Fifth Consecutive Year of Double Digit Dividend Growth

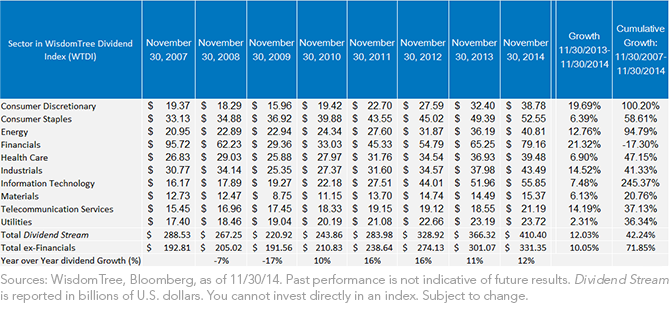

• New Record Dividend Stream: 2014 marks the fifth consecutive year of double-digit growth for the U.S. Dividend Stream. Remarkably, the cumulative decline of more than 23% from 2007 to 2009 has been erased, and 2014 marks a new high—42% above the mark set in 2007.1

• Tech Titan Growth: Information Technology sector dividends have grown a remarkable 245% since November 30, 2007. At the prior peak, this sector constituted only 5.6% of the Dividend Stream, whereas now it constitutes more than 13.6% and is the second-largest dividend-paying sector behind Financials.

• Financials Displayed Highest Growth: The sector grew its dividends more than 21% since last year’s screening and has averaged more than 20% growth over the past five years. Even after the impressive growth since the 2009 lows, the sector’s dividends are still more than 17% below their 2007 highs, and it’s the only sector whose Dividend Stream remains below its 2007 highs.

• Consumer Discretionary Grew close to 20%: The sector grew close to 20% since last year’s screening and has grown its dividends over 100% on a cumulative basis since 2007, ranking second after Information Technology. The sector’s dividends fell more than 17% during the recession, lagging only the Financials and Materials sectors during the crisis, but Consumer Discretionary has clearly rebounded much more quickly than those two sectors. This sector is also in focus this year as one that may stand to benefit the most from recent declines in oil prices—as consumers have more discretionary income they can spend on other items.

Number of Dividend Payers Also Increases

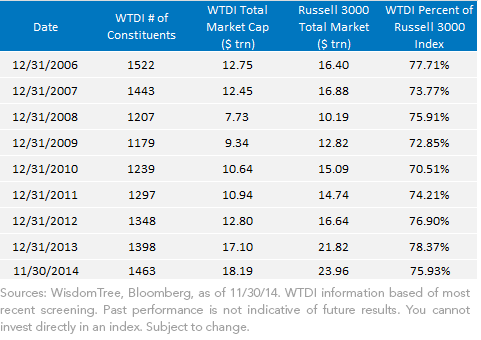

The November 30, 2014, rebalance screening makes it clear that the Dividend Stream has grown significantly, and one reason for that growth is the increased number of companies paying dividends. The table below helps illustrate how these new dividend payers are continuing to be a very significant part of the Russell 3000 Index market cap.

Figure 2: WisdomTree Dividend Index (WTDI) Historical Trends

• New Record Dividend Stream: 2014 marks the fifth consecutive year of double-digit growth for the U.S. Dividend Stream. Remarkably, the cumulative decline of more than 23% from 2007 to 2009 has been erased, and 2014 marks a new high—42% above the mark set in 2007.1

• Tech Titan Growth: Information Technology sector dividends have grown a remarkable 245% since November 30, 2007. At the prior peak, this sector constituted only 5.6% of the Dividend Stream, whereas now it constitutes more than 13.6% and is the second-largest dividend-paying sector behind Financials.

• Financials Displayed Highest Growth: The sector grew its dividends more than 21% since last year’s screening and has averaged more than 20% growth over the past five years. Even after the impressive growth since the 2009 lows, the sector’s dividends are still more than 17% below their 2007 highs, and it’s the only sector whose Dividend Stream remains below its 2007 highs.

