Small Cap Dividend Payers with Growth Potential

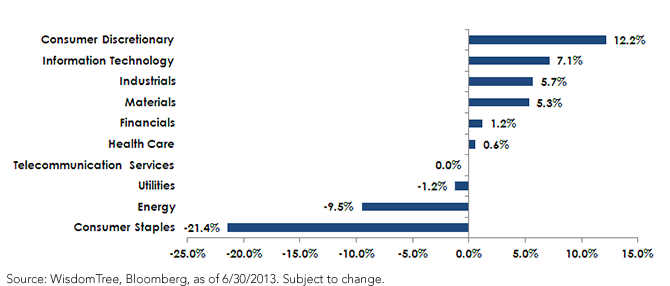

The biggest differences among sectors between WTSDG and the Achievers Select occur in the consumer sectors. The WisdomTree U.S. SmallCap Dividend Growth Index has a 21.4% under-weight in Consumer Staples and a 12.2% over-weight in Consumer Discretionary compared to the Achievers Select. If one believes in an improving U.S. economic picture—one where consumers may increase their discretionary purchasing—this could be of interest. Other cyclical sector over-weights compared to the Achievers Select include Information Technology, Industrials and Materials.

3. Small Caps More Sensitive to U.S. Local Economy

Neither the Achievers Select nor WTSDG focus on where constituents generate their revenues, but small-cap companies are often less globally based and more focused on a local economy. We looked at the weighted average geographic revenues for the top 10 constituents of the Achievers Select and WTSDG to illustrate this point. The WT small-cap Index derived more than 80% of its revenue from the United States, compared to less than 50% for the Achievers Select.3 While we understand that these are not the entire constituent lists, we believe that the logical conclusion—that large caps tend to be more multinational in their revenue distribution than small caps—seems to come through, and again this points to an interesting way of thinking about consequences for an improving U.S. economy.

Diversification Is about Being Different

The dividend growth and quality theme has been very popular, but we believe there were no good measures of these stocks outside of large caps. The WisdomTree U.S. SmallCap Dividend Growth Index is able to provide this precise focus, allowing people to extend this theme over a more complete swath of U.S. equities. Additionally, the completely different way of going about it (compared to the Achievers Select) provides great complementary potential.

1These interest rates refer to the U.S. 10-Year Treasury Note

2Source: Bloomberg.

3Source: Bloomberg, as of 6/30/2013.

The biggest differences among sectors between WTSDG and the Achievers Select occur in the consumer sectors. The WisdomTree U.S. SmallCap Dividend Growth Index has a 21.4% under-weight in Consumer Staples and a 12.2% over-weight in Consumer Discretionary compared to the Achievers Select. If one believes in an improving U.S. economic picture—one where consumers may increase their discretionary purchasing—this could be of interest. Other cyclical sector over-weights compared to the Achievers Select include Information Technology, Industrials and Materials.

3. Small Caps More Sensitive to U.S. Local Economy

Neither the Achievers Select nor WTSDG focus on where constituents generate their revenues, but small-cap companies are often less globally based and more focused on a local economy. We looked at the weighted average geographic revenues for the top 10 constituents of the Achievers Select and WTSDG to illustrate this point. The WT small-cap Index derived more than 80% of its revenue from the United States, compared to less than 50% for the Achievers Select.3 While we understand that these are not the entire constituent lists, we believe that the logical conclusion—that large caps tend to be more multinational in their revenue distribution than small caps—seems to come through, and again this points to an interesting way of thinking about consequences for an improving U.S. economy.

Diversification Is about Being Different

The dividend growth and quality theme has been very popular, but we believe there were no good measures of these stocks outside of large caps. The WisdomTree U.S. SmallCap Dividend Growth Index is able to provide this precise focus, allowing people to extend this theme over a more complete swath of U.S. equities. Additionally, the completely different way of going about it (compared to the Achievers Select) provides great complementary potential.

1These interest rates refer to the U.S. 10-Year Treasury Note

2Source: Bloomberg.

3Source: Bloomberg, as of 6/30/2013.

Important Risks Related to this Article

Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited. A company currently paying dividends may cease paying dividends at any time. Diversification does not eliminate the risk of experiencing investment loss. You cannot invest directly in an index.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.