Will Japan’s Day Traders Become Long Term Investors?

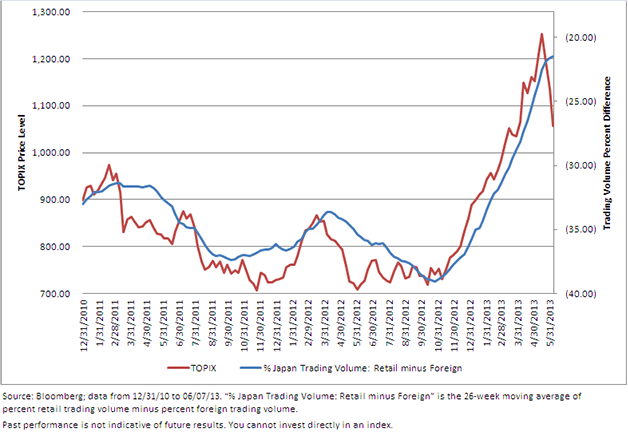

• Japanese Retail Investor Participation in Trading Activity Increased – The percentage of trading volume difference between retail and foreign investors has decreased as retail participation increased since late 2012.

• Retail Investors Have Experienced Gains – As the retail participation rate has increased relative to the foreign rate, the TOPIX has increased by over 26% year-to-date through 06/18/13.

• New Margin Rules: One factor explaining the pickup in retail trading activity relates to new margin rules that went into effect on January 1, 2013. The Financial Services Agency eliminated a three-day waiting period on rolling collateral over into new margin trades.2 Other margin changes that took effect include allowing gains from trades to be added to collateral before settlement dates so that borrowers can take on more leverage. This pickup in margin-related trading activity may be one factor leading to more volatility in the markets on both the up and the down side.

• Margin Trading Dominates This Retail Trading Activity: One explanation for the spike in retail trading activity is that margin trades often account for over half of the retail trading volume and that the margin-related percentage of retail volume increased following the new margin rules. According to data provided by the Tokyo Stock Exchange, margin transactions accounted for over 65% of individual transactions as of June 7, 2013, compared to fewer than 57% at the end of last year.

But will Japan’s retail day traders become more long-term investors? One catalyst pending for 2014 is a new tax incentive program to encourage equity market investments.

Japan ISA: Tax-Free Investment Accounts to Be Introduced in 2014

In a discussion with Morgan Stanley’s Japan equity research sales team, I just learned about a new investment savings account (ISA) that Japan is looking to introduce in 2014. This investment account creates a tax incentive to encourage more participation in the equity markets. The below description of the Japan ISA was provided by Nikko Asset Management:3

• “Any dividend income and capital gains from listed shares and mutual funds held in the account will be allowed to grow completely free of any tax during the tax-free period.

• “The tax-free period will be five years for each investment, or until the end of the fifth calendar year after the investment is made. For example, the tax-free period for all investments made during 2014 will end on December 31, 2018.

• “Up to ¥1 million per year, with an overall upper limit of ¥5 million, can be invested in the account.

• “Japan residents (or owners of a permanent residence in Japan) aged 20 or above on the 1st Jan of the year of account opening are eligible to open a single account, anytime during the 10-year period from 2014 to 2023.”

The SoftBank Investment Group (SBI) also focused on the Japan ISA as part of its initiatives for expanding equity market activities. The SBI Group noted in its investor presentation:4

• “SBI SECURITIES started accepting preliminary applications for opening an account from Mar. 29, 2013.

• “Morningstar Japan launched a NISA portal website on May 20.”5

While the total dollar figures being discussed here are not large—¥1 million per year and ¥5 million total correspond to approximately $10,000 a year and $50,000 total, respectively—the symbolic value of these investment accounts could help change the psychology of Japanese local investors. Japan needs to turn the retail day traders—who are trading in margin accounts—into more long-term investors, because they certainly have large asset bases. I look forward to seeing how these accounts might impact Japanese retail behavior over time.

Strong Initial Interest

According to a Nikkei story, Nomura Securities and Daiwa Securities have received applications for approximately 400,000 and 300,000 accounts, respectively. It has been reported that approximately 1.5 million investors in total have already applied for a tax-free investment account, even though the accounts cannot officially be opened until October. Nomura eventually expects the number of accounts to grow to 10 million.

Nikkei further reports, the FSA (Financial Services Agency) aims for ¥25 trillion (US$250bn) of household savings to flow into ISA accounts by 2020. Rarely do you see a government try to encourage investment at these levels and with these types of tax incentives.

Conclusion

There is no way predict the future of the TOPIX, but I do think current signs are encouraging for a long-term move higher. Increased retail investor participation and their potential allocation out of cash into the financial markets could be a major catalyst if Japan can provide the proper incentives to change the equity market culture. I believe this Japan ISA account is the right type of incentive program, whereas margin boosts that increase day-trading activity are less helpful.

1Source: Bank of Japan, as of 12/31/12

2Source: Kana Nishizawa & Satoshi Kawano, “Japan Margin Trade Doubles Amid Rally, Looser Regulation,” Bloomberg, Feb 13, 2013.

