Opportunities in Developed International Equities

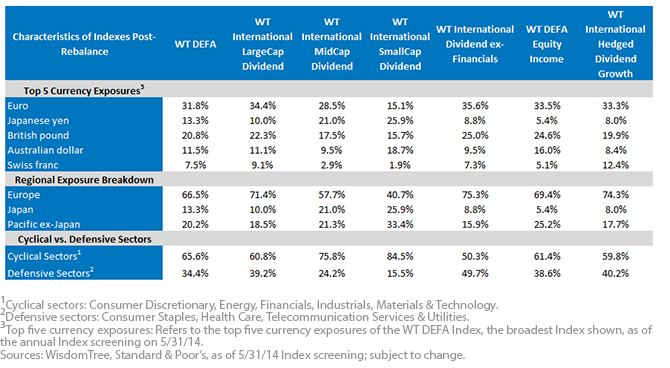

• Currency Exposure: As a baseline, we know that the MSCI EAFE Index has 30% to 33% exposure to the euro, and about 19% to 21% exposure to both the yen and the pound3. In terms of divergences of interest:

o Japanese yen: The WT International MidCap and WT International SmallCap Dividend Indexes have clear over-weights to the yen, compared to the MSCI EAFE Index, whereas the other Indexes represent significant under-weights.

o Euro: The WT International Dividend ex-Financials Index is interesting for its nearly 36% exposure to Eurozone. This Index has performed strongly in 2014, helped by its significant weight in European Utilities.

o WT International Hedged Dividend Growth Index: This is the only Index shown that is actually currency-hedged. Each of the other Indexes will be impacted by the movements of their underlying currency exposures versus the U.S. dollar, but this Index will not, making it very interesting for those thinking that the macroeconomic picture suggests the potential for a strengthening U.S. dollar relative to other developed-market currencies.

• Cyclicals vs. Defensives: As one looks from the WT International LargeCap Dividend Index down the continuum of the size spectrum to the WT International SmallCap Dividend Index, there is a notable ramp up—almost 25% (from 60.8% in large caps to 84.5% in small caps)—in terms of exposure to cyclical sectors. This fits with an important theme: those bullish on the prospects for an economic recovery should consider small caps.

o It’s also worth noting that the most “defensively positioned” index is the WT International Dividend ex-Financials Index. We’ll be examining this Index more closely in a future blog post, but suffice it to say that as defensive sectors, such as Utilities, have tended to outperform in 2014, this Index has definitely benefitted.

Shifting the Developed International Investment Paradigm

In U.S. markets, there is a lot of stratification—people will think in terms of large cap versus small cap or value versus growth. However, in developed international equities, the focus is primarily on the MSCI EAFE Index. Newer indexes, such as the MSCI EAFE IMI Index, look to be more representative of the total market opportunity—inclusive of mid-cap and small-cap stocks. But WisdomTree has been providing options inclusive of all developed international dividend payers since June 1, 2006. In two subsequent blog posts, we will examine our International SmallCap Dividend and International Dividend ex-Financials Indexes in greater detail.

For the full research on the WisdomTree International Developed Indexes rebalance, click here.

1Refers to the S&P 500 Index, which has periodically achieved record highs from 12/31/13 to 5/31/14.

2Refers to the MSCI Emerging Markets Index for the period from 12/31/13 to 5/31/14.

3Source: Bloomberg, as of 5/31/14.

• Currency Exposure: As a baseline, we know that the MSCI EAFE Index has 30% to 33% exposure to the euro, and about 19% to 21% exposure to both the yen and the pound3. In terms of divergences of interest:

o Japanese yen: The WT International MidCap and WT International SmallCap Dividend Indexes have clear over-weights to the yen, compared to the MSCI EAFE Index, whereas the other Indexes represent significant under-weights.

o Euro: The WT International Dividend ex-Financials Index is interesting for its nearly 36% exposure to Eurozone. This Index has performed strongly in 2014, helped by its significant weight in European Utilities.

o WT International Hedged Dividend Growth Index: This is the only Index shown that is actually currency-hedged. Each of the other Indexes will be impacted by the movements of their underlying currency exposures versus the U.S. dollar, but this Index will not, making it very interesting for those thinking that the macroeconomic picture suggests the potential for a strengthening U.S. dollar relative to other developed-market currencies.

• Cyclicals vs. Defensives: As one looks from the WT International LargeCap Dividend Index down the continuum of the size spectrum to the WT International SmallCap Dividend Index, there is a notable ramp up—almost 25% (from 60.8% in large caps to 84.5% in small caps)—in terms of exposure to cyclical sectors. This fits with an important theme: those bullish on the prospects for an economic recovery should consider small caps.

o It’s also worth noting that the most “defensively positioned” index is the WT International Dividend ex-Financials Index. We’ll be examining this Index more closely in a future blog post, but suffice it to say that as defensive sectors, such as Utilities, have tended to outperform in 2014, this Index has definitely benefitted.

Shifting the Developed International Investment Paradigm

In U.S. markets, there is a lot of stratification—people will think in terms of large cap versus small cap or value versus growth. However, in developed international equities, the focus is primarily on the MSCI EAFE Index. Newer indexes, such as the MSCI EAFE IMI Index, look to be more representative of the total market opportunity—inclusive of mid-cap and small-cap stocks. But WisdomTree has been providing options inclusive of all developed international dividend payers since June 1, 2006. In two subsequent blog posts, we will examine our International SmallCap Dividend and International Dividend ex-Financials Indexes in greater detail.

For the full research on the WisdomTree International Developed Indexes rebalance, click here.

1Refers to the S&P 500 Index, which has periodically achieved record highs from 12/31/13 to 5/31/14.

2Refers to the MSCI Emerging Markets Index for the period from 12/31/13 to 5/31/14.

3Source: Bloomberg, as of 5/31/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments focused in Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.