Emerging Market Equities Recovering in 2014

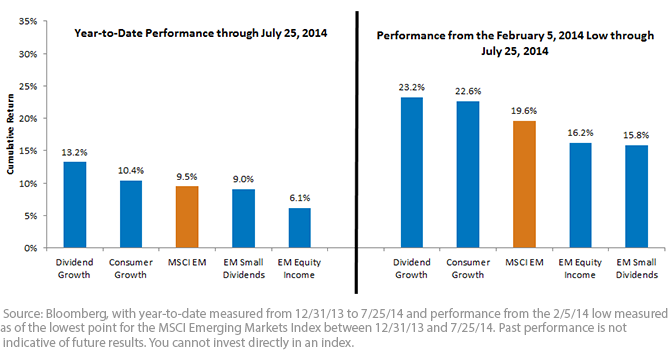

• Dividend Growth & Consumer Growth Outperform MSCI EM YTD and Since the February 5 Low3

o Dividend Growth: A greater than 9.5% average over-weight to Indonesia and a greater than 8% average over-weight to Thailand were primary drivers of outperformance. Both of these markets had a tumultuous 2013 but have been on the comeback trail in 2014. Surprisingly, even a 7.8% average over-weight to Russia contributed to outperformance by focusing on the combination of growth and quality. Exposures in South Africa and India saw positive total returns, but being under-weight in India and poor stock selection in South Africa hurt relative performance.

o Consumer Growth: This Index is actually the only one shown that is not weighted by dividends, but rather by earnings. As a result, instead of being under-weight to India compared to the MSCI EM, it maintained an approximate over-weight of 2.6% when India’s market was roaring. Additionally, the fact that the Materials and Energy sectors are ineligible leads to very small weight within Russia. The largest average country weight was to China, and exposure here was positive, but not as positive as that of the MSCI EM, causing it to contribute negatively to relative performance.

• WT EM Equity Income and EM Small Dividends Still Positive4

o EM Equity Income: Of the Indexes shown, this one can be characterized as the valuation hunter. Some of the least expensive, largest payers of cash dividends within emerging markets are those within the Russian Energy sector, which was hit with negative headline risk in March 2014 and then again in July 2014. It’s worth noting the positive performance shown within the chart for this diversified Index even with those exposures.

o EM Small Dividends: A dividend-weighted approach to emerging market small caps has tended toward a large weight in Taiwanese small caps and barely any weight to India’s small caps. This year, India’s small caps have been on fire, and Taiwan’s have been lackluster. Still, a year-to-date return of 9% is strong.

WisdomTree Is Excited about Emerging Market Equities

We remain excited about the valuations represented within emerging markets today compared to other global markets. The dispersion in performance across the WisdomTree Indexes mentioned speaks, in our view, to their unique exposures. We’ve emphasized broader signs of strength, and in future blogs we will dig a bit deeper into China and Russia—two markets that have often been in focus in 2014—to further characterize what we believe to be an exciting opportunity in emerging markets today.

1Source: Bloomberg. Refers to the 12/31/12 to 12/31/13 performance of the MSCI Europe, MSCI Japan and S&P 500 Indexes, respectively.

2Source: Bloomberg. Refers to the 12/31/12 to 12/31/13 performance of the MSCI Emerging Markets Index.

3Source for all sub-bullets: Bloomberg, with data from 12/31/13 to 7/25/14.

4Source for all sub-bullets: Bloomberg, with data from 12/31/13 to 7/25/14.

• Dividend Growth & Consumer Growth Outperform MSCI EM YTD and Since the February 5 Low3

o Dividend Growth: A greater than 9.5% average over-weight to Indonesia and a greater than 8% average over-weight to Thailand were primary drivers of outperformance. Both of these markets had a tumultuous 2013 but have been on the comeback trail in 2014. Surprisingly, even a 7.8% average over-weight to Russia contributed to outperformance by focusing on the combination of growth and quality. Exposures in South Africa and India saw positive total returns, but being under-weight in India and poor stock selection in South Africa hurt relative performance.

o Consumer Growth: This Index is actually the only one shown that is not weighted by dividends, but rather by earnings. As a result, instead of being under-weight to India compared to the MSCI EM, it maintained an approximate over-weight of 2.6% when India’s market was roaring. Additionally, the fact that the Materials and Energy sectors are ineligible leads to very small weight within Russia. The largest average country weight was to China, and exposure here was positive, but not as positive as that of the MSCI EM, causing it to contribute negatively to relative performance.

• WT EM Equity Income and EM Small Dividends Still Positive4

o EM Equity Income: Of the Indexes shown, this one can be characterized as the valuation hunter. Some of the least expensive, largest payers of cash dividends within emerging markets are those within the Russian Energy sector, which was hit with negative headline risk in March 2014 and then again in July 2014. It’s worth noting the positive performance shown within the chart for this diversified Index even with those exposures.

o EM Small Dividends: A dividend-weighted approach to emerging market small caps has tended toward a large weight in Taiwanese small caps and barely any weight to India’s small caps. This year, India’s small caps have been on fire, and Taiwan’s have been lackluster. Still, a year-to-date return of 9% is strong.

WisdomTree Is Excited about Emerging Market Equities

We remain excited about the valuations represented within emerging markets today compared to other global markets. The dispersion in performance across the WisdomTree Indexes mentioned speaks, in our view, to their unique exposures. We’ve emphasized broader signs of strength, and in future blogs we will dig a bit deeper into China and Russia—two markets that have often been in focus in 2014—to further characterize what we believe to be an exciting opportunity in emerging markets today.

1Source: Bloomberg. Refers to the 12/31/12 to 12/31/13 performance of the MSCI Europe, MSCI Japan and S&P 500 Indexes, respectively.

2Source: Bloomberg. Refers to the 12/31/12 to 12/31/13 performance of the MSCI Emerging Markets Index.

3Source for all sub-bullets: Bloomberg, with data from 12/31/13 to 7/25/14.

4Source for all sub-bullets: Bloomberg, with data from 12/31/13 to 7/25/14.

Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. Dividends are not guaranteed and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.