U.S. Equities: Historical Trends of Large Caps vs. Small Caps

Based on this historical picture, we see:

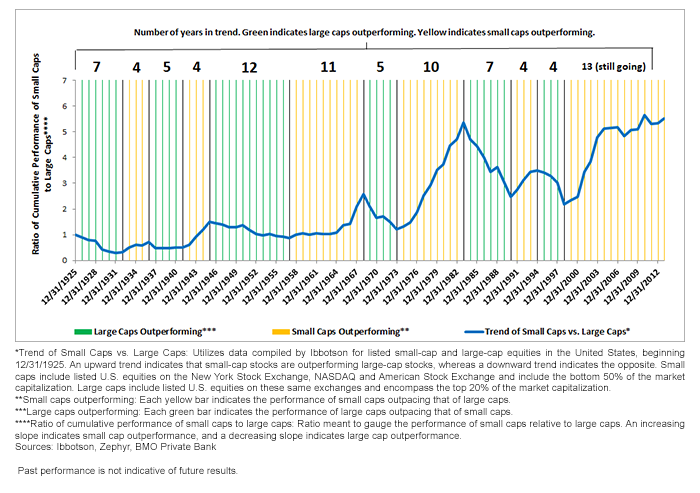

• Six Periods of Sustained Small-Cap Outperformance: There have been six sustained periods (in yellow) when small caps outperformed large caps. On average, these periods lasted slightly more than seven years. The current period has lasted approximately 13 years—nearly twice as long as the average going back about 88 years.

One conclusion resulting from analyzing this chart would be to shift U.S. equity allocations from small caps to large caps. But many will not want to eliminate small-cap exposure entirely, so I believe it is important to consider strategies that incorporate a process to manage the valuation risks building up in this asset class.

Dispersions in Sector Performance

The WisdomTree SmallCap Earnings Index was up more than 34% for the prior year,2 and the WisdomTree SmallCap Dividend Index was up nearly 28% for the same period. Both small-cap Indexes have therefore delivered large returns this year. Driving those returns:

• For the WisdomTree SmallCap Earnings Index: Consumer Discretionary and Industrials were the leading sectors, with returns of greater than 40% over the period. Health Care and Utilities, on the other hand, delivered returns of below 20%.

• For the WisdomTree SmallCap Dividend Index: Consumer Discretionary and Industrials were also the leading sectors for this Index, each with returns above 40% over the same period. However, the group of sectors with returns below 20% over the period was a bit broader, and in addition to Utilities included both Materials and Energy.

There was quite a dispersion in small-cap equity returns on a sector basis over this period—something could indicate an opportunity for a relative value rebalancing process to add value and take some chips off the table in sectors that have really run the most.

Past performance is not indicative of future results.

A Disciplined Focus on Relative Value

With market capitalization-weighted indexes, when constituents increase in price, there is no mechanism to subtract weight based on the idea of valuations becoming overly extended. I see this as a potential risk building up in market cap-weighted small-cap indexes.

One solution could be to look for small-cap indexes that have lower valuations. Value-oriented indexes are one way to focus on small-cap stocks with relatively lower prices. At WisdomTree, we have two small-cap Indexes that utilize a rigorous, rules-based approach to focus on relative-value rebalancing.

WisdomTree focuses on dividends (WisdomTree SmallCap Dividend Index) and earnings (WisdomTree SmallCap Earnings Index). During the rebalancing process, which occurs once per year in December, the relationship between share price performance and either dividend growth or earnings growth is measured.

• Firms whose prices have increased more than their relative earnings or dividend growth will see their weight decline at the rebalance.

• Firms whose prices have lagged behind their relative earnings or dividend growth will see their weight increase at the rebalance.

Conclusion

Without question, small-cap stocks have been outperforming large-cap stocks in the United States. We believe that the application of a process to focus on relative valuations is becoming increasingly important in this arena as this small-cap stretch carries on.

We thank the BMO Private Bank strategy team for sharing their great chart with us.

1Sources: Ibbotson, Zephyr, BMO Private Bank

2From 9/30/2012 to 9/30/2013.

Based on this historical picture, we see:

• Six Periods of Sustained Small-Cap Outperformance: There have been six sustained periods (in yellow) when small caps outperformed large caps. On average, these periods lasted slightly more than seven years. The current period has lasted approximately 13 years—nearly twice as long as the average going back about 88 years.

One conclusion resulting from analyzing this chart would be to shift U.S. equity allocations from small caps to large caps. But many will not want to eliminate small-cap exposure entirely, so I believe it is important to consider strategies that incorporate a process to manage the valuation risks building up in this asset class.

Dispersions in Sector Performance

The WisdomTree SmallCap Earnings Index was up more than 34% for the prior year,2 and the WisdomTree SmallCap Dividend Index was up nearly 28% for the same period. Both small-cap Indexes have therefore delivered large returns this year. Driving those returns:

• For the WisdomTree SmallCap Earnings Index: Consumer Discretionary and Industrials were the leading sectors, with returns of greater than 40% over the period. Health Care and Utilities, on the other hand, delivered returns of below 20%.

• For the WisdomTree SmallCap Dividend Index: Consumer Discretionary and Industrials were also the leading sectors for this Index, each with returns above 40% over the same period. However, the group of sectors with returns below 20% over the period was a bit broader, and in addition to Utilities included both Materials and Energy.

There was quite a dispersion in small-cap equity returns on a sector basis over this period—something could indicate an opportunity for a relative value rebalancing process to add value and take some chips off the table in sectors that have really run the most.

Past performance is not indicative of future results.

A Disciplined Focus on Relative Value

With market capitalization-weighted indexes, when constituents increase in price, there is no mechanism to subtract weight based on the idea of valuations becoming overly extended. I see this as a potential risk building up in market cap-weighted small-cap indexes.

One solution could be to look for small-cap indexes that have lower valuations. Value-oriented indexes are one way to focus on small-cap stocks with relatively lower prices. At WisdomTree, we have two small-cap Indexes that utilize a rigorous, rules-based approach to focus on relative-value rebalancing.

WisdomTree focuses on dividends (WisdomTree SmallCap Dividend Index) and earnings (WisdomTree SmallCap Earnings Index). During the rebalancing process, which occurs once per year in December, the relationship between share price performance and either dividend growth or earnings growth is measured.

• Firms whose prices have increased more than their relative earnings or dividend growth will see their weight decline at the rebalance.

• Firms whose prices have lagged behind their relative earnings or dividend growth will see their weight increase at the rebalance.

Conclusion

Without question, small-cap stocks have been outperforming large-cap stocks in the United States. We believe that the application of a process to focus on relative valuations is becoming increasingly important in this arena as this small-cap stretch carries on.

We thank the BMO Private Bank strategy team for sharing their great chart with us.

1Sources: Ibbotson, Zephyr, BMO Private Bank

2From 9/30/2012 to 9/30/2013.Important Risks Related to this Article

ALPS Distributors, Inc. is not affiliated with BMO Private Bank. You cannot invest directly in an index. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.