How to Add Mortgage-Backed Securities and Securitized Debt to Your Fixed Income Arsenal

Mortgage-backed securities and other securitized debt can potentially offer investors:

- Access to a favorable asset class with attractive income characteristics

- A diversifier with low correlations relative to other fixed income sectors and equities

- Less overall interest rate sensitivity than broad allocations to U.S. Treasuries and corporate bonds because of less interest rate duration, which has translated to a lower historical volatility profile.

The pool of available securities is deep, diverse and, for the most part, highly liquid. Agency mortgage-backed securities, which at $8.3 trillion comprise 72% of available securitized debt1, are the second most actively traded fixed income sector behind U.S. Treasuries. Targeted exposures to other securitized debt sectors (about $3 trillion in available securities) can provide greater diversification of risks and potential enhancement to income. The combination of a core of mortgage-backed securities and a smaller component of securitized debt provides a range of interest rate and credit exposures that are unique from U.S. Treasuries and corporate bonds.

The potential for income from investments in a favorable asset class is valuable in this low-yield environment. The recent buoyancy of the consumer sector and the relative sluggish growth of mortgage-backed debt (relative to economic growth) also provide an interesting counterpoint to the rapid growth in issuance of corporate sector debt. We believe that since the growth in mortgage debt is less than that of the U.S. economy, there is strength in the balance sheets for borrowers in the mortgage market.

Access a favorable asset class with attractive income characteristics…

Agency residential mortgage-backed securities (Agency RMBS) are guaranteed by government-sponsored enterprises (GSE) and supported by mortgage loans on single-family homes. Like U.S. Treasuries, Agency RMBS are generally perceived to have limited credit risk (rated Aaa by Moody’s), but do expose investors to prepayment risk. As homeowners pay down the mortgages or refinance, principal is paid back to the investor over the life of the mortgage loans. The potential for refinancing is the driver of prepayment risk and of the fluctuation in the overall level of interest rate risk. In accepting this risk, investors typically expect some incremental income relative to similar duration U.S. Treasuries.

Outside of Agency RMBS, the securitized debt market features bonds backed by single-family mortgages not guaranteed by the GSEs (Non-Agency RMBS), commercial mortgage loans (CMBS), consumer loans (asset-backed securities—ABS) and corporate loans (collateralized loan obligations—CLO). Most of these securities expose investors to less prepayment risk than Agency RMBS, but differing levels of credit risk.

As evidenced in the following exhibit of yields and durations of fixed income sectors, securitized debt sectors provided incremental yield relative to U.S. Treasuries with similar durations and significantly lower durations than broad-based exposures to corporate bonds. Access to securitized debt sectors provides an investment option which may increase yield relative to U.S. Treasuries without increasing portfolio duration. Lower durations are a good indicator of less price sensitivity to movements in interest rates.

Effective Yields vs. Effective Duration, 9/30/19

For definitions of terms and indexes in the tables, please visit our glossary.

…offering potential diversification benefits and…

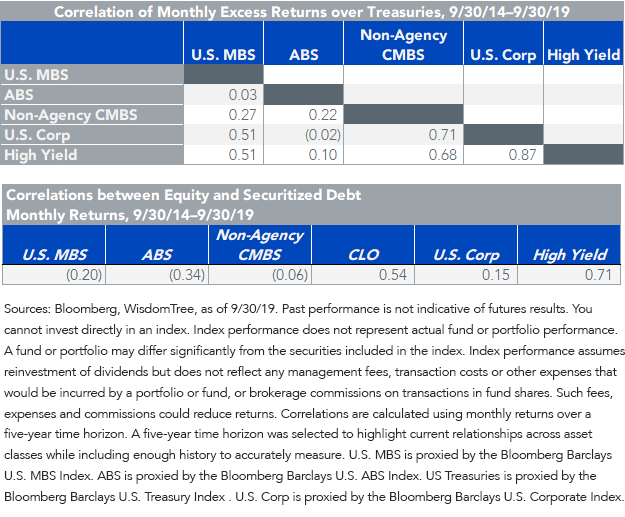

Most of the securitized debt universe is closely tied to the health of the Consumer and the Housing market , which often follows a different path than Corporate America. This distinction hints at the diversification potential offered by securitized debt relative to both corporate bonds and equities. Mortgage-backed securities and other securitized debt has historically exhibited low correlations to other fixed income spread sectors, such as corporates, and equities. Additionally, correlations between securitized debt sectors are also relatively modest, hinting at the potential value in diversifying within sectors.

For definitions of terms and indexes in the tables, please visit our glossary.

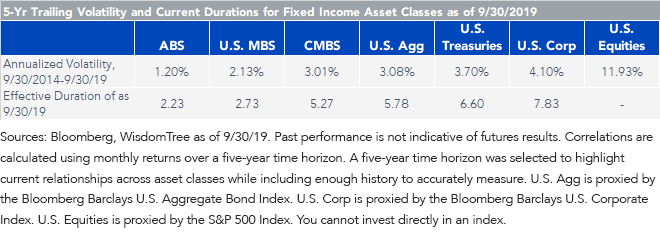

…historically less-volatile returns.

Historically, the shorter durations than broad-based corporate bonds and U.S. Treasury universes have translated into less return volatility. The table below shows the volatility of the respective assets over the last five years.

For definitions of terms and indexes in the tables, please visit our glossary.

How to Implement?

The WisdomTree Mortgage Plus Bond Fund (MTGP) is an actively managed bond fund. WisdomTree Asset Management Inc. (WisdomTree) will serve as the fund’s investment adviser, and Voya Investment Management (Voya IM) will serve as the Fund’s subadvisor. Voya IM is a well-respected securitized debt manager currently managing $34.9 billion in securitized assets as of September 30, 2019. The existing Voya securitized team led by David Goodson has been together for more than 17 years.

The Fund provides exposure to both Agency RMBS and Agency Commercial MBS with a core portfolio of at least 80% and the ability to diversify and seek yield-enhancing opportunities through targeted allocations (up to 20%) in other sectors of the securitized debt market. The Fund will be at least 80% investment grade and more than likely at least 80% Aaa.

A well-constructed exposure to securitized debt can be used to enhance the potential for outperformance of a fixed income portfolio and to deliver tailored investment solutions to investors. We believe the Mortgage Plus Bond Fund provides this exposure, underscored by the steady hand that Voya IM, as an experienced and influential manager, provides.

1Sources: Bloomberg, SFIMA, Fannie Mae and Freddie Mac, as of 6/30/19.

Important Risks Related to this Article

Credit ratings apply to the underlying holdings of the Fund, not to the Fund itself. Standard & Poor’s, Moody’s and Fitch study the financial condition of an entity to ascertain its creditworthiness. The credit ratings reflect the rating agency’s opinion of the holdings’ financial condition and histories. The ratings displayed are based on the highest of each portfolio constituent as currently rated by Standard & Poor’s, Moody’s or Fitch. Long-term ratings are generally measured on a scale ranging from AAA (highest) to D (lowest), while short-term ratings are generally measured on a scale ranging from A-1 to C.

There are risks associated with investing, including possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of an investment will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that investment to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Liquidity risk may result from the lack of an active market, reduced number and capacity of traditional market participants to make a market in fixed income securities, and may be magnified in a rising interest rate environment and/or with respect to particular types of securities, such as securitized credit securities. Non-agency and other securitized debt are subject to heightened risks as compared to agency-backed securities. High yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions. Unlike typical exchange-traded funds, the Fund is actively managed using proprietary investment strategies and processes and there can be no guarantee that these strategies and processes will be successful or that the Fund will achieve its investment objective. Due to the investment strategy of the Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.