Fresh Catalysts for Europe in the Second Half of 2019

European equities had a strong start in the first half of 2019 (+16%).1 WisdomTree views the recently announced slate of European Union (EU) leaders as a further positive catalyst for markets. Additionally, we believe the European Central Bank (ECB) is likely to provide additional stimulus to support the economy and markets, counteracting global growth fears and Brexit-related uncertainty. It is a good time to review exposures to European asset markets and options for implementation.

Madame President

Once touted as a leading candidate for the French presidency, Christine Lagarde is set to replace Mario Draghi as ECB president. Lagarde’s appointment is expected to coincide with an acceleration in accommodative monetary policy. As the former managing director of the International Monetary Fund, Lagarde publicly endorsed Draghi’s “do whatever it takes” policy stance.

Lagarde supports keeping interest rates low, especially when faced with low inflation, for as long as needed to support domestic demand. Lagarde has also embraced the use of unconventional monetary policy tools, including negative interest rates, large-scale asset purchase programs and targeted long-term refinancing operations to stimulate credit and economic growth, as well as outright monetary transactions to preserve the integrity of the EU.

Lagarde emphasizes that easing monetary policy is most effective when implemented as a part of a three-pronged approach in conjunction with congruous structural and fiscal policies.

We anticipate a smooth transition in leadership from Draghi to Lagarde—both leaders appear open to taking policy actions necessary to stimulate economic conditions should they begin to worsen.

Given how low interest rates already are—and some uncertainty associated with negative rates—we see the ECB looking for unconventional policy measures, including the possible launch of a new quantitative easing program aimed at unorthodox asset classes, potentially even equities.

This potential for an expanded European policy toolbox is helpful for adding to European equity allocations over the next 12 to 18 months.

How Should Investors Position in Europe?

One sector has been battered by the low and negative rate policy of the ECB: European financials and the large-cap banks. While they could be tempting for those value investors chasing the downtrodden, banks still face a challenging operating environment.

In 2019, despite fears of global growth, European multinationals (those with more than 50% revenue abroad) have beaten returns of the domestic economy-focused group by 480 basis points (bps).2

Weakness in banks and financials hurt the domestically focused segment of the market compared with the more globally tilted firms—as did real estate exposure.

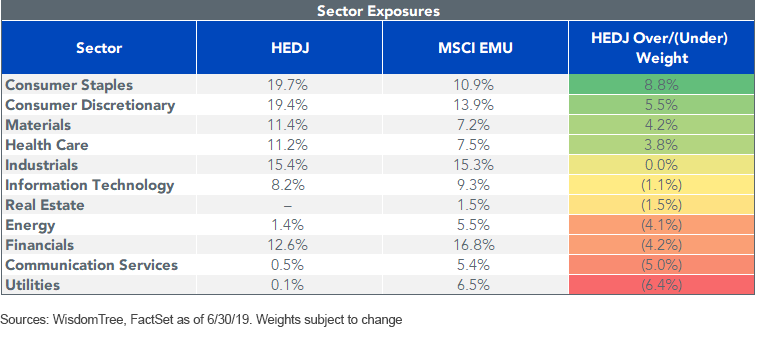

Notably, the MSCI EMU Index’s largest sector exposure is Financials (17%), and this exposure is heavily concentrated within domestically focused companies (12%).3

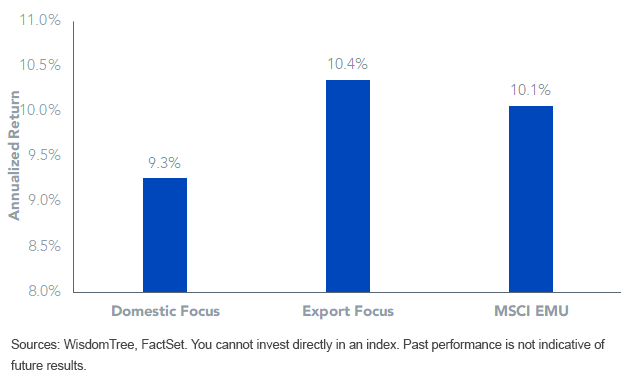

Multinationals within the MSCI EMU Index have not just performed well in 2019, they have also outperformed domestically focused EU companies by approximately 110 bps annually since July 2012.4

MSCI European Monetary Union Index (MSCI EMU) Local Currency: Domestic vs. Export Focused

Currency-Hedged European Equities

WisdomTree was the first firm to offer currency-hedged exchange-traded funds focused on the eurozone and particularly to a basket of multinational companies whose revenue tends to be from outside Europe.

