Why Take Currency Risk If Diversification Benefit Is Declining?

More importantly, one has to wonder if the past gain in EAFE FX can be repeated. We know with hindsight that the U.S. dollar declined. But do we know the U.S. dollar will decline going forward? Theoretical models suggest there is no expected return to owning currency. So why does one want to take on this FX risk embedded in foreign equity exposure unless one is a tactical U.S. dollar bear?

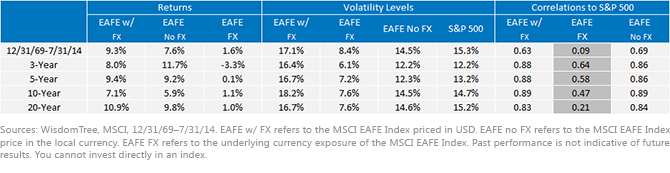

• The correlation to the S&P 500 for EAFE with FX and EAFE with no FX shows practically no differentials over the last 3-, 5-, 10- and 20-year periods. There is a slightly lower correlation to EAFE with FX over 40 years of data, but that does not appear to be a compelling case to add currency exposure on top of the local equity market return given the uptick in total volatility from adding FX and the unpredictability of future currency moves.

The Declining Diversification of Owning the Euro

Below is the same chart for the European FX3 correlation to the S&P 500, which also shows a consistent increase and less diversification from holding euros on top of owning the European equities.

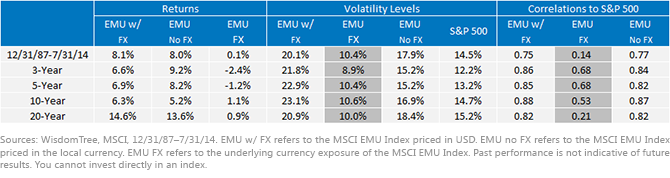

• The European FX as a standalone asset class historically had 10% volatility consistently over most major periods—again, just about half the volatility of the local equity market.

• The long-term returns to the MSCI EMU Index currencies were only 0.1% per year—this means the risk-return trade-off for European currencies as a standalone asset class showed relatively miniscule historical returns with large volatility (a bad combination).

• EMU FX over the long run had a correlation of 0.14 versus the S&P 500, but that has risen significantly to 0.68 over the last three- and five-year periods. This rising correlation means there is less diversification benefit to owning the euro.4

Figure 2: MSCI EMU Index: Return, Volatility and Correlation

More importantly, one has to wonder if the past gain in EAFE FX can be repeated. We know with hindsight that the U.S. dollar declined. But do we know the U.S. dollar will decline going forward? Theoretical models suggest there is no expected return to owning currency. So why does one want to take on this FX risk embedded in foreign equity exposure unless one is a tactical U.S. dollar bear?

• The correlation to the S&P 500 for EAFE with FX and EAFE with no FX shows practically no differentials over the last 3-, 5-, 10- and 20-year periods. There is a slightly lower correlation to EAFE with FX over 40 years of data, but that does not appear to be a compelling case to add currency exposure on top of the local equity market return given the uptick in total volatility from adding FX and the unpredictability of future currency moves.

The Declining Diversification of Owning the Euro

Below is the same chart for the European FX3 correlation to the S&P 500, which also shows a consistent increase and less diversification from holding euros on top of owning the European equities.

• The European FX as a standalone asset class historically had 10% volatility consistently over most major periods—again, just about half the volatility of the local equity market.

• The long-term returns to the MSCI EMU Index currencies were only 0.1% per year—this means the risk-return trade-off for European currencies as a standalone asset class showed relatively miniscule historical returns with large volatility (a bad combination).

• EMU FX over the long run had a correlation of 0.14 versus the S&P 500, but that has risen significantly to 0.68 over the last three- and five-year periods. This rising correlation means there is less diversification benefit to owning the euro.4

Figure 2: MSCI EMU Index: Return, Volatility and Correlation

The discussion of currency-hedged strategies has shaken some of the core beliefs of investors. Traditional investment vehicles that package equity risk plus a secondary currency risk on top of the equity risk have been referred to as the traditional “plain vanilla” exposure because they were the first to the market, and it is what investors have been using for so long.

I believe it’s necessary to take a harder look at the diversification attained by adding in this FX risk. If investors evaluated FX as a pure standalone investment instead of a package product, I think they would rarely find themselves convinced of the reason to add in this exposure to their portfolios. There has been rising correlation to the S&P 500, low historical returns to FX, high historical volatility and a tactical environment that looks likely to favor the U.S. dollar.

For more of our research, see our market insight here.

1References currency exposure of MSCI EAFE Index.

2WisdomTree, MSCI, 12/31/69–7/31/14. Applies to all bullet points.

3References currency exposure of MSCI EMU Index.

4Sources: WisdomTree, MSCI, 12/31/87–7/31/14. Applies to all bullet points.

The discussion of currency-hedged strategies has shaken some of the core beliefs of investors. Traditional investment vehicles that package equity risk plus a secondary currency risk on top of the equity risk have been referred to as the traditional “plain vanilla” exposure because they were the first to the market, and it is what investors have been using for so long.

I believe it’s necessary to take a harder look at the diversification attained by adding in this FX risk. If investors evaluated FX as a pure standalone investment instead of a package product, I think they would rarely find themselves convinced of the reason to add in this exposure to their portfolios. There has been rising correlation to the S&P 500, low historical returns to FX, high historical volatility and a tactical environment that looks likely to favor the U.S. dollar.

For more of our research, see our market insight here.

1References currency exposure of MSCI EAFE Index.

2WisdomTree, MSCI, 12/31/69–7/31/14. Applies to all bullet points.

3References currency exposure of MSCI EMU Index.

4Sources: WisdomTree, MSCI, 12/31/87–7/31/14. Applies to all bullet points.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Past performance is not indicative of future results. Diversification does not eliminate the risk of experiencing investment losses.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.