Japanese Yen Weakness Flowing Through to Exporters’ Bottom Line

For definition of FOREX, click here.

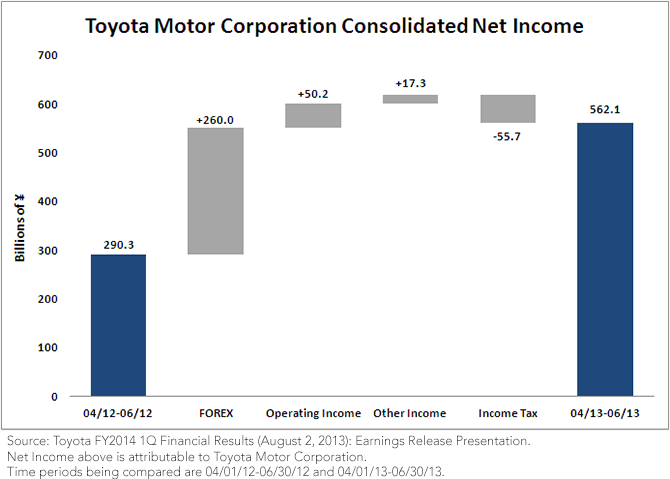

• Yen Depreciation Dramatically Contributes to Earnings – The depreciation of the yen accounted for ¥260 billion of the ¥270.1 billion growth in net income over the same period last year. It is important to realize that Toyota’s gain from the yen depreciation is absolutely remarkable and represents over 95% of the total growth in net income for the period.

• Further Yen Depreciation Can Add to Future Profits - If the yen continues to depreciate, it could potentially continue to add to Toyota’s bottom line. Toyota is forecasting to sell 9.1 million vehicles over their 2014 fiscal year, and 6.8 million (approximately 75%) of those are expected to be sold outside Japan.1 These future overseas sales converted back to a potentially weaker yen translate to even more yen revenue.

• Toyota’s Stock Performance Also Strong – Market participants have recognized the benefit a weaker yen has had on Toyota’s bottom line. As of this writing (August 23), Toyota’s total return has been 94%, while the broader Tokyo Stock Price Index (TOPIX) for Japan is up 53%, over the past year. The yen is down 21% over this same period.2

Other Automakers Also Benefit from a Weaker Yen

Other large Japanese automakers have all benefited from a weakening yen due to their export-oriented business models. The list below shows the major automakers and the amount of reported income during their most recent earnings period compared to the same period of the preceding year.

• Honda – Reported income of ¥172.0 billion, down ¥22.7 billion from the year before, even with a gain of ¥82.9 billion from currency effects.3

• Nissan – Reported income of ¥117.8 billion, down ¥2.9 billion from the year before, even with a gain of ¥69.8 billion from currency effects.4

• Mazda – Reported income of ¥36.5 billion, up ¥34.7 billion from the year before, with a gain of ¥29.2 billion from currency effects.5

Hedge Your Currency Exposure

If the yen continues to weaken, Japanese exporters should continue to benefit. On the other hand, a weakening yen is not good for U.S. investors in Japanese equities—unless they hedge the currency. Currency-hedged strategies allow investors to focus on Japanese equities without the worry over currency declines.

Don’t Forget about Small Caps

Japan’s global revenue generators might be in favor due to recent yen weakness, while in the future the focus could shift more toward the domestically sensitive firms. Small-cap stocks typically export less and are more sensitive to the domestic economy than large-cap stocks. I think the majority of the smaller-cap stocks have yet to fully benefit from the structural reforms of Abenomics, which are still a work in progress and will play out over the next two years. WisdomTree has two different small-cap Indexes that track dividend-paying stocks in Japan.

• WisdomTree Japan SmallCap Dividend Index – includes exposure to the yen

• WisdomTree Japan Hedged SmallCap Equity Index – hedges out the currency risk

Conclusion

All the actions by the Japanese government have the same goal: stimulate Japan’s economic growth. The weaker yen has helped start the economic engine, but I feel we are still in the early innings of Japan’s true transformation. If Japan’s citizens are able to benefit from structural reforms and thus increase consumption and investments, and yen weakness continues to provide tailwind, the result could be very positive for Japan’s equity investors. I remain optimistic on the prospects for Japanese equities.

For current holdings of the WisdomTree Japan SmallCap Dividend Index, please click here.

