How to Blend In a Currency Hedge

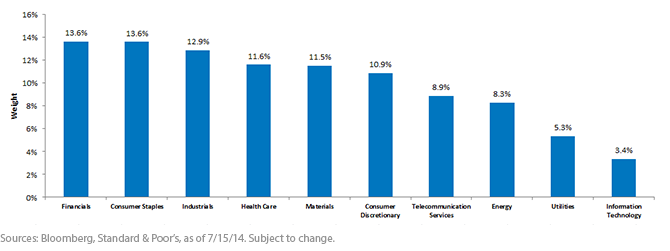

Some of the more notable details underlying the characteristics of this blend:

• Financials: High Dividend Yielders had nearly 25% exposure to Financials, but Dividend Growers had less than 2.5% exposure. It’s also worth mentioning that the resulting 13.6% weight to Financials in the blend represented an 11.8% under-weight compared to the MSCI EAFE Index, the most widely followed performance measure of broad, developed international equities.6

• Balancing the Consumer Sectors with the High-Yielding Sectors: It’s interesting that the Dividend Growers had much greater exposure to the Consumer Discretionary and Consumer Staples sectors—10.1% and 12.8% higher, respectively, than the High Dividend Yielders. If economic fundamentals in developed markets improve and rates begin to rise, these are important sectors to be attentive to. On the other hand, the High Dividend Yielders had much greater exposure to Telecommunication Services and Utilities—10.8% and 8.6% higher, respectively, than the Dividend Growers. In the present, lower-yielding environment, exposure to these sectors can be important for potential income generation.

Bringing Valuation into the Discussion

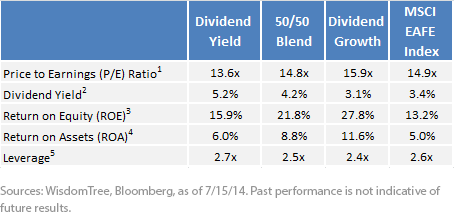

To conclude, we present a simple table showing the valuation characteristics of this blend, its component indexes and how this relates to the MSCI EAFE Index.

Valuation Attributes

Some of the more notable details underlying the characteristics of this blend:

• Financials: High Dividend Yielders had nearly 25% exposure to Financials, but Dividend Growers had less than 2.5% exposure. It’s also worth mentioning that the resulting 13.6% weight to Financials in the blend represented an 11.8% under-weight compared to the MSCI EAFE Index, the most widely followed performance measure of broad, developed international equities.6

• Balancing the Consumer Sectors with the High-Yielding Sectors: It’s interesting that the Dividend Growers had much greater exposure to the Consumer Discretionary and Consumer Staples sectors—10.1% and 12.8% higher, respectively, than the High Dividend Yielders. If economic fundamentals in developed markets improve and rates begin to rise, these are important sectors to be attentive to. On the other hand, the High Dividend Yielders had much greater exposure to Telecommunication Services and Utilities—10.8% and 8.6% higher, respectively, than the Dividend Growers. In the present, lower-yielding environment, exposure to these sectors can be important for potential income generation.

Bringing Valuation into the Discussion

To conclude, we present a simple table showing the valuation characteristics of this blend, its component indexes and how this relates to the MSCI EAFE Index.

Valuation Attributes

For definitions of terms in the chart, please visit our glossary.

In our opinion, the story that stands out is that, as of July 15, the 50–50 blend had a similar P/E ratio, a dividend yield approximately 80 basis points higher and a three-year average return on equity that was approximately 860 basis points higher than the MSCI EAFE Index. While it’s true that the MSCI EAFE Index is the most widely utilized market capitalization-weighted measure of the performance of developed international equities, we believe that this blend combines sector and currency diversification while maintaining a focus on high-quality stocks. This is an attractive combination, in our view, for the current market environment.

1Refers to the U.S. Federal Reserve tapering the amount of its monthly asset purchases.

2Refers to the U.S. Federal Funds Rate, the rate that banks that are members of the Federal Reserve system charge on overnight loans to one another. The Federal Open Market Committee sets this rate. Also referred to as the “policy rate” of the U.S. Federal Reserve.

3Source: Bloomberg, as of 7/15/14.

4Refers to the universe of the WisdomTree International Hedged Dividend Growth Index.

5Refers to the universe of the WisdomTree DEFA Equity Income Index.

6Sources: Bloomberg, Standard & Poor’s, as of 7/15/14.

For definitions of terms in the chart, please visit our glossary.

In our opinion, the story that stands out is that, as of July 15, the 50–50 blend had a similar P/E ratio, a dividend yield approximately 80 basis points higher and a three-year average return on equity that was approximately 860 basis points higher than the MSCI EAFE Index. While it’s true that the MSCI EAFE Index is the most widely utilized market capitalization-weighted measure of the performance of developed international equities, we believe that this blend combines sector and currency diversification while maintaining a focus on high-quality stocks. This is an attractive combination, in our view, for the current market environment.

1Refers to the U.S. Federal Reserve tapering the amount of its monthly asset purchases.

2Refers to the U.S. Federal Funds Rate, the rate that banks that are members of the Federal Reserve system charge on overnight loans to one another. The Federal Open Market Committee sets this rate. Also referred to as the “policy rate” of the U.S. Federal Reserve.

3Source: Bloomberg, as of 7/15/14.

4Refers to the universe of the WisdomTree International Hedged Dividend Growth Index.

5Refers to the universe of the WisdomTree DEFA Equity Income Index.

6Sources: Bloomberg, Standard & Poor’s, as of 7/15/14.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focused in Europe or Japan are increasing the impact of events and developments associated with the region, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.