3This material was prepared solely for the purpose of Nikko AM to communicate information on the Japan ISA. The information in this document has been prepared from what is considered reliable information, but the accuracy and integrity of the information are not guaranteed by Nikko AM. This information may be subject to change in the future, depending on changes to laws or the regulatory system. See: http://en.nikkoam.com/files/pdf/asian_perspective/intro_isa_201302.pdf#search='isa+japan+million'

4Source: SBI Group presentation (page 68): http://www.sbigroup.co.jp/english/investors/disclosure/presentation/pdf/130528presentations.pdf

5Website: http://www.morningstar.co.jp/nisa/

• Japanese Retail Investor Participation in Trading Activity Increased – The percentage of trading volume difference between retail and foreign investors has decreased as retail participation increased since late 2012.

• Retail Investors Have Experienced Gains – As the retail participation rate has increased relative to the foreign rate, the TOPIX has increased by over 26% year-to-date through 06/18/13.

• New Margin Rules: One factor explaining the pickup in retail trading activity relates to new margin rules that went into effect on January 1, 2013. The Financial Services Agency eliminated a three-day waiting period on rolling collateral over into new margin trades.2 Other margin changes that took effect include allowing gains from trades to be added to collateral before settlement dates so that borrowers can take on more leverage. This pickup in margin-related trading activity may be one factor leading to more volatility in the markets on both the up and the down side.

• Margin Trading Dominates This Retail Trading Activity: One explanation for the spike in retail trading activity is that margin trades often account for over half of the retail trading volume and that the margin-related percentage of retail volume increased following the new margin rules. According to data provided by the Tokyo Stock Exchange, margin transactions accounted for over 65% of individual transactions as of June 7, 2013, compared to fewer than 57% at the end of last year.

But will Japan’s retail day traders become more long-term investors? One catalyst pending for 2014 is a new tax incentive program to encourage equity market investments.

Japan ISA: Tax-Free Investment Accounts to Be Introduced in 2014

In a discussion with Morgan Stanley’s Japan equity research sales team, I just learned about a new investment savings account (ISA) that Japan is looking to introduce in 2014. This investment account creates a tax incentive to encourage more participation in the equity markets. The below description of the Japan ISA was provided by Nikko Asset Management:3

• “Any dividend income and capital gains from listed shares and mutual funds held in the account will be allowed to grow completely free of any tax during the tax-free period.

• “The tax-free period will be five years for each investment, or until the end of the fifth calendar year after the investment is made. For example, the tax-free period for all investments made during 2014 will end on December 31, 2018.

• “Up to ¥1 million per year, with an overall upper limit of ¥5 million, can be invested in the account.

• “Japan residents (or owners of a permanent residence in Japan) aged 20 or above on the 1st Jan of the year of account opening are eligible to open a single account, anytime during the 10-year period from 2014 to 2023.”

The SoftBank Investment Group (SBI) also focused on the Japan ISA as part of its initiatives for expanding equity market activities. The SBI Group noted in its investor presentation:4

• “SBI SECURITIES started accepting preliminary applications for opening an account from Mar. 29, 2013.

• “Morningstar Japan launched a NISA portal website on May 20.”5

While the total dollar figures being discussed here are not large—¥1 million per year and ¥5 million total correspond to approximately $10,000 a year and $50,000 total, respectively—the symbolic value of these investment accounts could help change the psychology of Japanese local investors. Japan needs to turn the retail day traders—who are trading in margin accounts—into more long-term investors, because they certainly have large asset bases. I look forward to seeing how these accounts might impact Japanese retail behavior over time.

Strong Initial Interest

According to a Nikkei story, Nomura Securities and Daiwa Securities have received applications for approximately 400,000 and 300,000 accounts, respectively. It has been reported that approximately 1.5 million investors in total have already applied for a tax-free investment account, even though the accounts cannot officially be opened until October. Nomura eventually expects the number of accounts to grow to 10 million.

Nikkei further reports, the FSA (Financial Services Agency) aims for ¥25 trillion (US$250bn) of household savings to flow into ISA accounts by 2020. Rarely do you see a government try to encourage investment at these levels and with these types of tax incentives.

Conclusion

There is no way predict the future of the TOPIX, but I do think current signs are encouraging for a long-term move higher. Increased retail investor participation and their potential allocation out of cash into the financial markets could be a major catalyst if Japan can provide the proper incentives to change the equity market culture. I believe this Japan ISA account is the right type of incentive program, whereas margin boosts that increase day-trading activity are less helpful.

1Source: Bank of Japan, as of 12/31/12

2Source: Kana Nishizawa & Satoshi Kawano, “Japan Margin Trade Doubles Amid Rally, Looser Regulation,” Bloomberg, Feb 13, 2013.

3This material was prepared solely for the purpose of Nikko AM to communicate information on the Japan ISA. The information in this document has been prepared from what is considered reliable information, but the accuracy and integrity of the information are not guaranteed by Nikko AM. This information may be subject to change in the future, depending on changes to laws or the regulatory system. See: http://en.nikkoam.com/files/pdf/asian_perspective/intro_isa_201302.pdf#search='isa+japan+million'

4Source: SBI Group presentation (page 68): http://www.sbigroup.co.jp/english/investors/disclosure/presentation/pdf/130528presentations.pdf

5Website: http://www.morningstar.co.jp/nisa/Important Risks Related to this Article

ALPS Distributors, Inc. is not affiliated with JPMorgan or Morgan Stanley. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments focusing on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments focusing in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.