Chief Investment Officer, Fixed Income and Model Portfolios

• While not a new asset class,

senior loans became available in an exchange-traded fund (ETF) in March 2011 and have seen more than $3 billion in net inflows over the last year.

• Prior to this, the most common way for investors to access the bank loan market was through

collateralized loan obligations (CLOs).

• In the current environment, investors have been attracted to senior loans due to their high income potential and limited

interest rate risk.

• As an alternative, stripping Treasury interest-rate risk out of short-term high-yield bonds has, in recent years, produced a return advantage compared to senior loan indexes.

• Correlations between the returns of high-yield bonds excluding Treasury rate risk and the returns of bank loans have been strong with comparable

volatility.

The demand for high income amid concerns about rising rates has generated significant interest in exchange-traded funds offering exposure to senior loans. Senior loans, also commonly known as bank loans or leveraged loans, typically pay interest rates based on a spread above a short-term interest rate such as the London Interbank Offered Rate (LIBOR). Should rates rise, investor income payments should increase along with LIBOR. Since these loans are made to issuers of lower

credit quality, senior loans provide high levels of income potential.

However, risks may be increasing in the leveraged loan market. After a period of 95 straight weeks of inflows totaling $66.3 billion in assets, these strategies have recently seen the largest amount of outflows in nearly three years (-$1.2 billion). At the same time, supply is continuing to increase at its fastest pace since 2007. In 2013, underwriting and syndication of loans topped $1.14 trillion, near a fresh record.

Of the projected $1 trillion in new deals in 2014, nearly 70% are earmarked as a refinancing or repricing whereby borrowers are attempting to lower their borrowing costs. While lower borrowing costs are good for issuers, they come at the expense of income potential for investors. Even though most analysts are not forecasting a change in the tide of credit, it could make sense to reduce exposure to an asset class that has historically not had a strong retail presence. While strong, sustained inflows have lifted prices, what happens when the tide begins to reverse?

In our view, one of the largest unknown risks about the asset class has to do with

liquidity in stressed market environments. Compared to bonds, loans tend to exhibit lower levels of liquidity because of smaller issue sizes and nonstandard

settlement cycles (bonds tend to settle in three days versus seven days for loans). While nonstandard settlement is one potential risk, we believe the bigger unknown may be a result of lower inventory levels held by bank trading desks in the changing regulatory environment. Should everyone rush for the exits at once, how will the market react?

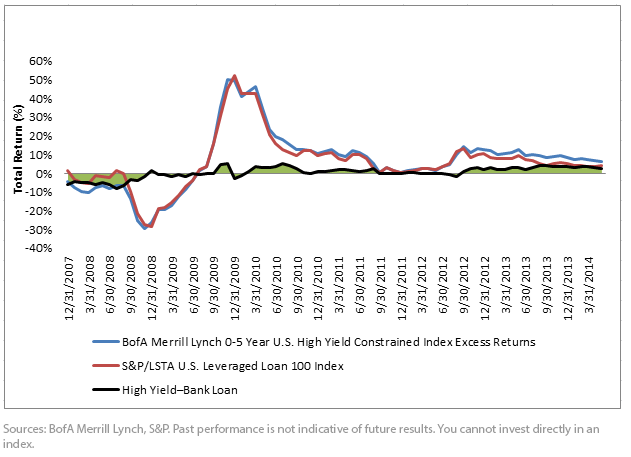

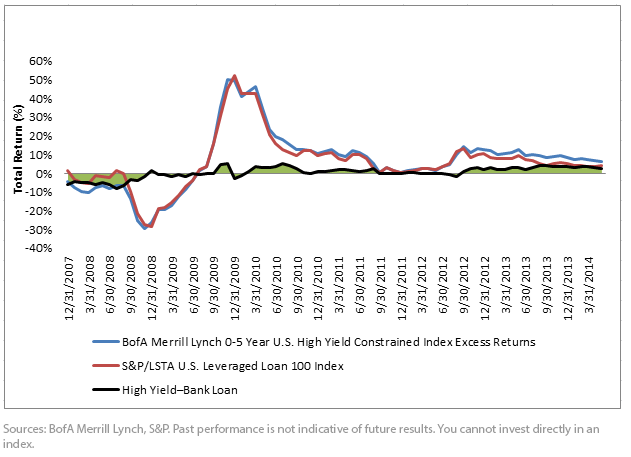

Zero Duration High Yield versus Bank Loans

As one potential alternative to the bank loan market, we believe that investors should consider allocations to high-yield strategies that seek to mitigate exposure to interest rate risk. Since these two attributes are what attracted investors to the asset class in the first place, we feel this is a fair comparison. As shown in the chart below, since the Federal Reserve began its

tapering process, the excess returns of high-yield bonds (used to proxy high-yield bonds without interest rate risk) have performed remarkably well compared to bank loans.

Bank Loans versus High-Yield Excess Returns, 12/31/11–5/31/14

12-Month Rolling Total Returns

For definition of terms and indexes in the chart, please visit our glossary.

For definition of terms and indexes in the chart, please visit our glossary.

In today’s market environment, investors are not only continuing to search for income but are also seeking to limit interest rate risk. With those objectives in mind, bank loan investment funds have continued to rise in popularity. For many investors, we believe that substituting a portion of your bank loan portfolio for zero duration high yield could be an effective means of reducing a portion of the unknown liquidity risk of a comparatively untested asset class.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Non-investment-grade debt securities (also known as high-yield or “junk” bonds) have lower credit ratings and involve a greater risk to principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. The duration Funds seek to mitigate interest rate risk by taking short positions in U.S. Treasuries, but there is no guarantee this will be achieved. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effects of varied economic conditions.

For definition of terms and indexes in the chart, please visit our glossary.

In today’s market environment, investors are not only continuing to search for income but are also seeking to limit interest rate risk. With those objectives in mind, bank loan investment funds have continued to rise in popularity. For many investors, we believe that substituting a portion of your bank loan portfolio for zero duration high yield could be an effective means of reducing a portion of the unknown liquidity risk of a comparatively untested asset class.

For definition of terms and indexes in the chart, please visit our glossary.

In today’s market environment, investors are not only continuing to search for income but are also seeking to limit interest rate risk. With those objectives in mind, bank loan investment funds have continued to rise in popularity. For many investors, we believe that substituting a portion of your bank loan portfolio for zero duration high yield could be an effective means of reducing a portion of the unknown liquidity risk of a comparatively untested asset class.