Annual Rebalance: Continuing Evolution of the Bloomberg Dollar Spot Index

A Broader, More Representative Approach

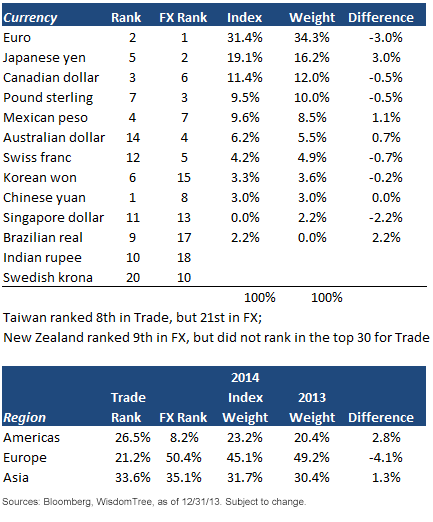

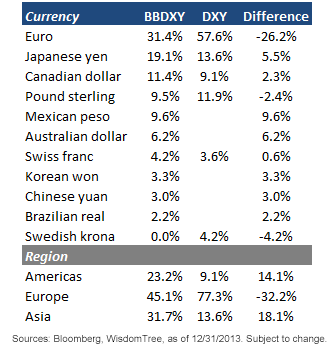

The countries whose currencies are included in the BBDXY basket represent 81% of the overall trade with the United States. By another measure, the currencies included in the Bloomberg Dollar Spot Index comprise 93.7% of the $5.3 trillion traded each day in the foreign exchange market. By comparison, the six components of the ICE U.S. Dollar Index represent only 42% of the trade with the U.S. and barely 80% of the daily FX volume. From our perspective, when investors ask themselves what the U.S. dollar is worth, we believe this more comprehensive assessment of the dollar provides a more intuitive approach.

Bloomberg Dollar Spot Index (BBDXY) vs. ICE U.S. Dollar Index (DXY)

A Broader, More Representative Approach

The countries whose currencies are included in the BBDXY basket represent 81% of the overall trade with the United States. By another measure, the currencies included in the Bloomberg Dollar Spot Index comprise 93.7% of the $5.3 trillion traded each day in the foreign exchange market. By comparison, the six components of the ICE U.S. Dollar Index represent only 42% of the trade with the U.S. and barely 80% of the daily FX volume. From our perspective, when investors ask themselves what the U.S. dollar is worth, we believe this more comprehensive assessment of the dollar provides a more intuitive approach.

Bloomberg Dollar Spot Index (BBDXY) vs. ICE U.S. Dollar Index (DXY)

Even after the most recent rebalance, BBDXY remains more broadly differentiated than DXY. In our view, a dynamic measure of the U.S. dollar provides a more representative approach to measuring the role the U.S. dollar plays in the global economy.

1Source: Bloomberg, WisdomTree, as of 12/31/13.

2Source: Bank for International Settlements (BIS), Triennial Survey, April 2013.

3Sources: Bloomberg, WisdomTree, as of 12/31/13.

Even after the most recent rebalance, BBDXY remains more broadly differentiated than DXY. In our view, a dynamic measure of the U.S. dollar provides a more representative approach to measuring the role the U.S. dollar plays in the global economy.

1Source: Bloomberg, WisdomTree, as of 12/31/13.

2Source: Bank for International Settlements (BIS), Triennial Survey, April 2013.

3Sources: Bloomberg, WisdomTree, as of 12/31/13.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Diversification does not eliminate the risk of experiencing investment losses.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.