Diversifying With the Yen? Not If Japanese Equities Are Involved

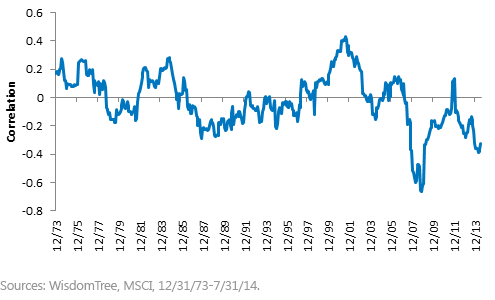

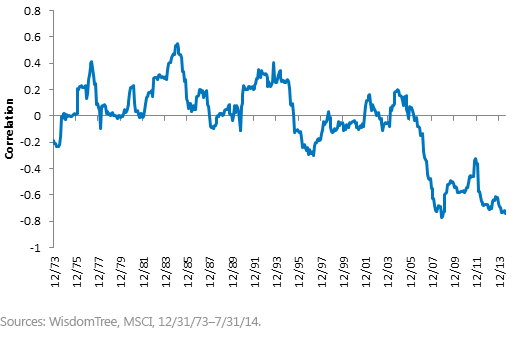

Figure 2: Three-Year Correlation of Yen vs. MSCI Japan Index

Figure 2: Three-Year Correlation of Yen vs. MSCI Japan Index

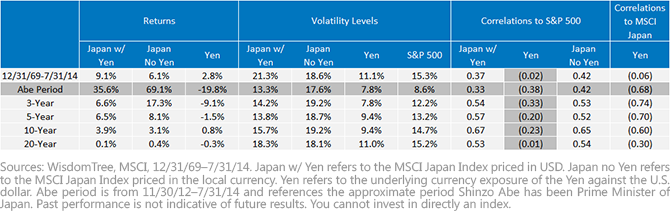

Figure 3: MSCI Japan Index: Return, Volatility and Correlation Table

Figure 3: MSCI Japan Index: Return, Volatility and Correlation Table

Diversification vs. Risk

The discussion of currency-hedged strategies has shaken some of the core beliefs of investors. Traditional investment vehicles that package equity risk plus a secondary currency risk on top of the equity risk have been referred to as the traditional “plain vanilla” exposure because they were the first to the market, and it is what investors have been using for so long.

The yen is a currency that looks like a portfolio diversifier, as it has a negative correlation to U.S. equities. But when the yen is packaged on top of Japanese equities, which have an even stronger negative correlation to the yen, that diversification benefit is compromised and ultimately becomes nothing more than added risk.

Japan was a market that highlighted the benefits of a currency-hedged approach in 2013 as the yen sank and stocks performed very well1. Increasingly, investors will come to look at currency-hedged products as more strategic options for international allocations, as they continue to question the diversification benefit of layering currency risk on top of international equities.

1Source: Bloomberg, 12/31/12–12/31/13; references the yen weakening more than 17% against the U.S. dollar while the MSCI Japan Local Index was up more than 54%. Past performance is not indicative of future results.

Diversification vs. Risk

The discussion of currency-hedged strategies has shaken some of the core beliefs of investors. Traditional investment vehicles that package equity risk plus a secondary currency risk on top of the equity risk have been referred to as the traditional “plain vanilla” exposure because they were the first to the market, and it is what investors have been using for so long.

The yen is a currency that looks like a portfolio diversifier, as it has a negative correlation to U.S. equities. But when the yen is packaged on top of Japanese equities, which have an even stronger negative correlation to the yen, that diversification benefit is compromised and ultimately becomes nothing more than added risk.

Japan was a market that highlighted the benefits of a currency-hedged approach in 2013 as the yen sank and stocks performed very well1. Increasingly, investors will come to look at currency-hedged products as more strategic options for international allocations, as they continue to question the diversification benefit of layering currency risk on top of international equities.

1Source: Bloomberg, 12/31/12–12/31/13; references the yen weakening more than 17% against the U.S. dollar while the MSCI Japan Local Index was up more than 54%. Past performance is not indicative of future results.

Important Risks Related to this Article

Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.