The Case for Taking the Euro out of Germany

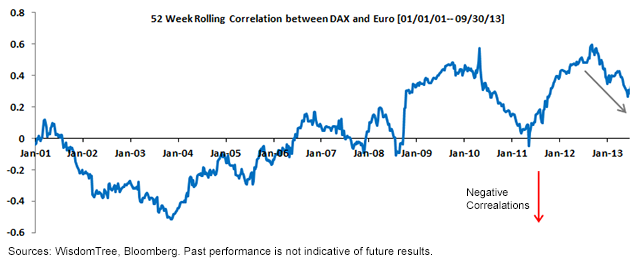

A more concrete depiction of the correlation is a simple chart that looks at the 52-week rolling relationship between the DAX and the euro. The 52-week correlation is generally considered a structural picture of the relationship between German equities and its currency, given the one-year horizon.

A more concrete depiction of the correlation is a simple chart that looks at the 52-week rolling relationship between the DAX and the euro. The 52-week correlation is generally considered a structural picture of the relationship between German equities and its currency, given the one-year horizon.

• In the five years following 2001, the correlation between the two asset classes was firmly in negative territory.

• It appears that the correlation tended to spike in times of economic duress and uncertainty, as with the global financial crisis in 2008/2009 and the European crisis in 2010/2012.

• The current trajectory of the correlation seems to indicate a decreasing correlation between the euro and German equities, which could motivate an increased focus on currency-hedged strategies.

Conclusion

The equities represented in the WisdomTree Germany Hedged Equity Index have the potential to play many important roles in a portfolio. First and foremost, the Index measures the equities of the largest exporter nation and the largest economy in the European Monetary Union.4 These German exporters stand to benefit from a pick-up in the global growth cycle, particularly in the developed markets.

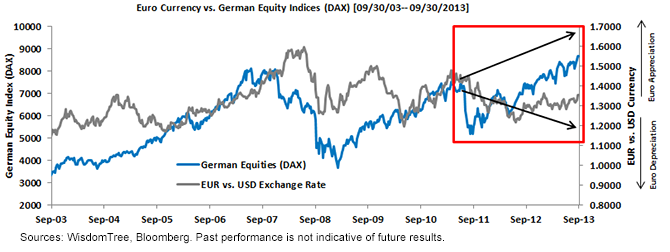

If one wants to invest in German equities, we believe there is a great benefit that comes from hedging currency—as it removes a source of risk, currency risk, which is not related to the investment thesis that European or German equities are cheap. We are not convinced the euro is cheap and we may see a secular increase in the U.S. dollar versus developed world currencies over the coming years. Thus, we believe that hedging the euro is becoming increasingly more important, and we wouldn’t be surprised to see a stronger negative correlation return to the market, with German equities appreciating as the euro depreciates over time.

1Refers to the euro spot rate against the U.S. dollar, measured from about 8/31/2003 to 8/31/2009.

2Refers to the price movements of the FTSE 100 Index.

3Source: WisdomTree, Bloomberg

4Source: Eurostat, September 2013.

• In the five years following 2001, the correlation between the two asset classes was firmly in negative territory.

• It appears that the correlation tended to spike in times of economic duress and uncertainty, as with the global financial crisis in 2008/2009 and the European crisis in 2010/2012.

• The current trajectory of the correlation seems to indicate a decreasing correlation between the euro and German equities, which could motivate an increased focus on currency-hedged strategies.

Conclusion

The equities represented in the WisdomTree Germany Hedged Equity Index have the potential to play many important roles in a portfolio. First and foremost, the Index measures the equities of the largest exporter nation and the largest economy in the European Monetary Union.4 These German exporters stand to benefit from a pick-up in the global growth cycle, particularly in the developed markets.

If one wants to invest in German equities, we believe there is a great benefit that comes from hedging currency—as it removes a source of risk, currency risk, which is not related to the investment thesis that European or German equities are cheap. We are not convinced the euro is cheap and we may see a secular increase in the U.S. dollar versus developed world currencies over the coming years. Thus, we believe that hedging the euro is becoming increasingly more important, and we wouldn’t be surprised to see a stronger negative correlation return to the market, with German equities appreciating as the euro depreciates over time.

1Refers to the euro spot rate against the U.S. dollar, measured from about 8/31/2003 to 8/31/2009.

2Refers to the price movements of the FTSE 100 Index.

3Source: WisdomTree, Bloomberg

4Source: Eurostat, September 2013.Important Risks Related to this Article

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. Investments focused in Germany are increasing the impact of events and developments associated with the region, which can adversely affect performance.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.