Capturing China’s Equity Rally

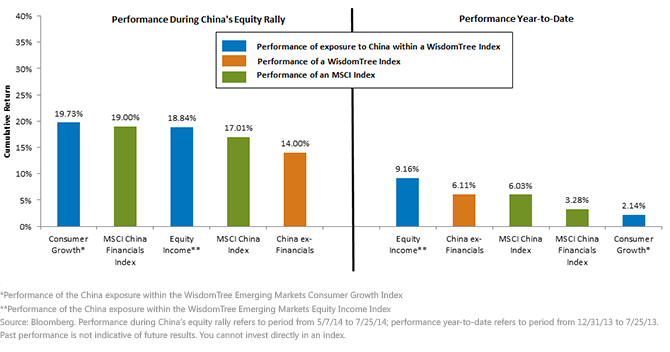

• China Exposures of Both Indexes Outperform during the Rally: In the chart, we include the performance of the MSCI China Index as a reference point for how China’s equity markets overall did during the rally. Both Consumer Growth and Equity Income outperformed the MSCI China Index, and this tells us that China’s recent rally has been broad in nature and not confined to the large banks—even though the performance of the MSCI China Financials Index shows that they clearly participated.

Top 3 China Stocks in Equity Income and Consumer Growth;

• Consumer Growth3

1.) Ping Ann Insurance4 (3.73% weight): Ping Ann provides property, casualty and life insurance as well as financial services in China. As of July 25, 2014, its price-to-earnings (P/E) ratio was about 11.0x, compared to that of the MSCI China Index, which was 9.8x. During China’s equity rally, the stock was up about 14.8%, but year-to-date it’s still down about 6.4%.

2.) Dongfeng Motor5 (3.14% weight): Dongfeng is a comprehensive supplier of vehicles and vehicle parts in China. Even with 37.6% returns during the rally and 17.26% returns year-to-date, its P/E ratio (7.6x) remains below that of China’s equity markets, due largely to expectations of strong earnings growth.

3.) PICC Property & Casualty6 (2.18% weight): PICC provides a wide range of property and casualty insurance services in China, and its P/E valuation was 10.7x. During China’s recent rally, shares were up over 23%, and they are up nearly 13% for the year.

• Equity Income7

1.) The three firms China Construction Bank8 (4.58% weight), Industrial & Commercial Bank of China9 (3.25% weight) and Bank of China10 (2.17% weight) are all large, state-owned Chinese banks. These are some of the largest payers of cash dividends across all emerging markets, which accounts for their large weights.

2.) Even though each of these firms has delivered positive performance year-to-date and double-digit performance during the recent rally, P/E ratios for all of them remain below 5.0x. China Construction Bank is the “most expensive” at 4.9x.

Positioning for Upturn in China

One point of this blog post is to highlight that an investor’s China exposure does not need to be defined by large, state-owned banks. Sure, these firms are important and, currently, are some of the least expensive equities in China, but the methodologies of Consumer Growth and China ex-Financials avoid them, providing tools that can potentially be helpful complements to traditional, market capitalization-weighted approaches to China’s equities.

1Refers to performance of the MSCI China Index through 7/25/14.Source: Bloomberg.

2Refers to the MSCI Emerging Markets Index (about 18.5% weight to China) and the FTSE Emerging Markets Index (about 20.5% weight to China) as of 7/25/14. Source: Bloomberg.

3Source for all sub-bullet information: Bloomberg, with valuation data as of 7/25/14, year-to-date performance data from 12/31/13 to 7/25/14 and performance during the rally data from 5/7/14 to 7/25/14.

4As of 7/25/14, Ping Ann Insurance was a 0.30% weight in the WisdomTree Global ex-U.S. Dividend Growth Index, a 0.09% weight in the WisdomTree Asia Pacific ex-Japan Index, and a 0.59% weight in the WisdomTree Emerging Markets Dividend Growth Index.

5As of 7/25/14, Dong Feng Motor was a 1.84% weight within the WisdomTree China Dividend ex-Financials Index and a 0.26% weight within the WisdomTree Asia Pacific ex-Japan Index.

6As of 7/25/14, PICC Property & Casualty was a 0.21% weight within the WisdomTree Asia Pacific ex-Japan Index.

7Source for all sub-bullet information: Bloomberg, with valuation data as of 7/25/14, year-to-date performance data from 12/31/13 to 7/25/14 and performance during the rally data from 5/7/14 to 7/25/14.

8As of 7/25/14, China Construction Bank was a 1.44% weight in the WisdomTree Global Equity Income Index and a 3.83% weight within the WisdomTree Asia Pacific ex-Japan Index.

