Late Inning Relief for High Yield

Are you tired of reading about inverted yield curves yet? Well, let’s turn our attention to a recurring question in bond-land instead: is this the end of the credit cycle?

Without a doubt, high yield (HY) has shown definite resilience over the last few years, and has not, as yet, indicated that it’s at the end of the cycle. But maybe a better way of looking at it is that perhaps investors are witnessing the late innings.

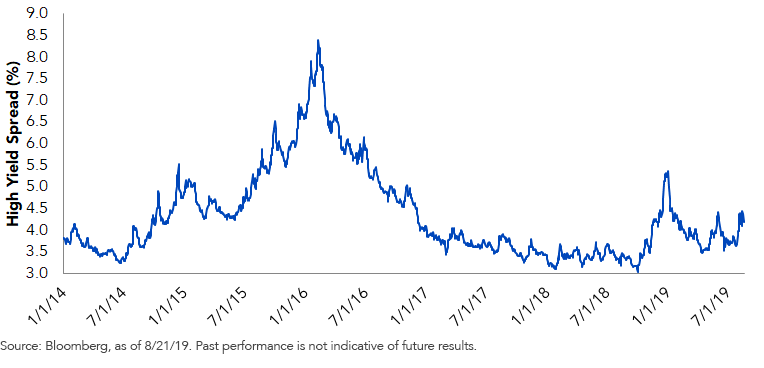

Figure 1: HY Spread

Figure 1 illustrates the five-year trend for HY spreads (Bloomberg Barclays US Corporate High Yield average option-adjusted spread). The spike in differentials that occurred in early 2016 clearly stands out. As readers will recall, this was the by-product of the headlines relating to the plunge in energy prices and concerns regarding China’s economy, which resulted in a rather significant risk-off period for the financial markets.

Needless to say, HY was an unfortunate participant in the negative side of this equation. However, after peaking at +839 basis points (bps) in February 2016, spreads came roaring in and hit a near-term low of +303 bps in October of last year. In this intermittent, roughly 2½ year period, each time HY spreads widened out, investors seemingly viewed it as a buying opportunity. Then “risk-off round 2” hit during Q4 2018 and lasted into the early days of this year, pushing the HY differential out nearly 235 bps to +537 bps on January 3.

Some could argue investors are experiencing “risk-off round 3” at the present. HY spreads, once again, narrowed throughout the first half of this year, but have since climbed back up over the +400 threshold to +422 bps, as of this writing. Given the volatility of late, we feel investors should consider looking at HY through a different lens going forward; one that focuses on the health of balance sheets.

WisdomTree’s Approach to HY

We continue to advocate to investors that incorporating fundamentals into your HY bond strategies is a more intuitive way of accessing the market. By screening based on whether an issuer has positive or negative free-cash-flows, one can effectively target bonds that exhibit favorable fundamentals while presenting opportunities for income and screening out those that don’t. WisdomTree was one of the first to bring an entire suite of fundamentally weighted corporate bond ETFs to market . One fund in the HY portion of the suite that has shown strong performance over the last few years relative to the various benchmarks is the WisdomTree Fundamental U.S. High Yield Corporate Bond Fund (WFHY).

WFHY’s underlying Index, the WisdomTree Fundamental U.S. High Yield Corporate Bond Index, employs a multistep process. It screens by fundamentals of HY corporate bonds by screening out those that have a negative average free-cash-flow over the past five years, then tilts to those that offer attractive income characteristics within a risk-constrained range. As an added layer of security, we also cut 5% of the bonds with the lowest estimated liquidity, an important consideration given the universe of illiquid bonds in the HY sector.

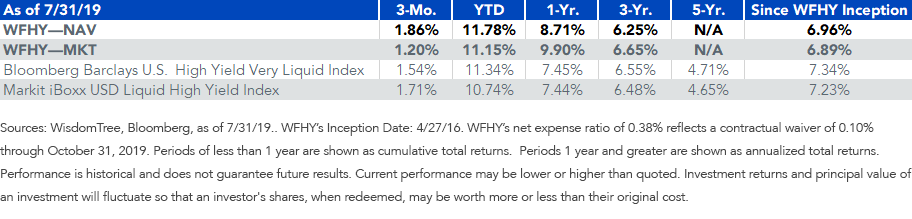

Fund Performance Relative to HY Benchmarks

The table below shows at a high level how screening for fundamentals have provided excess return year-to-date and year-over-year compared to widely popular high yield corporate benchmarks. The old narrative, that screening for fundamentals will sacrifice on yield and ultimately on performance, seems to have not really held true, particularly in a market that has seen various bouts of volatility over the last few years.

For definitions of terms in chart, please visit our glossary.

For standardized performance of WFHY, please click here.

Conclusion

Given recent market volatility and geopolitical/economic concerns, we continue to lean into using sound, time-tested fundamental metrics to help navigate an uncertain future. With this approach, investors have the potential to avoid those riskier names that are more susceptible to downfalls in a volatile market, while preserving the potential to earn higher levels of income and participate in a growing part of the economy.

Unless otherwise stated, data source is Bloomberg, as of 8/19/19.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. High-yield or “junk” bonds have lower credit ratings and involve a greater risk to principal. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.