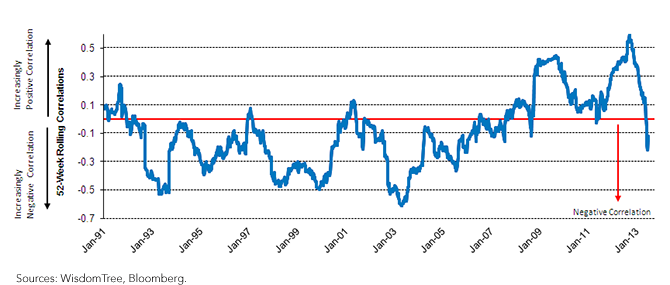

UK Equities and the British Pound Becoming Inversely Related

The 52-week correlations have shown that the broad market5 and the currency tend to be negatively correlated for most of the ’90s and into 2007.

Interest Rate Differentials and UK Equities

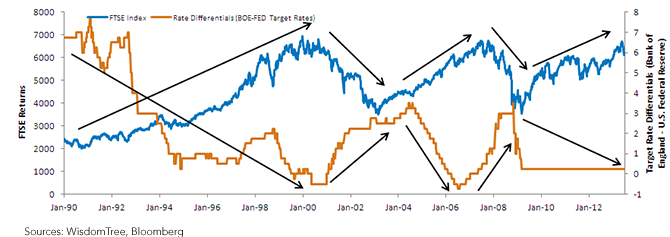

The interest rate differentials between the United States and the United Kingdom play a large role in explaining the inverse correlation between the UK’s equities and its currency. While interest rate differentials between the UK and the U.S. are negatively correlated with the FTSE 100 Index (chart 2), the interest rate differentials are positively correlated to the GBP exchange rate versus the U.S. dollar. These two relationships contribute to the overall negative correlation between UK equities and the GBP.

Chart 2: The FTSE 100 Index and Rate Differentials Imply an Inverse Relationship

01/05/1990–06/28/2013

The 52-week correlations have shown that the broad market5 and the currency tend to be negatively correlated for most of the ’90s and into 2007.

Interest Rate Differentials and UK Equities

The interest rate differentials between the United States and the United Kingdom play a large role in explaining the inverse correlation between the UK’s equities and its currency. While interest rate differentials between the UK and the U.S. are negatively correlated with the FTSE 100 Index (chart 2), the interest rate differentials are positively correlated to the GBP exchange rate versus the U.S. dollar. These two relationships contribute to the overall negative correlation between UK equities and the GBP.

Chart 2: The FTSE 100 Index and Rate Differentials Imply an Inverse Relationship

01/05/1990–06/28/2013

• Since 2009, interest rate differentials between the UK and the U.S. have been relatively flat. However, equities have been flirting with record highs as the FTSE has attracted many global leaders that have a multinational revenue base.6 While the currency has weakened to reflect general concerns regarding poor UK growth and twin deficits, equities, on the other hand, have appreciated in line with stronger global growth post the global financial crisis. This explains the significant drop in correlation since 2012.

• As severe economic tail risks becomes less of a focus—the spike in correlation that is typical of extreme uncertainty becomes less likely. Barring another crisis situation, we could see correlations become even more negative.

• The differentials in interest rate policies of the UK and the U.S. have an impact on both the currency markets and the equity markets. It is thus interesting to contrast the initial stages of U.S. discussions to slow down the Fed’s extraordinary monetary accommodation with the first meeting of the new head of the UK’s central bank, Mark Carney, where he brought a new measure of communication to the Bank of England by stating that its interest rates were going to stay low for an extended period. If interest rates in the U.S. increase due to better economic growth while UK rates stay low, this could be negative for the British currency but positive for UK equities.

Conclusion

In light of the lackluster growth prospects for the UK and the potential for aggressive policy easing by the newly elected Bank of England governor, Mark Carney, we believe that equities can continue to climb while the British pound weakens to address competitiveness issues. In other words, the negative correlation between UK equities and the British pound can persist and even increase. During such an environment for currency and equities, just as we have seen with Japan, currency-hedged equity strategies become of greater importance.

1UK equities: Universe is the FTSE 100 Index.

2Source: The World Bank, Economic Growth in the 1990s: Learning from a Decade of Reform. March 2005.

3Interest rate differentials: Measured by the difference between the Bank of England and the U.S. Federal Reserve target rates.

4WisdomTree, Bloomberg. We use 52-week rolling correlations on returns, as this provides a longer-term perspective on how equity and currency returns relate to one another.

5Broad market: Measured by FTSE 100 Index.

6Source: Turcan Connell,"Think Global", May 2011.

• Since 2009, interest rate differentials between the UK and the U.S. have been relatively flat. However, equities have been flirting with record highs as the FTSE has attracted many global leaders that have a multinational revenue base.6 While the currency has weakened to reflect general concerns regarding poor UK growth and twin deficits, equities, on the other hand, have appreciated in line with stronger global growth post the global financial crisis. This explains the significant drop in correlation since 2012.

• As severe economic tail risks becomes less of a focus—the spike in correlation that is typical of extreme uncertainty becomes less likely. Barring another crisis situation, we could see correlations become even more negative.

• The differentials in interest rate policies of the UK and the U.S. have an impact on both the currency markets and the equity markets. It is thus interesting to contrast the initial stages of U.S. discussions to slow down the Fed’s extraordinary monetary accommodation with the first meeting of the new head of the UK’s central bank, Mark Carney, where he brought a new measure of communication to the Bank of England by stating that its interest rates were going to stay low for an extended period. If interest rates in the U.S. increase due to better economic growth while UK rates stay low, this could be negative for the British currency but positive for UK equities.

Conclusion

In light of the lackluster growth prospects for the UK and the potential for aggressive policy easing by the newly elected Bank of England governor, Mark Carney, we believe that equities can continue to climb while the British pound weakens to address competitiveness issues. In other words, the negative correlation between UK equities and the British pound can persist and even increase. During such an environment for currency and equities, just as we have seen with Japan, currency-hedged equity strategies become of greater importance.

1UK equities: Universe is the FTSE 100 Index.

2Source: The World Bank, Economic Growth in the 1990s: Learning from a Decade of Reform. March 2005.

3Interest rate differentials: Measured by the difference between the Bank of England and the U.S. Federal Reserve target rates.

4WisdomTree, Bloomberg. We use 52-week rolling correlations on returns, as this provides a longer-term perspective on how equity and currency returns relate to one another.

5Broad market: Measured by FTSE 100 Index.

6Source: Turcan Connell,"Think Global", May 2011.

Important Risks Related to this Article

Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investment risk which can be volatile and may be less liquid than other securities and more sensitive to the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.