For International Exposure, Look Beyond Large Caps

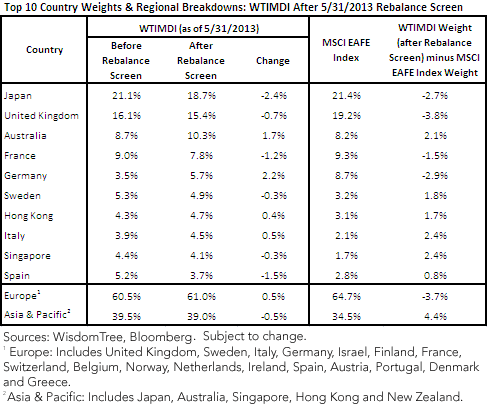

• Changes at 5/31/2013 Rebalance: Germany saw one of the more significant additions in weight, gaining 2.2%. Japan was one of the larger reductions in weight, losing 2.4% of its exposure. For WTIMDI, the regional breakdown of Europe vs. Asia & Pacific did not change much.

• WTIMDI Weights Compared to MSCI EAFE Index: Compared to the regional exposures of the MSCI EAFE Index, WTIMDI is over-weight in Asia & Pacific and under-weight in Europe. The MSCI EAFE Index has notably more weight in Japan, the United Kingdom and Germany, whereas WTIMDI has notably greater weight in Australia, Italy and Singapore.

The Sector Picture

• Changes at 5/31/2013 Rebalance: Germany saw one of the more significant additions in weight, gaining 2.2%. Japan was one of the larger reductions in weight, losing 2.4% of its exposure. For WTIMDI, the regional breakdown of Europe vs. Asia & Pacific did not change much.

• WTIMDI Weights Compared to MSCI EAFE Index: Compared to the regional exposures of the MSCI EAFE Index, WTIMDI is over-weight in Asia & Pacific and under-weight in Europe. The MSCI EAFE Index has notably more weight in Japan, the United Kingdom and Germany, whereas WTIMDI has notably greater weight in Australia, Italy and Singapore.

The Sector Picture

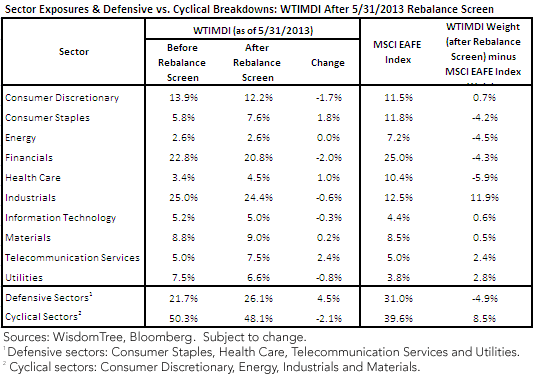

• Changes at the 5/31/2013 Rebalance: Telecommunication Services saw the biggest absolute change, with its weight increasing by 2.4%, while Financials saw the largest decrease in weight. In terms of defensive sectors vs. cyclical sectors, weight titled more toward defensives and less toward cyclicals at this latest rebalance. Of course, it is worth noting that overall, cyclical sectors still comprise approximately twice as much weight as their defensive counterparts.

• WTIMDI Weights Compared to MSCI EAFE Index: The sector weights of WTIMDI compared to the MSCI EAFE Index exhibit a much wider dispersion than does the country picture. Industrials are the standout—an 11.9% over-weight. Health Care, Financials, Energy and Consumer Staples represent significant under-weights. WTIMDI is also notable for its 8.5% over-weight to cyclical sectors compared to the MSCI EAFE Index. Generally speaking, WTIMDI’s positioning compared to the MSCI EAFE Index, being under-weight in defensive sectors and over-weight in cyclical sectors, represents what we believe is an important diversification potential between the two indexes.

Conclusion

We believe that the WisdomTree International MidCap Dividend Index rebalance affords a further opportunity to build on the picture of developed international mid caps relative to the MSCI EAFE Index. When investors consider equities in developed markets outside the U.S., they tend to think first of the MSCI EAFE Index, but WTIMDI has the potential to focus on similar regions as that index but in a way that provides the opportunity for diversification.

• Changes at the 5/31/2013 Rebalance: Telecommunication Services saw the biggest absolute change, with its weight increasing by 2.4%, while Financials saw the largest decrease in weight. In terms of defensive sectors vs. cyclical sectors, weight titled more toward defensives and less toward cyclicals at this latest rebalance. Of course, it is worth noting that overall, cyclical sectors still comprise approximately twice as much weight as their defensive counterparts.

• WTIMDI Weights Compared to MSCI EAFE Index: The sector weights of WTIMDI compared to the MSCI EAFE Index exhibit a much wider dispersion than does the country picture. Industrials are the standout—an 11.9% over-weight. Health Care, Financials, Energy and Consumer Staples represent significant under-weights. WTIMDI is also notable for its 8.5% over-weight to cyclical sectors compared to the MSCI EAFE Index. Generally speaking, WTIMDI’s positioning compared to the MSCI EAFE Index, being under-weight in defensive sectors and over-weight in cyclical sectors, represents what we believe is an important diversification potential between the two indexes.

Conclusion

We believe that the WisdomTree International MidCap Dividend Index rebalance affords a further opportunity to build on the picture of developed international mid caps relative to the MSCI EAFE Index. When investors consider equities in developed markets outside the U.S., they tend to think first of the MSCI EAFE Index, but WTIMDI has the potential to focus on similar regions as that index but in a way that provides the opportunity for diversification.

Important Risks Related to this Article

You cannot invest directly in an index. Diversification does not eliminate the risk of experiencing investment loss.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.