The Emerging Markets 50/50: Yields & Volatility

For definitions of indexes in the chart, visit our Glossary.

The 50/50 blend offers the opportunity of:

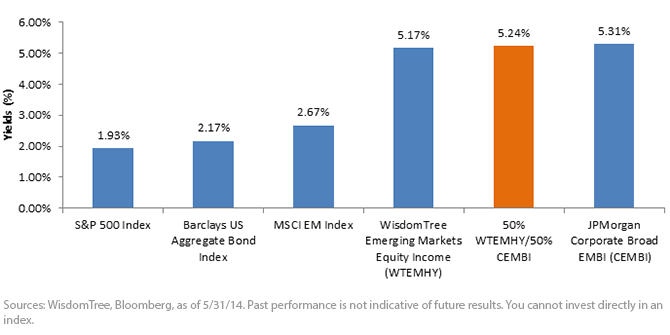

• Yield Pickup: Compared with an all-equity position in WTEMHY that yields 5.17%, the blend offers approximately a 10-basis-point pickup in yields (5.24%). Compared with the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, the WTEMHY/CEMBI blend offers a 3.31% and 2.57% pickup in yields, respectively. It is also noteworthy that WTEMHY has a 2.50% yield advantage compared with the broad MSCI EM Index. We believe that WisdomTree’s yield advantage is largely a function of WTEMHY’s smart beta methodology, which is focused on higher-dividend-yielding stocks.

• Lower Volatility: WTEMHY, has an annualized volatility of 22.07% since its inception on June 1, 2007. We contrast this with CEMBI Index, which has an annualized volatility of 10.77% since inception. The 50/50 blend gives investors a midway total volatility number of 15.10% annually. To add further context, the S&P 500 Index and the MSCI EM Index have annual volatility numbers of 17.06% and 26.22%, respectively. The blend’s ability to help lessen volatility is especially powerful against a backdrop of higher yields, as discussed in the above bullet point.

• Attractive Equity Valuations: Since the inception of WTEMHY, the price-to-earnings ratio (as of May 31, 2014) is trading at a 20% discount to its average; the price-to-book ratio is trading at a 35% discount; the price-to-sales ratio1 is trading at a 15% discount; and the price-to-cash-flow ratio is trading at a 5.8% discount. This offers a powerful rationale for considering emerging market equities in a portfolio.

• Attractive Fixed Income Valuations: EM corporates presently trade at a yield premium to B-rated U.S. corporates. CEMBI is 69% investment grade as of 5/31/2014, while B-rated corporates represent the middle tier of speculative credits in the U.S. Prior to last year’s sell-off, yields for EM corporates have historically traded more in line with Ba-rated credits. Yields for Ba corporates as of 5/31/2014 are 4.16%, a full 115 basis points lower than CEMBI. The wider spreads are representative of more attractive valuations in EM corporates.

Some of the notable characteristics of using this 50/50 blend of WTEMHY and CEMBI include:

• First, the blend maintains exposure to leading EM corporations while reducing emerging markets foreign exchange (FX) exposure by half. Through WTEMHY’s methodology, investors gain exposure to some of the highest-yielding segments of emerging market equities and exposure to the pursuant currencies. As we have argued in the past, EM currencies can be very expensive to hedge, given relatively higher local interest rates. CEMBI offers a solution for investors who want to take part in the EM story while dialing down exposure to EM FX. In particular, a 50% allocation to CEMBI can help reduce currency exposure by half without incurring the high cost of hedging local currencies; CEMBI invests in USD-denominated corporate bonds.

• Second, the blend scales the capital structure. Going up in capital structure from equities to emerging market corporate bonds can translate into a reduction in asset volatility for the balanced portfolio. Further, a priority claim on assets is an important consideration in emerging markets.

• Third, it blends active and passive management: WisdomTree’s Emerging Markets Corporate Bond Fund is sub-advised by Western Asset Management, one of the premier active managers for emerging markets. Given that the role of fixed income in a portfolio is principally to deliver income and mitigate risk from equities alone, the active overlay, with history evaluating credits, may provide an extra level of comfort in accessing this asset class.

For definitions of indexes in the chart, visit our Glossary.