We believe focusing on the stocks of European companies—where there is an equity risk premium potential to earn—makes more sense than betting on appreciation in the euro, and currency hedging with the WisdomTree Europe Hedged Equity Fund (HEDJ) helps mitigate any moves in the euro from affecting the performance of HEDJ.

The revenue screen and dividend weighting in HEDJ also results in an under-weight allocation to traditional banks relative to the MSCI EMU Index—something we like in this negative rate environment.

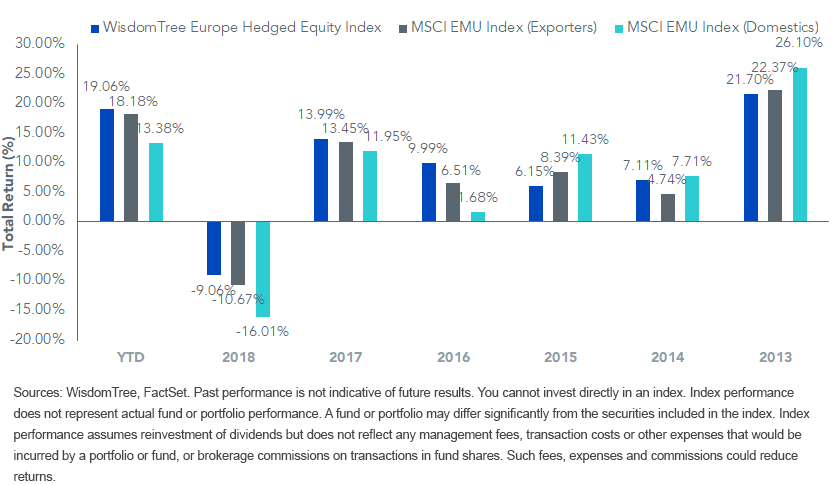

So far in 2019, HEDJ has returned +18.95%, outpacing the return of the benchmark MSCI EMU Index by around 250 bps.5 For standardized performance and characteristics of HEDJ, click here.

Key aggregate characteristics of HEDJ include:6

- Earnings yield of 7.5% (above 6.9% of MSCI EMU Index).

- Return on equity of 12.9% (above 10.9% of the MSCI EMU Index).

- Return on assets of 2.0% (above 1.4% of MSCI EMU Index).

- Dividend yield of 3.1% (mostly consistent with 3.2% of MSCI EMU Index).

- The global orientation of HEDJ adds a growth and quality tilt compared with slower growth, local economy utilities and financials.

WisdomTree Europe Hedged Equity Index vs. MSCI EMU Index (Local Currency)

Conclusion

In our view, the reshuffling of ECB and broader EU leadership could be a positive catalyst for European equities in 2019. We sense Lagarde is likely to embrace nonstandard measures to stimulate EU economic growth, laying the foundation for ongoing strength in European equity markets in the second half of 2019 and into 2020.

With its tilt toward quality stocks and attractive valuation metrics, we favor HEDJ for European exposure.

1As measured by the MSCI EMU Local Currency Index for the period 12/31/18–6/30/19.

2As measured by the MSCI EMU Local Currency Index for the period 12/31/18–6/30/19.

3As of 6/30/19.

4As measured by the MSCI EMU Local Currency Index for the period 7/2/12–6/30/19.

5As measured by the WisdomTree Europe Hedged Equity Fund and the MSCI EMU Local Currency Index for the period 12/31/18–6/30/19.

6As of 6/30/19 for the WisdomTree Europe Hedged Equity Fund and the MSCI EMU Local Currency Index.

Important Risks Related to this Article

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month end performance visit the fund’s webpage.

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.