Past Performance Is Not Indicative of Future Results

Through the first six months of the year, the global fixed income markets have certainly put in a surprising performance. Indeed, as investors headed into 2019, the consensus opinion was that fixed income would more than likely put in a lackluster showing. As we are all well aware by now, a little central bank, a.k.a. the Federal Reserve (Fed), decided to shift its policy course in dramatic fashion, and the results have been overwhelmingly positive for bond investors. That, of course, was for the first six months of the year, and given some of the positive returns printed thus far, we should caution that it will more than likely be difficult to replicate this outcome in the final six-month timeframe.

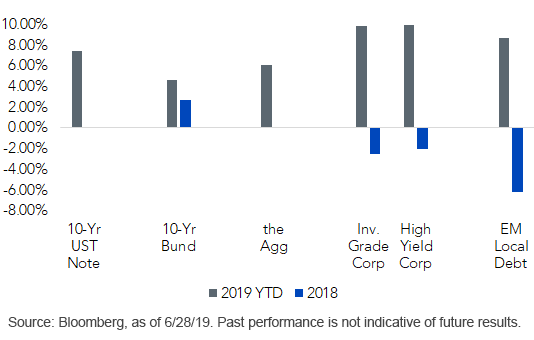

The U.S. corporate bond market has led the charge to the upside with both the high yield (HY) and the investment grade (IG) sectors completely reversing last year’s performance thus far. To provide some perspective, as measured by the Bloomberg Barclays U.S. Corporate High Yield Total Return Index Value Unhedged, HY produced a positive reading of roughly +10% following 2018’s disappointing decline of a little more than -2%. Within the investment grade corporate market, according to the Bloomberg Barclays U.S. Corporate Total Return Value Unhedged Index, the IG sector also registered a gain of nearly 10% (9.85%, to be precise) versus last year’s shortfall of -2.5%.

Fixed Income Total Returns

The emerging market (EM) local debt space won “the bronze,” producing a total return of +8.7% (J.P. Morgan Government Bond Index-Emerging Markets Global Diversified Index), after posting a visible drop of -6.2% for all of last year.

Perhaps the biggest surprise in the fixed income arena has been within the interest-sensitive side, specifically the U.S. Treasury market (UST). With the Fed now appearing to be on the verge of a rate cut next week, the 10-Year yield plunged by close to 70 basis points during 1H, registering a 7.4% gain in the process. Along the same lines, a more dovish European Central Bank has also played a role in the German government bond market, with 10-year Bund yields visibly back into negative territory, for a +4.6% positive performance. For the record, the Bloomberg Barclays U.S. Aggregate Bond Index, better known as the Agg, has come in at a +6.1% reading. Interestingly, both the UST 10-Year note and the Agg were virtually unchanged in 2018.

Conclusion

How do we finish 2019? Great question. As I mentioned in the opening paragraph, the odds do not seem to favor this type of performance in 2H 2019. Against this backdrop, I offer three solutions for investors to consider:

1. Yield enhanced core strategies

2. U.S. Treasury floating rate notes as a short-term government solution

3. Screen for quality in U.S. High Yield and consider balance sheet health

Unless otherwise stated, data source is Bloomberg, as of June 28, 2019.