Emerging Markets: Focusing on the Current Account

The Macroeconomic Double Standard

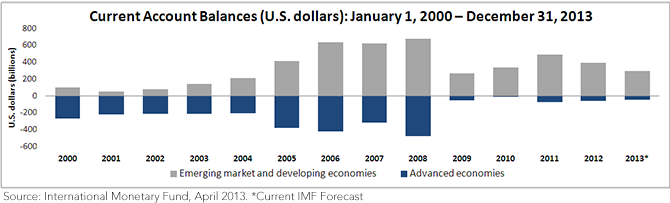

Given that many emerging market countries rely on exports to power their economic growth, a current account deficit (more imports than exports) can be particularly troubling for investors. In this scenario, the emerging economy is increasing its liabilities to its trading partners (through balancing financial account flows) that will eventually need to be repaid. During periods of market stress, investors become concerned about these deficits and reduce their exposure. This can have a particularly strong effect on the price of assets and the value of the currency. As investors sell assets and convert the currency to U.S. dollars, simple effects of supply and demand decrease prices and weaken the currency.

Yet for all the focus on emerging markets, the country with the largest current account deficit in the world is the United States! Also, Australia and New Zealand have been able to run current account deficits equivalent to 5% of GDP for the last 20 years.1 Indeed, developed markets seem to be held to different standards. However, developed markets tend to have higher savings rates than developing economies and, generally, are much less likely to be as reliant on foreign capital to finance these trade imbalances.

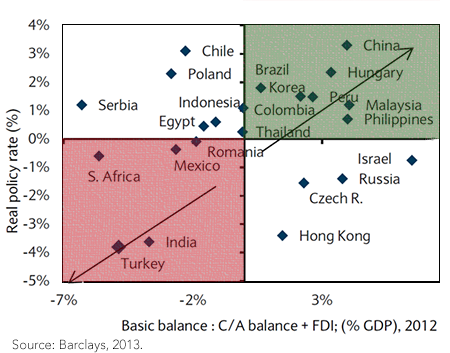

But reverting the focus to a topic we’ve discussed multiple times before, not all emerging markets are created equal. In addition to where they fall along the development continuum, EM countries also have varying degrees of external vulnerability. The countries that seem to have come under the most pressure so far are India, Indonesia, South Africa and Turkey. While each country’s causes and positioning tell their own story, the market is focusing on these countries’ current difficulties and extrapolating those challenges to essentially all emerging markets. In our view, although they may currently face headwinds, we believe that each of these countries will eventually correct course.

External Vulnerability

The Macroeconomic Double Standard

Given that many emerging market countries rely on exports to power their economic growth, a current account deficit (more imports than exports) can be particularly troubling for investors. In this scenario, the emerging economy is increasing its liabilities to its trading partners (through balancing financial account flows) that will eventually need to be repaid. During periods of market stress, investors become concerned about these deficits and reduce their exposure. This can have a particularly strong effect on the price of assets and the value of the currency. As investors sell assets and convert the currency to U.S. dollars, simple effects of supply and demand decrease prices and weaken the currency.

Yet for all the focus on emerging markets, the country with the largest current account deficit in the world is the United States! Also, Australia and New Zealand have been able to run current account deficits equivalent to 5% of GDP for the last 20 years.1 Indeed, developed markets seem to be held to different standards. However, developed markets tend to have higher savings rates than developing economies and, generally, are much less likely to be as reliant on foreign capital to finance these trade imbalances.

But reverting the focus to a topic we’ve discussed multiple times before, not all emerging markets are created equal. In addition to where they fall along the development continuum, EM countries also have varying degrees of external vulnerability. The countries that seem to have come under the most pressure so far are India, Indonesia, South Africa and Turkey. While each country’s causes and positioning tell their own story, the market is focusing on these countries’ current difficulties and extrapolating those challenges to essentially all emerging markets. In our view, although they may currently face headwinds, we believe that each of these countries will eventually correct course.

External Vulnerability

For definitions of the terms in the chart, please visit our Glossary.

Maintaining Perspective

As emerging markets continue to evolve, it is important to have an investment process in place that is capable of evolving with the market. In our view, looking to a single data point doesn’t provide the necessary context to identify a potentially destabilizing trend. Looking at supporting evidence and more recent, market-based factors can also be beneficial when attempting to make investment decisions. While focusing on macroeconomic fundamentals may not always lead to investment gains in the short term, we believe that vigilant monitoring of external vulnerabilities can ultimately lead to a more intuitive approach to investing in emerging markets.

1Source: International Monetary Fund (IMF), April 2013.

For definitions of the terms in the chart, please visit our Glossary.

Maintaining Perspective

As emerging markets continue to evolve, it is important to have an investment process in place that is capable of evolving with the market. In our view, looking to a single data point doesn’t provide the necessary context to identify a potentially destabilizing trend. Looking at supporting evidence and more recent, market-based factors can also be beneficial when attempting to make investment decisions. While focusing on macroeconomic fundamentals may not always lead to investment gains in the short term, we believe that vigilant monitoring of external vulnerabilities can ultimately lead to a more intuitive approach to investing in emerging markets.

1Source: International Monetary Fund (IMF), April 2013.Important Risks Related to this Article

Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

Rick Harper serves as the Chief Investment Officer, Fixed Income and Model Portfolios at WisdomTree Asset Management, where he oversees the firm’s suite of fixed income and currency exchange-traded funds. He is also a voting member of the WisdomTree Model Portfolio Investment Committee and takes a leading role in the management and oversight of the fixed income model allocations. He plays an active role in risk management and oversight within the firm.

Rick has over 29 years investment experience in strategy and portfolio management positions at prominent investment firms. Prior to joining WisdomTree in 2007, Rick held senior level strategist roles with RBC Dain Rauscher, Bank One Capital Markets, ETF Advisors, and Nuveen Investments. At ETF Advisors, he was the portfolio manager and developer of some of the first fixed income exchange-traded funds. His research has been featured in leading periodicals including the Journal of Portfolio Management and the Journal of Indexes. He graduated from Emory University and earned his MBA at Indiana University.