Smart Beta in Action: Taking Chips Off the Small Cap European Table

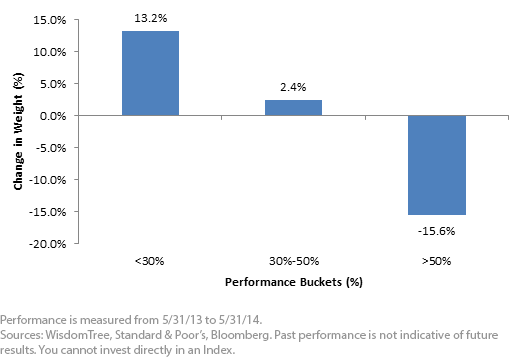

• Almost 50% of Weight in Top Performers: Approximately 47% of the weight in WT Europe Small was in firms that delivered a return greater than 50% from May 31, 2013, to May 31, 2014. We can see that 15.6% of WT Europe Small’s weight in these securities was trimmed as a result of the 2014 Index screening.

• Subtracting from Winners and Adding to Losers: Regardless of how strong a year it must be to have “losers” defined as those returning less than 30%, we clearly see that weight is taken from those firms with returns greater than 50% over the prior year and redistributed to firms with returns below 30%.

Effectively Taking the “Decision” Off the Table

WT Europe Small’s relative value rebalance, the mechanics of which are seen above, is helpful in that it attacks the market in a disciplined way every year. This is especially important after the strong performance of European small caps this year, in that we believe investors might tend to want to hold on to the stronger performers. In sticking to the investment mantra “buy low, sell high,” a relative value rebalance may aid in accomplishing this notably difficult action—a key feature of how we think investors can become smarter with their beta exposures.

For the full research on the WisdomTree European Indexes rebalance, click here.

1 Drillisch AG was a 1.76% in the WisdomTree Europe SmallCap Dividend Index as of 6/30/14.

• Almost 50% of Weight in Top Performers: Approximately 47% of the weight in WT Europe Small was in firms that delivered a return greater than 50% from May 31, 2013, to May 31, 2014. We can see that 15.6% of WT Europe Small’s weight in these securities was trimmed as a result of the 2014 Index screening.

• Subtracting from Winners and Adding to Losers: Regardless of how strong a year it must be to have “losers” defined as those returning less than 30%, we clearly see that weight is taken from those firms with returns greater than 50% over the prior year and redistributed to firms with returns below 30%.

Effectively Taking the “Decision” Off the Table

WT Europe Small’s relative value rebalance, the mechanics of which are seen above, is helpful in that it attacks the market in a disciplined way every year. This is especially important after the strong performance of European small caps this year, in that we believe investors might tend to want to hold on to the stronger performers. In sticking to the investment mantra “buy low, sell high,” a relative value rebalance may aid in accomplishing this notably difficult action—a key feature of how we think investors can become smarter with their beta exposures.

For the full research on the WisdomTree European Indexes rebalance, click here.

1 Drillisch AG was a 1.76% in the WisdomTree Europe SmallCap Dividend Index as of 6/30/14.Important Risks Related to this Article

Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Dividends are not guaranteed and a company’s future abilities to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Performance, especially for very short time periods, should not be the sole factor in making your investment decision.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.