For current holdings of the WisdomTree Japan Hedged SmallCap Equity Index, please click here.

1Source: Toyota FY2014 1Q Financial Results (August 2, 2013).

2Source: Bloomberg (08/23/13).

3Source: Honda FY2014 1st Quarter Financial Results (July 31, 2013).

4Source: Nissan FY2013 First-Quarter Financial Results (July 25, 2013).

5Source: Mazda Consolidated Financial Results for the First Quarter of the Fiscal Year Ending March 31, 2014 (July 31, 2013).

For definition of FOREX, click here.

• Yen Depreciation Dramatically Contributes to Earnings – The depreciation of the yen accounted for ¥260 billion of the ¥270.1 billion growth in net income over the same period last year. It is important to realize that Toyota’s gain from the yen depreciation is absolutely remarkable and represents over 95% of the total growth in net income for the period.

• Further Yen Depreciation Can Add to Future Profits - If the yen continues to depreciate, it could potentially continue to add to Toyota’s bottom line. Toyota is forecasting to sell 9.1 million vehicles over their 2014 fiscal year, and 6.8 million (approximately 75%) of those are expected to be sold outside Japan.1 These future overseas sales converted back to a potentially weaker yen translate to even more yen revenue.

• Toyota’s Stock Performance Also Strong – Market participants have recognized the benefit a weaker yen has had on Toyota’s bottom line. As of this writing (August 23), Toyota’s total return has been 94%, while the broader Tokyo Stock Price Index (TOPIX) for Japan is up 53%, over the past year. The yen is down 21% over this same period.2

Other Automakers Also Benefit from a Weaker Yen

Other large Japanese automakers have all benefited from a weakening yen due to their export-oriented business models. The list below shows the major automakers and the amount of reported income during their most recent earnings period compared to the same period of the preceding year.

• Honda – Reported income of ¥172.0 billion, down ¥22.7 billion from the year before, even with a gain of ¥82.9 billion from currency effects.3

• Nissan – Reported income of ¥117.8 billion, down ¥2.9 billion from the year before, even with a gain of ¥69.8 billion from currency effects.4

• Mazda – Reported income of ¥36.5 billion, up ¥34.7 billion from the year before, with a gain of ¥29.2 billion from currency effects.5

Hedge Your Currency Exposure

If the yen continues to weaken, Japanese exporters should continue to benefit. On the other hand, a weakening yen is not good for U.S. investors in Japanese equities—unless they hedge the currency. Currency-hedged strategies allow investors to focus on Japanese equities without the worry over currency declines.

Don’t Forget about Small Caps

Japan’s global revenue generators might be in favor due to recent yen weakness, while in the future the focus could shift more toward the domestically sensitive firms. Small-cap stocks typically export less and are more sensitive to the domestic economy than large-cap stocks. I think the majority of the smaller-cap stocks have yet to fully benefit from the structural reforms of Abenomics, which are still a work in progress and will play out over the next two years. WisdomTree has two different small-cap Indexes that track dividend-paying stocks in Japan.

• WisdomTree Japan SmallCap Dividend Index – includes exposure to the yen

• WisdomTree Japan Hedged SmallCap Equity Index – hedges out the currency risk

Conclusion

All the actions by the Japanese government have the same goal: stimulate Japan’s economic growth. The weaker yen has helped start the economic engine, but I feel we are still in the early innings of Japan’s true transformation. If Japan’s citizens are able to benefit from structural reforms and thus increase consumption and investments, and yen weakness continues to provide tailwind, the result could be very positive for Japan’s equity investors. I remain optimistic on the prospects for Japanese equities.

For current holdings of the WisdomTree Japan SmallCap Dividend Index, please click here.

For current holdings of the WisdomTree Japan Hedged SmallCap Equity Index, please click here.

1Source: Toyota FY2014 1Q Financial Results (August 2, 2013).

2Source: Bloomberg (08/23/13).

3Source: Honda FY2014 1st Quarter Financial Results (July 31, 2013).

4Source: Nissan FY2013 First-Quarter Financial Results (July 25, 2013).

5Source: Mazda Consolidated Financial Results for the First Quarter of the Fiscal Year Ending March 31, 2014 (July 31, 2013).Important Risks Related to this Article

You cannot invest directly in an index. Investments focusing in Japan increase the impact of events and developments in Japan, which can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investment risk and the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.