How the Europe Small Cap Portfolio Changed at the Rebalance

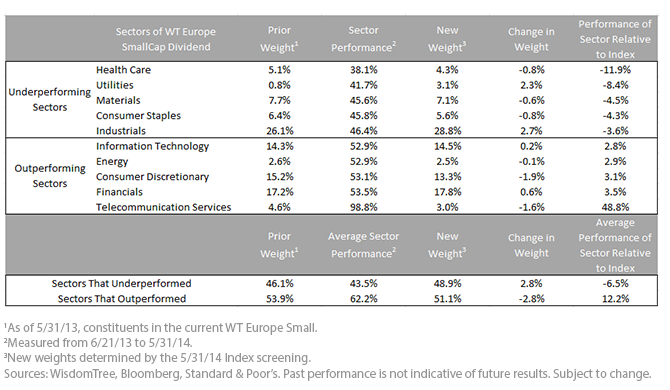

Utilities and Industrials saw the largest incremental increases in weight. These were underperforming sectors; it makes sense that exposure would be increased to sectors that had underperformed. The largest weight reductions occurred in Consumer Discretionary and Telecommunication Services. The Telecom sector in particular had a blowout year, with the stocks in WT Europe Small in this sector up nearly 100%. No other sector had anything close to this performance.

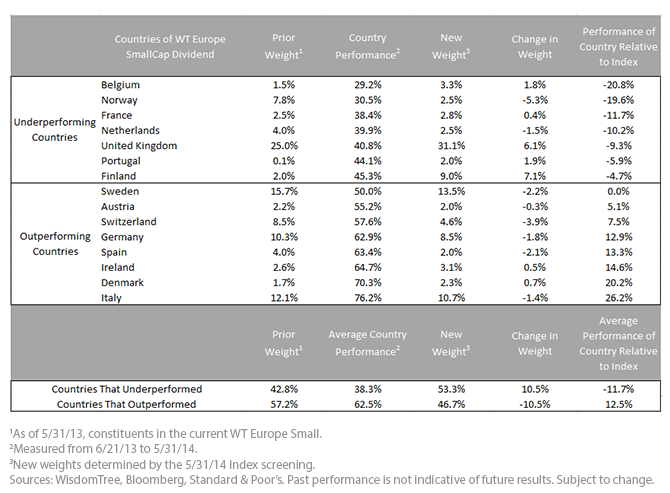

Figure 2: Changes in Country Exposure for WT Europe Small

Utilities and Industrials saw the largest incremental increases in weight. These were underperforming sectors; it makes sense that exposure would be increased to sectors that had underperformed. The largest weight reductions occurred in Consumer Discretionary and Telecommunication Services. The Telecom sector in particular had a blowout year, with the stocks in WT Europe Small in this sector up nearly 100%. No other sector had anything close to this performance.

Figure 2: Changes in Country Exposure for WT Europe Small

In aggregate, countries that outperformed the broad Index had returns that ranged from 50% to approximately 77%. Three of the four best country returns were in the peripheral European countries Italy, Ireland and Spain. This speaks to the recovery that occurred in the bond yield spreads for these countries as well. In aggregate, these outperforming countries saw their weight reduced by 10.5 percentage points.

The Foundation of this Process Rests on Fundamentals

Market-capitalization-weighted indexes tend to hold greater exposures to securities (therefore also to countries and sectors) that have appreciated in price because this also leads to an increase in market capitalization. What is happening in WT Europe Small is that weight is being lowered to sectors—and even more notably, to countries—that have outperformed, and weight is being added to sectors and countries that have underperformed. Why is this? Because these are precisely the sectors and countries that have seen greater relative dividend growth.

For the full research on the WisdomTree European Indexes rebalance, click here.

In aggregate, countries that outperformed the broad Index had returns that ranged from 50% to approximately 77%. Three of the four best country returns were in the peripheral European countries Italy, Ireland and Spain. This speaks to the recovery that occurred in the bond yield spreads for these countries as well. In aggregate, these outperforming countries saw their weight reduced by 10.5 percentage points.

The Foundation of this Process Rests on Fundamentals

Market-capitalization-weighted indexes tend to hold greater exposures to securities (therefore also to countries and sectors) that have appreciated in price because this also leads to an increase in market capitalization. What is happening in WT Europe Small is that weight is being lowered to sectors—and even more notably, to countries—that have outperformed, and weight is being added to sectors and countries that have underperformed. Why is this? Because these are precisely the sectors and countries that have seen greater relative dividend growth.

For the full research on the WisdomTree European Indexes rebalance, click here.

Important Risks Related to this Article

Investments focused in Europe are increasing the impact of events and developments associated with the region, which can adversely affect performance. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.