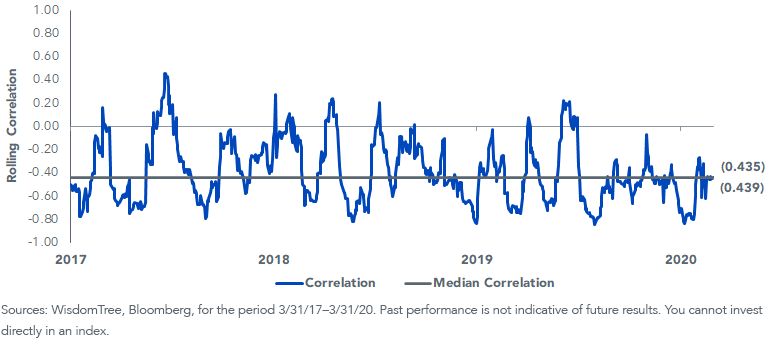

We tip our hat to the Wall Street Journal’s Daily Shot email, which recently published a chart showing that bonds’ inverse correlation to stocks is about as strong as it’s ever been. We recreated it using index-level data below to illustrate the point.

20-Day Correlation: S&P 500 Index vs. ICE U.S. Treasury 7–10 Index

For definitions of terms in the chart, please visit our glossary.

A Late-Cycle Solution

In August 2018, we launched the WisdomTree 90/60 U.S. Balanced Fund (NTSX) to capitalize on this phenomenon.

For every $100 invested in NTSX, the fund has $90 of equity exposure and $10 of U.S. dollar-denominated collateral combined, plus $60 of bond futures1 exposure.

We believe the negative correlation bond trend adds to the total diversification NTSX provides compared to a traditional 100% equity fund.

The roots of this portfolio approach go back a quarter century, when Cliff Asness first wrote about a levered 60/40 offering better diversification and more return potential than a 100% equity position.

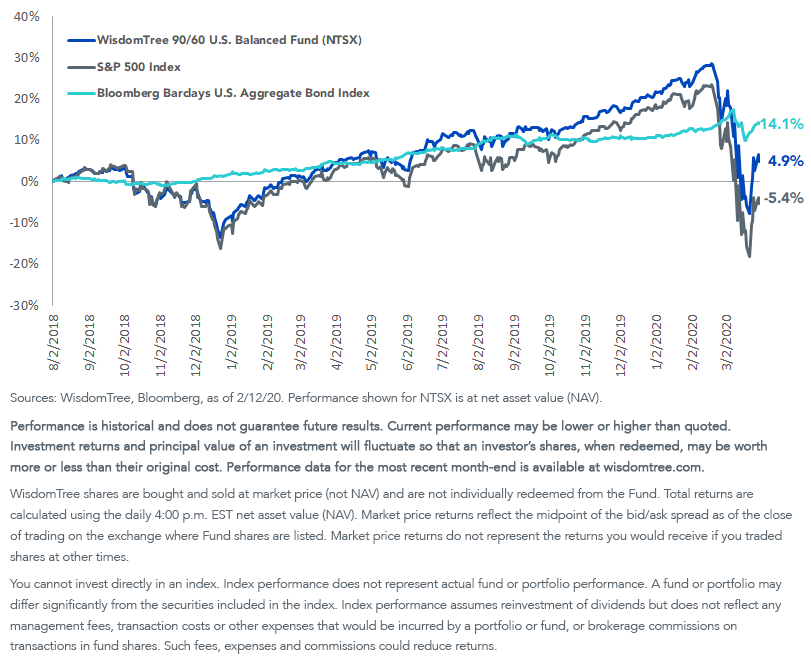

While there are decades of historical research on this topic, the 1.5+ year live track record for NTSX shows how the Fund can add value.

Cumulative Returns of NTSX vs. Stocks & bonds: 8/2/18–3/31/20

For standardized performance of NTSX, please click here.

Have Your Cake, and Eat It Too

Without much in the way of real return, the primary role of bonds is to hedge against stocks. We believe the negative-beta hedging characteristic that bonds offer further strengthens the case for NTSX as a substitute for pure equity beta today.

1Bond futures refers to a contract that reflects the expected future value of the underlying instrument, which in this case is the price of U.S. Treasuries.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models, and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning, and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.