Retirement 101, Part 6: You Can’t Afford Not to Save

Save early and often

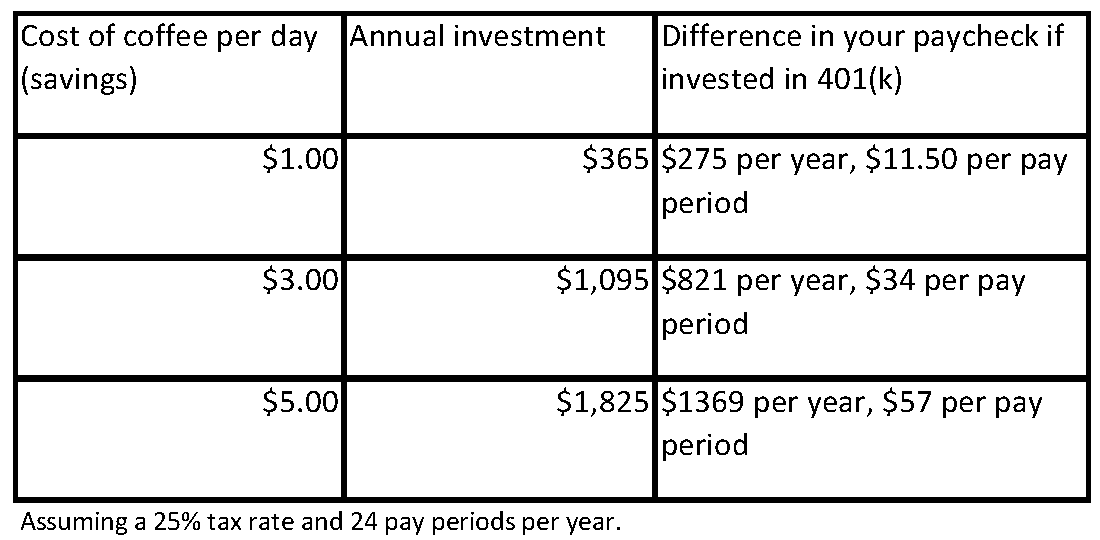

As you can see, even that $1 per day can make a big difference over time. And if that’s all you can afford, it’s better than doing nothing. Once you determine how much you might be able to save, you should start saving right away. Consider that interest and earnings compound over time. For example, if you invest $100 and earn 5%, at the end of the year you’ll have $105. Then, even if you don’t invest any more, you begin to earn interest on the interest as well, so if you earn another 5% the following year, you’ll have $110.25. And so on and so on.

Consider ETFs

Exchange-traded funds (ETFs) may provide many benefits that make them attractive for retirement savings. But perhaps the most compelling are their low fees. Lower fees mean more of your investment is working for you. And just like that $1 per day can make a big difference over time, 1% lower fees per year can make a big difference as well, as we illustrated in previous blogs.

It’s never too early—or too late— to save, and every little bit helps, so get going. For more information on ETFs, 401(k) plans or other investment topics, please visit www.wisdomtree.com. In future installments, we’ll discuss ways to determine how much you need to retire—and much more.

Read our 401(k) series here.

Save early and often

As you can see, even that $1 per day can make a big difference over time. And if that’s all you can afford, it’s better than doing nothing. Once you determine how much you might be able to save, you should start saving right away. Consider that interest and earnings compound over time. For example, if you invest $100 and earn 5%, at the end of the year you’ll have $105. Then, even if you don’t invest any more, you begin to earn interest on the interest as well, so if you earn another 5% the following year, you’ll have $110.25. And so on and so on.

Consider ETFs

Exchange-traded funds (ETFs) may provide many benefits that make them attractive for retirement savings. But perhaps the most compelling are their low fees. Lower fees mean more of your investment is working for you. And just like that $1 per day can make a big difference over time, 1% lower fees per year can make a big difference as well, as we illustrated in previous blogs.

It’s never too early—or too late— to save, and every little bit helps, so get going. For more information on ETFs, 401(k) plans or other investment topics, please visit www.wisdomtree.com. In future installments, we’ll discuss ways to determine how much you need to retire—and much more.

Read our 401(k) series here.Important Risks Related to this Article

Ordinary brokerage commissions apply. Neither WisdomTree Investments, Inc., nor its affiliates, nor ALPS Distributors, Inc., and its affiliates, provide tax advice. Information provided herein should not be considered tax advice. Investors seeking tax advice should consult an independent tax advisor.