Adding Value in Model Portfolios

This article is relevant to financial professionals interested in model portfolios. WisdomTree ETF model portfolios are available only to financial professionals, through various portfolio platforms.

The use of third-party asset allocation model portfolios by financial advisors and RIAs is growing rapidly. Industry surveys1 suggest that 53% of all advisors use prepackaged model portfolios in their overall investment solutions, and 28% plan to increase their use of model portfolios in the coming years. The reasons are varied, and include increased operational efficiency and delivering an investment solution that can help open up more time to spend in client-facing activities.

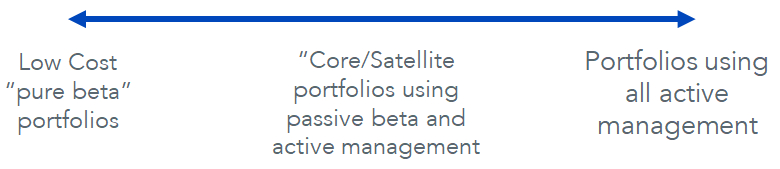

There are numerous approaches to building and managing model portfolios, but they can be summarized with the following spectrum:

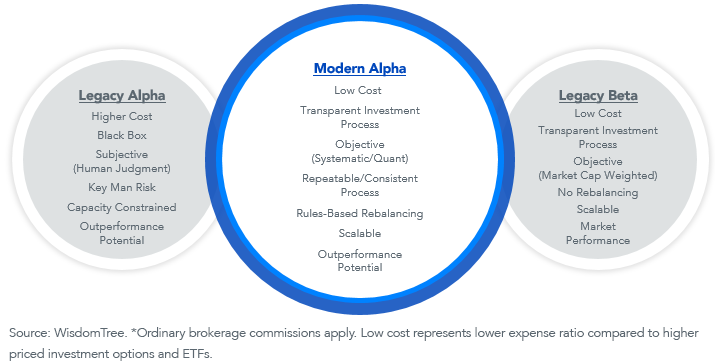

Let’s examine how each of these approaches seeks to add alpha, or value, in the portfolio management process:

1. Low-cost2 “pure beta” model portfolios: Pure beta products, such as cap-weighted exchange-traded funds (ETFs), are designed explicitly to track the performance of an underlying index (e.g., the S&P 500 Index or the Barclays Capital U.S. Aggregate Bond Index, an index used by bond traders, mutual funds and ETFs as a benchmark to measure their relative performance) gross of expense ratios and tracking error. The manager of a pure beta portfolio, therefore, has only one potential alpha lever to pull—the asset allocation decisions. By “alpha lever” we mean portfolio decisions a manager can make in an attempt to generate outperformance relative to an underlying benchmark.

For example, suppose a global equity model was designed to be benchmarked to the MSCI ACWI Index. The only source of potential alpha in a pure beta portfolio is to make allocation decisions that deviate from the regional and sector weightings of the benchmark, in this case, the MSCI ACWI Index. This is definitionally true since the underlying products are designed to track specific cap-weighted indexes. While this certainly can be a source of alpha, it is somewhat limiting.

2. All active management model portfolios: In these portfolios, the manager has three potential alpha levers to pull:

- Asset allocation: Similar to a pure beta portfolio, the manager can make allocation decisions away from the underlying portfolio index (in our example, the MSCI ACWI Index);

- Portfolio construction and security selection: Unlike with pure beta portfolios, the manager can select different active management strategies to fit the manager’s market views and the portfolio objectives; and

- Portfolio construction and security selection: This, of course, is the potential allure of active management—the potential for the manager to deliver outperformance, net of fees and taxes.

2. Portfolio construction and security selection: As an “open architecture” portfolio manager, we deploy both WisdomTree and third-party strategies in an attempt to deliver an optimal mix of asset class and risk factor diversification, to provide potentially more consistent performance through full market cycles; and

3. Factor tilts: Like more traditional active managers, all WisdomTree products have built into them explicit factor tilts, except cap-weighted. Our products, by design, are not cap-weighted. Depending on the product, they are all tilted to one or more risk factors—size, value, dividends, earnings and quality (i.e., strength of balance sheet, stability of earnings, higher operating margins, etc.). Most WisdomTree products are designed to track customized indexes that we create ourselves using sophisticated and algorithmic filtering and security selection protocols. Our products have the potential to deliver performance alpha over cap-weighted indexes, similar to active management, but in a disciplined and rules-based manner; and

4. Cost and tax efficiency: Because all WisdomTree models deploy only ETFs, we believe we add significant cost and tax-efficiency alpha versus the more traditional core/satellite portfolios that use actively managed mutual funds.

In summary, we believe that with our Modern Alpha approach, WisdomTree has “built a better mousetrap” with respect to outsourced model portfolios. We pull all potential alpha levers to potentially optimize portfolio performance, consistency, cost and tax efficiency.

More financial advisors and RIAs are adopting outsourced model portfolios into their practices as they seek to deliver an institutional-quality investment solution in a cost- and operationally efficient manner. The WisdomTree Model Portfolios allow these advisors to focus on core competencies, maximize client-facing activities and deliver a differentiated end-client experience.

1Ignites Research, “Modernizing National Accounts Strategy for Model Portfolios,”, October 2019.

2Ordinary brokerage commissions apply. Low cost represents lower expense ratio compared to higher priced investment options and ETFs.

Important Risks Related to this Article

This content is for information only and is not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should it be considered or relied upon as a recommendation by WisdomTree regarding the use or suitability of any model portfolio or any particular security. This content is intended for use only by a financial advisor as a resource in the development of a portfolio for the financial advisor’s clients. The financial advisor is solely responsible for making investment recommendations and/or decisions with respect to its clients without input from WisdomTree, including with respect to investing in accordance with any model portfolio or any particular security. WisdomTree is not acting in an investment advisory, fiduciary or quasi-fiduciary capacity to any financial advisor or its client and is not providing individualized investment advice to any financial advisor or its client based on or tailored to the circumstances of any individual financial advisor or its individual client.This content has been prepared without regard to the individual financial circumstances and objectives of any investor, and the appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Investors and their advisors should consider the investor’s individual financial circumstances, investment time frame, risk tolerance level and investment goals. Investors should consult with their own advisors before engaging in any transaction. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a model portfolio’s allocations will provide positive performance over any period. The model portfolios are provided “as is,” without any warranty of any kind, express or implied. Information and other marketing materials provided to you by WisdomTree or any third party concerning a WisdomTree model portfolio, including allocations, performance and other characteristics, may not be indicative of an investor’s actual experience from an account managed in accordance with a model portfolio’s strategy.

This content, and any assistance provided as described herein, including portfolio construction and asset allocation stress testing, assessments, discussions, output or other assistance (whether by WisdomTree personnel or digital tools) (the “Assistance Tools”) are for information only and no material or Assistance Tools are intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice. This content and the Assistance Tools are intended for use only by a financial advisor as a resource in the development of a portfolio for the financial advisor’s clients.

Neither WisdomTree Investments, Inc., nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax advice. All references to tax matters or information provided in this material are for illustrative purposes only and should not be considered tax advice and cannot be used for the purpose of avoiding tax penalties. Investors seeking tax advice should consult an independent tax advisor.