The 50/50 blend offers the opportunity of:

• Yield Pickup: Compared with an all-equity position in WTEMHY that yields 5.17%, the blend offers approximately a 10-basis-point pickup in yields (5.24%). Compared with the S&P 500 Index and the Barclays U.S. Aggregate Bond Index, the WTEMHY/CEMBI blend offers a 3.31% and 2.57% pickup in yields, respectively. It is also noteworthy that WTEMHY has a 2.50% yield advantage compared with the broad MSCI EM Index. We believe that WisdomTree’s yield advantage is largely a function of WTEMHY’s smart beta methodology, which is focused on higher-dividend-yielding stocks.

• Lower Volatility: WTEMHY, has an annualized volatility of 22.07% since its inception on June 1, 2007. We contrast this with CEMBI Index, which has an annualized volatility of 10.77% since inception. The 50/50 blend gives investors a midway total volatility number of 15.10% annually. To add further context, the S&P 500 Index and the MSCI EM Index have annual volatility numbers of 17.06% and 26.22%, respectively. The blend’s ability to help lessen volatility is especially powerful against a backdrop of higher yields, as discussed in the above bullet point.

• Attractive Equity Valuations: Since the inception of WTEMHY, the price-to-earnings ratio (as of May 31, 2014) is trading at a 20% discount to its average; the price-to-book ratio is trading at a 35% discount; the price-to-sales ratio1 is trading at a 15% discount; and the price-to-cash-flow ratio is trading at a 5.8% discount. This offers a powerful rationale for considering emerging market equities in a portfolio.

• Attractive Fixed Income Valuations: EM corporates presently trade at a yield premium to B-rated U.S. corporates. CEMBI is 69% investment grade as of 5/31/2014, while B-rated corporates represent the middle tier of speculative credits in the U.S. Prior to last year’s sell-off, yields for EM corporates have historically traded more in line with Ba-rated credits. Yields for Ba corporates as of 5/31/2014 are 4.16%, a full 115 basis points lower than CEMBI. The wider spreads are representative of more attractive valuations in EM corporates.

Some of the notable characteristics of using this 50/50 blend of WTEMHY and CEMBI include:

• First, the blend maintains exposure to leading EM corporations while reducing emerging markets foreign exchange (FX) exposure by half. Through WTEMHY’s methodology, investors gain exposure to some of the highest-yielding segments of emerging market equities and exposure to the pursuant currencies. As we have argued in the past, EM currencies can be very expensive to hedge, given relatively higher local interest rates. CEMBI offers a solution for investors who want to take part in the EM story while dialing down exposure to EM FX. In particular, a 50% allocation to CEMBI can help reduce currency exposure by half without incurring the high cost of hedging local currencies; CEMBI invests in USD-denominated corporate bonds.

• Second, the blend scales the capital structure. Going up in capital structure from equities to emerging market corporate bonds can translate into a reduction in asset volatility for the balanced portfolio. Further, a priority claim on assets is an important consideration in emerging markets.

• Third, it blends active and passive management: WisdomTree’s Emerging Markets Corporate Bond Fund is sub-advised by Western Asset Management, one of the premier active managers for emerging markets. Given that the role of fixed income in a portfolio is principally to deliver income and mitigate risk from equities alone, the active overlay, with history evaluating credits, may provide an extra level of comfort in accessing this asset class.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. In addition, when interest rates fall, income may decline. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Derivative investments can be volatile, and these investments may be less liquid than other securities and more sensitive to the effects of varied economic conditions. Unlike typical exchange-traded funds, there is no index that EMCB attempts to track or replicate. Thus, the ability of EMCB to achieve its objective will depend on the effectiveness of the portfolio manager. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for specific details regarding each Fund’s risk profile. Credit ratings apply to the underlying holdings of the Fund, not to the Fund itself. Standard &Poor’s, Moody’s and Fitch study the financial condition of an entity to ascertain its creditworthiness. The credit ratings reflect the rating agency’s opinion of the holdings’ financial conditions and histories. The ratings displayed are based on the highest of each portfolio constituent as currently rated by Standard and Poor’s, Moody’s or Fitch. Long-term ratings are generally measured on a scale ranging from AAA (highest) to D (lowest), while short-term ratings are generally measured on a scale ranging from A-1 to C. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. ALPS Distributors, Inc., is not affiliated with Western Asset Management.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.