Rising Rates Impact

For definitions of indexes in the chart, please visit our Glossary.

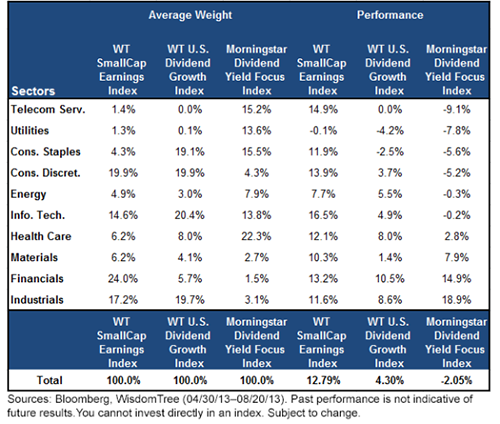

• High-Yield Stocks Underperformed – A look at the Morningstar Dividend Yield Focus Index reveals that the typically higher-yielding sectors (Consumer Staples, Utilities and Telecommunications) had the worst performance since April 30. Each of these sectors represented at least 13% of the index and 44.3% in aggregate.

• Performance Divergences Even among Sectors – Looking at specific sectors across the indexes, we see vastly different constituent performance, which is largely a result of selection methodology. A closer look at the Consumer Discretionary sector reveals how the WT SmallCap Earnings and WT U.S. Dividend Growth Indexes outperformed the Morningstar Dividend Yield Focus Index by 19.1% and 8.9%, respectively, from a stock selection basis. It is also important to note that all the underlying constituents in both the WT U.S. Dividend Growth and Morningstar Dividend Yield Focus indexes are dividend payers, but the WisdomTree Index focuses on potential dividend growers while the Morningstar index focuses on high-dividend yielders.

• Cyclical Sectors Outperformed – Some of the best-performing sectors during the period for all indexes above were the cyclical sectors. These sectors are usually tied more closely to economic growth and tend to perform well when the economy is growing or expectations are improving. Cyclical sectors are characteristically some of the lower-yielding sectors, and indexes that select based on dividend yield are typically under-weight in these sectors compared to the broad market.

Diversifying for the Future

The recent rising rate environment has signaled an improving U.S. economic picture for some. If this is indeed the case and rates continue to increase, it could be beneficial to diversify dividend-paying equity exposure away from sectors that are most sensitive to rising interest rates and into sectors that could benefit from economic growth. This coincides with a broader exposure to more cyclical sectors (lower yield and higher dividend growth) and potentially less exposure to the more defensive (higher-yielding) sectors. To read more on this topic, please see the market insight we published here.

1Source: Bloomberg

For definitions of indexes in the chart, please visit our Glossary.

• High-Yield Stocks Underperformed – A look at the Morningstar Dividend Yield Focus Index reveals that the typically higher-yielding sectors (Consumer Staples, Utilities and Telecommunications) had the worst performance since April 30. Each of these sectors represented at least 13% of the index and 44.3% in aggregate.

• Performance Divergences Even among Sectors – Looking at specific sectors across the indexes, we see vastly different constituent performance, which is largely a result of selection methodology. A closer look at the Consumer Discretionary sector reveals how the WT SmallCap Earnings and WT U.S. Dividend Growth Indexes outperformed the Morningstar Dividend Yield Focus Index by 19.1% and 8.9%, respectively, from a stock selection basis. It is also important to note that all the underlying constituents in both the WT U.S. Dividend Growth and Morningstar Dividend Yield Focus indexes are dividend payers, but the WisdomTree Index focuses on potential dividend growers while the Morningstar index focuses on high-dividend yielders.

• Cyclical Sectors Outperformed – Some of the best-performing sectors during the period for all indexes above were the cyclical sectors. These sectors are usually tied more closely to economic growth and tend to perform well when the economy is growing or expectations are improving. Cyclical sectors are characteristically some of the lower-yielding sectors, and indexes that select based on dividend yield are typically under-weight in these sectors compared to the broad market.

Diversifying for the Future

The recent rising rate environment has signaled an improving U.S. economic picture for some. If this is indeed the case and rates continue to increase, it could be beneficial to diversify dividend-paying equity exposure away from sectors that are most sensitive to rising interest rates and into sectors that could benefit from economic growth. This coincides with a broader exposure to more cyclical sectors (lower yield and higher dividend growth) and potentially less exposure to the more defensive (higher-yielding) sectors. To read more on this topic, please see the market insight we published here.

1Source: BloombergImportant Risks Related to this Article

Diversification does not eliminate the risk of experiencing investment loss. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.