Real Estate as an Income Generating Asset Class

For current performance of WTGRE click here.

For definitions of terms and Indexes in the chart, visit our glossary.

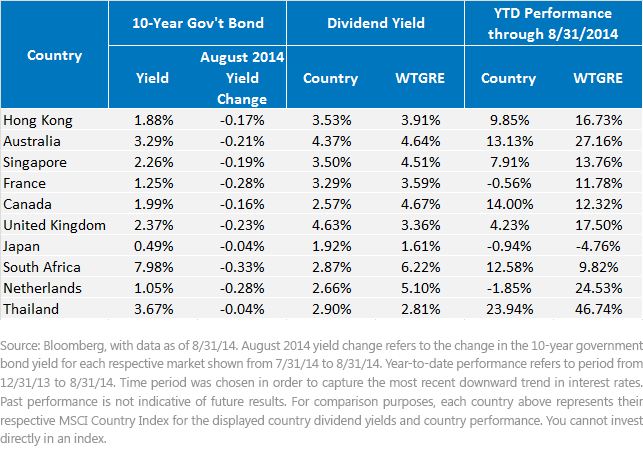

• 10-Year Government Bond Yields Drop: We call particular attention to France, the United Kingdom and the Netherlands, in that all of their 10-year interest rates dropped significantly. When people think about falling interest rates presently, Europe is one of the first places they look. The real estate exposure in WTGRE performed quite well in each of these markets.

• Dividend Yields: In general, equity dividend yields look compelling within developed markets compared to 10-year government bond yields. In seven out of 10 cases, we see that WTGRE’s country exposure has led to a dividend yield that is even higher than that of the broad country equity market defined by the respective MSCI country index.

• Performance: In seven out of 10 cases, the country exposure defined within WTGRE has outperformed the respective MSCI country index through August 31, 2014. We believe this is indicative of the fact that these income-generating assets have been in demand.

Managing Valuation Risk with a Rebalance Back to Fundamentals

Some might look at the nearly 30% return within WTGRE’s Australia exposure or 46% return within its exposure to Thailand and think, what if these markets are becoming overvalued? This could be particularly true in an environment where the broad MSCI ACWI ex-U.S. Index is up a mere 5.1% over the same period. Of the 10 exposures within WTGRE, Japan’s is the only one underperforming this figure.2 Fortunately, on September 30, 2014, WTGRE will undergo its annual screening, which helps to avoid valuation risk concerns.

• Constituents that have seen significant increases in share price performance but whose dividends have not commensurately grown could see decreases in weight.

• Constituents that have seen significant increases in their dividends but have not seen similar increases in their share prices may see increases in weight.

Thinking of this at the country aggregate level means that countries that maintain significant exposure after positive performance are delivering not only share-price performance but also dividend growth.

One Option in the Search for Income-Generating Solutions

In the current interest rate environment, a big theme that we often write about regards thinking of dividend-paying equities as potential income solutions. Focusing on the real estate sector—accomplished here with WTGRE—could be an even more precisely tuned income focus within the current equity landscape outside of the United States.

1Source for paragraph: Bloomberg, with 10- year sovereign debt used for the interest rates of each market. Data from 7/31/14 to 8/31/14.

2Source for paragraph: Bloomberg, with data from 12/31/13 to 8/31/14.

For current performance of WTGRE click here.

For definitions of terms and Indexes in the chart, visit our glossary.

• 10-Year Government Bond Yields Drop: We call particular attention to France, the United Kingdom and the Netherlands, in that all of their 10-year interest rates dropped significantly. When people think about falling interest rates presently, Europe is one of the first places they look. The real estate exposure in WTGRE performed quite well in each of these markets.

• Dividend Yields: In general, equity dividend yields look compelling within developed markets compared to 10-year government bond yields. In seven out of 10 cases, we see that WTGRE’s country exposure has led to a dividend yield that is even higher than that of the broad country equity market defined by the respective MSCI country index.

• Performance: In seven out of 10 cases, the country exposure defined within WTGRE has outperformed the respective MSCI country index through August 31, 2014. We believe this is indicative of the fact that these income-generating assets have been in demand.

Managing Valuation Risk with a Rebalance Back to Fundamentals

Some might look at the nearly 30% return within WTGRE’s Australia exposure or 46% return within its exposure to Thailand and think, what if these markets are becoming overvalued? This could be particularly true in an environment where the broad MSCI ACWI ex-U.S. Index is up a mere 5.1% over the same period. Of the 10 exposures within WTGRE, Japan’s is the only one underperforming this figure.2 Fortunately, on September 30, 2014, WTGRE will undergo its annual screening, which helps to avoid valuation risk concerns.

• Constituents that have seen significant increases in share price performance but whose dividends have not commensurately grown could see decreases in weight.

• Constituents that have seen significant increases in their dividends but have not seen similar increases in their share prices may see increases in weight.

Thinking of this at the country aggregate level means that countries that maintain significant exposure after positive performance are delivering not only share-price performance but also dividend growth.

One Option in the Search for Income-Generating Solutions

In the current interest rate environment, a big theme that we often write about regards thinking of dividend-paying equities as potential income solutions. Focusing on the real estate sector—accomplished here with WTGRE—could be an even more precisely tuned income focus within the current equity landscape outside of the United States.

1Source for paragraph: Bloomberg, with 10- year sovereign debt used for the interest rates of each market. Data from 7/31/14 to 8/31/14.

2Source for paragraph: Bloomberg, with data from 12/31/13 to 8/31/14. Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Investments in real estate involve additional special risks, such as credit risk, interest rate fluctuations and the effect of varied economic conditions.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.