9As of 7/25/14, Industrial & Commercial Bank of China was a 0.47% weight within the WisdomTree Global Equity Income Index and a 1.26% weight within the WisdomTree Asia Pacific ex-Japan Index.

10As of 7/25/14, Bank of China was a 0.32% weight within the WisdomTree Global Equity Income Index and a 0.84% weight within the WisdomTree Asia Pacific ex-Japan Index.

• China Exposures of Both Indexes Outperform during the Rally: In the chart, we include the performance of the MSCI China Index as a reference point for how China’s equity markets overall did during the rally. Both Consumer Growth and Equity Income outperformed the MSCI China Index, and this tells us that China’s recent rally has been broad in nature and not confined to the large banks—even though the performance of the MSCI China Financials Index shows that they clearly participated.

Top 3 China Stocks in Equity Income and Consumer Growth;

• Consumer Growth3

1.) Ping Ann Insurance4 (3.73% weight): Ping Ann provides property, casualty and life insurance as well as financial services in China. As of July 25, 2014, its price-to-earnings (P/E) ratio was about 11.0x, compared to that of the MSCI China Index, which was 9.8x. During China’s equity rally, the stock was up about 14.8%, but year-to-date it’s still down about 6.4%.

2.) Dongfeng Motor5 (3.14% weight): Dongfeng is a comprehensive supplier of vehicles and vehicle parts in China. Even with 37.6% returns during the rally and 17.26% returns year-to-date, its P/E ratio (7.6x) remains below that of China’s equity markets, due largely to expectations of strong earnings growth.

3.) PICC Property & Casualty6 (2.18% weight): PICC provides a wide range of property and casualty insurance services in China, and its P/E valuation was 10.7x. During China’s recent rally, shares were up over 23%, and they are up nearly 13% for the year.

• Equity Income7

1.) The three firms China Construction Bank8 (4.58% weight), Industrial & Commercial Bank of China9 (3.25% weight) and Bank of China10 (2.17% weight) are all large, state-owned Chinese banks. These are some of the largest payers of cash dividends across all emerging markets, which accounts for their large weights.

2.) Even though each of these firms has delivered positive performance year-to-date and double-digit performance during the recent rally, P/E ratios for all of them remain below 5.0x. China Construction Bank is the “most expensive” at 4.9x.

Positioning for Upturn in China

One point of this blog post is to highlight that an investor’s China exposure does not need to be defined by large, state-owned banks. Sure, these firms are important and, currently, are some of the least expensive equities in China, but the methodologies of Consumer Growth and China ex-Financials avoid them, providing tools that can potentially be helpful complements to traditional, market capitalization-weighted approaches to China’s equities.

1Refers to performance of the MSCI China Index through 7/25/14.Source: Bloomberg.

2Refers to the MSCI Emerging Markets Index (about 18.5% weight to China) and the FTSE Emerging Markets Index (about 20.5% weight to China) as of 7/25/14. Source: Bloomberg.

3Source for all sub-bullet information: Bloomberg, with valuation data as of 7/25/14, year-to-date performance data from 12/31/13 to 7/25/14 and performance during the rally data from 5/7/14 to 7/25/14.

4As of 7/25/14, Ping Ann Insurance was a 0.30% weight in the WisdomTree Global ex-U.S. Dividend Growth Index, a 0.09% weight in the WisdomTree Asia Pacific ex-Japan Index, and a 0.59% weight in the WisdomTree Emerging Markets Dividend Growth Index.

5As of 7/25/14, Dong Feng Motor was a 1.84% weight within the WisdomTree China Dividend ex-Financials Index and a 0.26% weight within the WisdomTree Asia Pacific ex-Japan Index.

6As of 7/25/14, PICC Property & Casualty was a 0.21% weight within the WisdomTree Asia Pacific ex-Japan Index.

7Source for all sub-bullet information: Bloomberg, with valuation data as of 7/25/14, year-to-date performance data from 12/31/13 to 7/25/14 and performance during the rally data from 5/7/14 to 7/25/14.

8As of 7/25/14, China Construction Bank was a 1.44% weight in the WisdomTree Global Equity Income Index and a 3.83% weight within the WisdomTree Asia Pacific ex-Japan Index.

9As of 7/25/14, Industrial & Commercial Bank of China was a 0.47% weight within the WisdomTree Global Equity Income Index and a 1.26% weight within the WisdomTree Asia Pacific ex-Japan Index.

10As of 7/25/14, Bank of China was a 0.32% weight within the WisdomTree Global Equity Income Index and a 0.84% weight within the WisdomTree Asia Pacific ex-Japan Index. Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in China are increasing the impact of events and developments associated with the region, which can adversely affect performance. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.