• Consumer Discretionary Grew close to 20%: The sector grew close to 20% since last year’s screening and has grown its dividends over 100% on a cumulative basis since 2007, ranking second after Information Technology. The sector’s dividends fell more than 17% during the recession, lagging only the Financials and Materials sectors during the crisis, but Consumer Discretionary has clearly rebounded much more quickly than those two sectors. This sector is also in focus this year as one that may stand to benefit the most from recent declines in oil prices—as consumers have more discretionary income they can spend on other items.

Number of Dividend Payers Also Increases

The November 30, 2014, rebalance screening makes it clear that the Dividend Stream has grown significantly, and one reason for that growth is the increased number of companies paying dividends. The table below helps illustrate how these new dividend payers are continuing to be a very significant part of the Russell 3000 Index market cap.

Figure 2: WisdomTree Dividend Index (WTDI) Historical Trends

• Over 100 Additions: There were over 100 additions to WTDI this year, and they contributed $7.2 billion to the Dividend Stream. This year’s rebalance saw more than 100 additions for the second year in a row, but the total number of constituents is still below its prerecession highs. Two of the largest additions were General Motors and Intercontinental Exchange Inc., contributing $1.9 billion and $293 million, respectively.2

• A Large Majority of Constituents Exhibited Dividend Stream Growth: Excluding the additions, over 98% of the current constituents remained in the Index, meaning 98% of the constituents have indicated they will continue to pay dividends. Of the constituents remaining in the Index, approximately 88% have increased their indicated Dividend Stream since last year’s screening. Household names like Verizon Communications, Bank of America, General Electric, Wells Fargo and Microsoft were some of the leaders in the indicated Dividend Stream growth3.

Conclusion

WisdomTree interprets this year’s aggregate dividend growth of more than 12% as a very positive indicator of underlying market fundamentals. Even more impressive is the fact that this was the fifth consecutive year of double-digit dividend growth. We take comfort in the fact that the overall valuations of dividend stocks have not become overly stretched as a result of this strong dividend growth and believe future dividend growth could provide a notable foundation for potential future gains.

1Each calendar year mentioned refers to the November 30 screening date for that year.

2General Motors’ and Intercontinental Exchange Inc. projected rebalance weights in the WisdomTree Dividend Index are 0.47% and 0.07%, respectively.

3The projected rebalance weights of the mentioned companies in the WisdomTree Dividend Index are as follows: Verizon Communications, 2.22%; Bank of America, 0.51%; General Electric, 2.15%; Wells Fargo, 1.77%; Microsoft, 2.49%.

• Over 100 Additions: There were over 100 additions to WTDI this year, and they contributed $7.2 billion to the Dividend Stream. This year’s rebalance saw more than 100 additions for the second year in a row, but the total number of constituents is still below its prerecession highs. Two of the largest additions were General Motors and Intercontinental Exchange Inc., contributing $1.9 billion and $293 million, respectively.2

• A Large Majority of Constituents Exhibited Dividend Stream Growth: Excluding the additions, over 98% of the current constituents remained in the Index, meaning 98% of the constituents have indicated they will continue to pay dividends. Of the constituents remaining in the Index, approximately 88% have increased their indicated Dividend Stream since last year’s screening. Household names like Verizon Communications, Bank of America, General Electric, Wells Fargo and Microsoft were some of the leaders in the indicated Dividend Stream growth3.

Conclusion

WisdomTree interprets this year’s aggregate dividend growth of more than 12% as a very positive indicator of underlying market fundamentals. Even more impressive is the fact that this was the fifth consecutive year of double-digit dividend growth. We take comfort in the fact that the overall valuations of dividend stocks have not become overly stretched as a result of this strong dividend growth and believe future dividend growth could provide a notable foundation for potential future gains.

1Each calendar year mentioned refers to the November 30 screening date for that year.

2General Motors’ and Intercontinental Exchange Inc. projected rebalance weights in the WisdomTree Dividend Index are 0.47% and 0.07%, respectively.

3The projected rebalance weights of the mentioned companies in the WisdomTree Dividend Index are as follows: Verizon Communications, 2.22%; Bank of America, 0.51%; General Electric, 2.15%; Wells Fargo, 1.77%; Microsoft, 2.49%.Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.